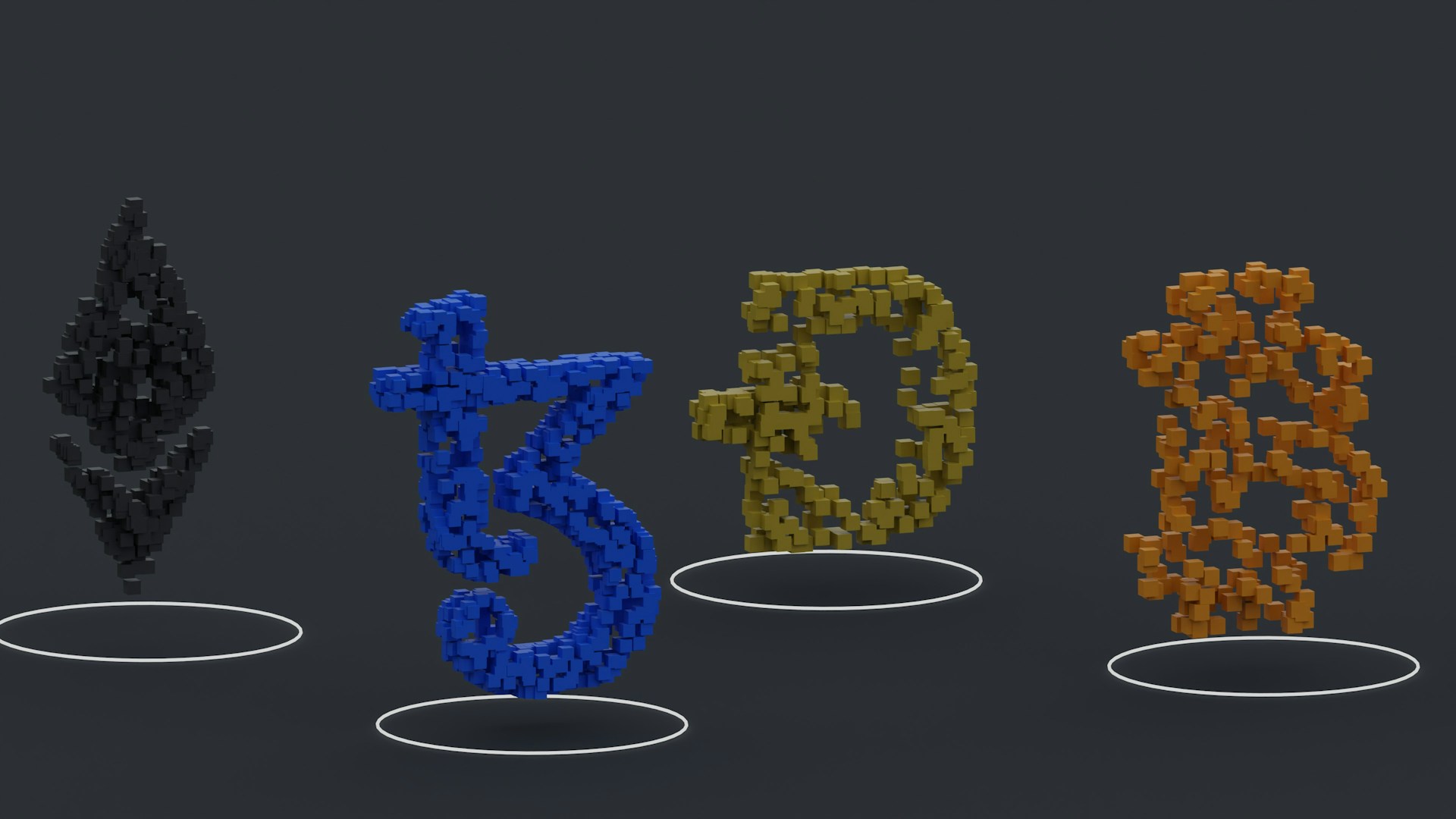

TRON Climbs to New Heights in Crypto Rankings

TRON (TRX) is now worth $25.7 billion and is in the ninth...

USDC Maintains Stability Amid Crypto Surge

Second-ranked USDC is holding at $0.9997 after a tiny 0.01%...

How UK players are choosing smarter ways to play with casino offers

As the online UK gaming landscape evolves, so do the...

GoMining: Winning Miner Wars

As the world of crypto continues to expand, passive income...

How to Trade CFDs: WS Group Experts Break It Down for Beginners

Are you curious about online trading but don’t know where...

Mastering Travel Payments: How to Navigate Gaps with Confidence

Navigating the world of travel payment gaps and...

How to Plan a Group Golf Trip in Berwick with Luxury Accommodation

Planning a group golf trip in the UK? Whether you’re...

The Impact of AI on Ecommerce Hiring

Artificial intelligence (AI) is changing how businesses...

MyBookie – Analyzing User Feedback on Games and Payouts

MyBookie Casino is considered one of the top-ranking online...

The Ultimate Tips for Crypto Gamblers – All You Need to Know

Crypto betting has exploded in recent years, and in 2025,...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin