Aisles UK Secures £1 Million in Angel Funding to Launch AI-Powered Infrastructure for Retail, Education, and Public Safety

London, UK – Aisles UK has completed a £1 million Angel...

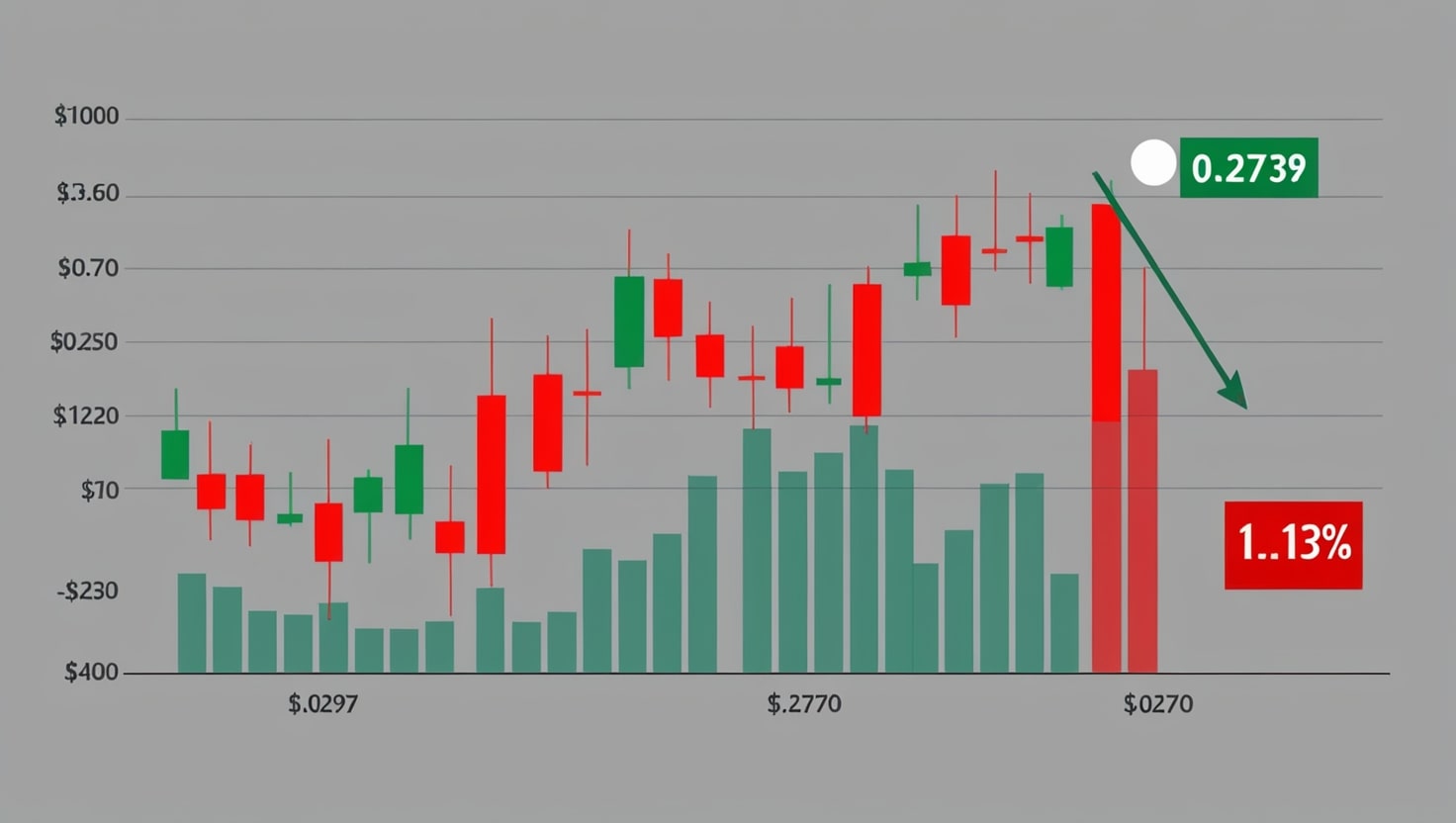

TRON Price Falls Amid Crypto Market Woes

TRON (TRX) declined by 1.13 percent today, trading at a...

Why You Should Choose a Career in Code Enforcement

Code enforcement is an important career that focuses on...

Tax Hikes Loom: Spending Review Sparks Wealth Flight Warnings

The UK Chancellor’s latest Spending Review signals looming...

Lagoon Dredging Technology Drives Breakthroughs in Wastewater Efficiency

Wastewater lagoons are a vital component of municipal and...

Smart Solar: How IoT Helps Maximize the Value of Your Photovoltaic System

These days, it’s common to spot solar panels on...

Offices Streamline Communication With Voicemail-to-Email Integration

In today’s busy work environment, keeping up with messages...

Finance Management Trends Shift Toward Risk-Aware Planning

Let’s be honest, managing your finances can feel a lot like...

Repairing Over Replacing Gains Ground in Sustainable Transport Trends

Over the past few years, consumers have been increasingly...

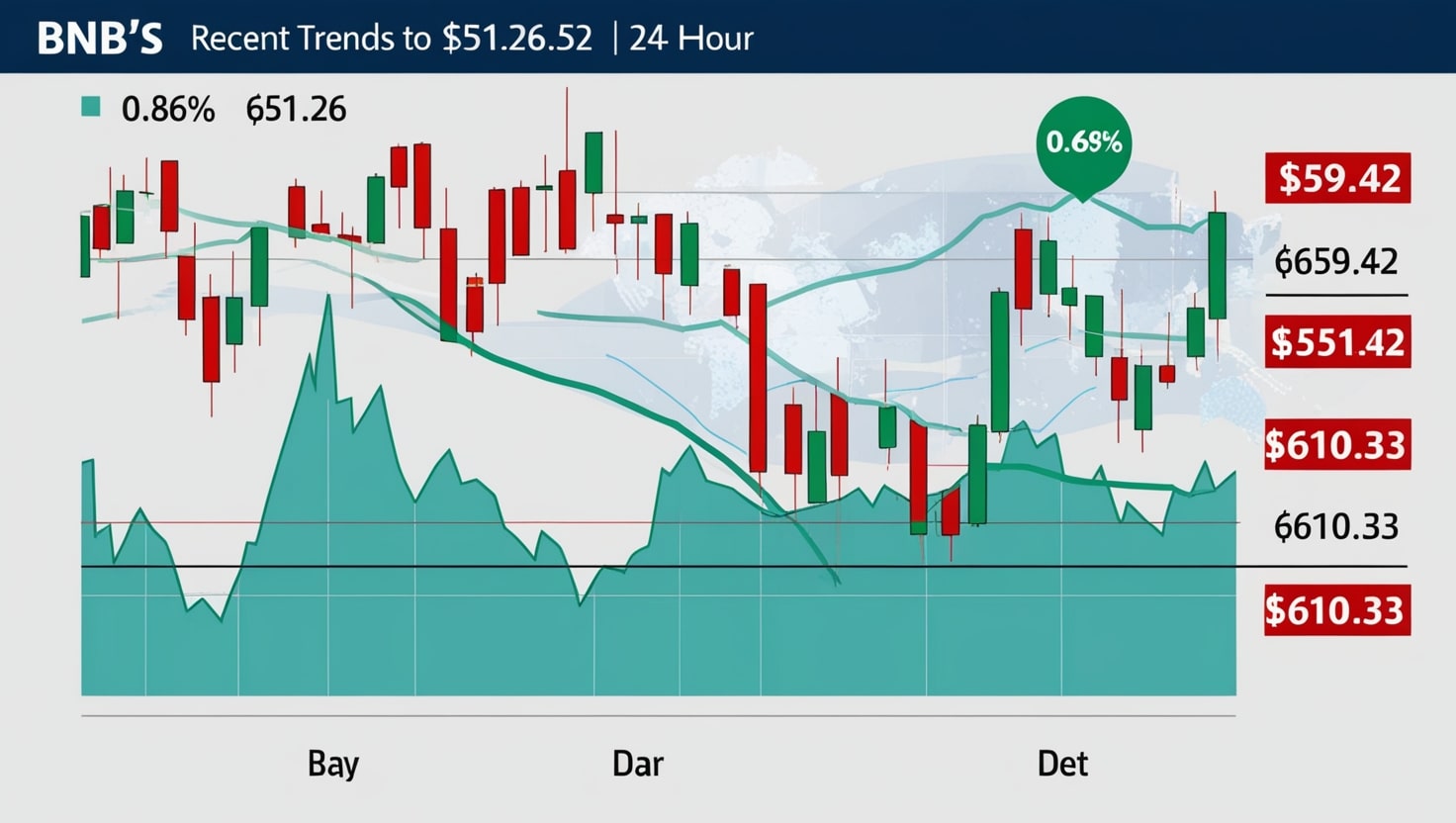

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin