In a move that has reverberated across financial markets, BlackRock, the world’s largest asset manager with over $11.6 trillion in assets under management, has reportedly acquired approximately $350 million worth of Bitcoin (BTC) through its iShares Bitcoin Trust ETF (IBIT). This acquisition, part of a broader trend of institutional investment in cryptocurrencies, underscores Bitcoin’s growing legitimacy as an asset class.

As of May 2, 2025, this purchase aligns with BlackRock’s aggressive strategy to integrate digital assets into its portfolio, signaling a pivotal moment in the mainstream adoption of cryptocurrencies. This article explores the details of BlackRock’s investment, its implications for the crypto market, the motivations behind the move, and the broader context of institutional involvement in Bitcoin.

The Details of BlackRock’s Bitcoin Purchase

BlackRock’s $350 million Bitcoin acquisition is part of a series of significant inflows into its IBIT ETF, which has become a cornerstone of the firm’s cryptocurrency strategy since its launch in January 2024. According to data from Farside Investors, BlackRock’s IBIT ETF has seen consistent inflows, with a notable $970.9 million purchase on April 28, 2025, marking its second-largest single-day inflow.

While the specific $350 million purchase is not explicitly detailed in recent reports, posts on X from late 2024 indicate BlackRock’s pattern of acquiring Bitcoin in similar price ranges, such as a $337.8 million purchase of 3,515 BTC on December 3, 2024, and a $359 million purchase on December 19, 2024. These figures suggest that the $350 million acquisition likely occurred as part of BlackRock’s ongoing accumulation strategy, potentially involving thousands of BTC at current market prices hovering around $94,000 per Bitcoin.

The IBIT ETF, which tracks the spot price of Bitcoin, has grown to over $54 billion in assets under management, accounting for approximately 51% of the total spot Bitcoin ETF market share, according to Dune data. BlackRock’s holdings now exceed 567,000 BTC, valued at over $47.8 billion as of March 2025, making it one of the largest institutional holders of Bitcoin globally. The $350 million purchase, while significant, is a continuation of BlackRock’s methodical approach to scaling its exposure to digital assets, driven by client demand and strategic market positioning.

The Context of BlackRock’s Crypto Strategy

BlackRock’s foray into Bitcoin is not an isolated event but part of a broader strategy to embrace digital assets. The firm’s CEO, Larry Fink, has undergone a notable transformation in his stance on cryptocurrencies. Once dismissive of Bitcoin as “an index of money laundering,” Fink has since described it as “digital gold” and a “legitimate” financial instrument.

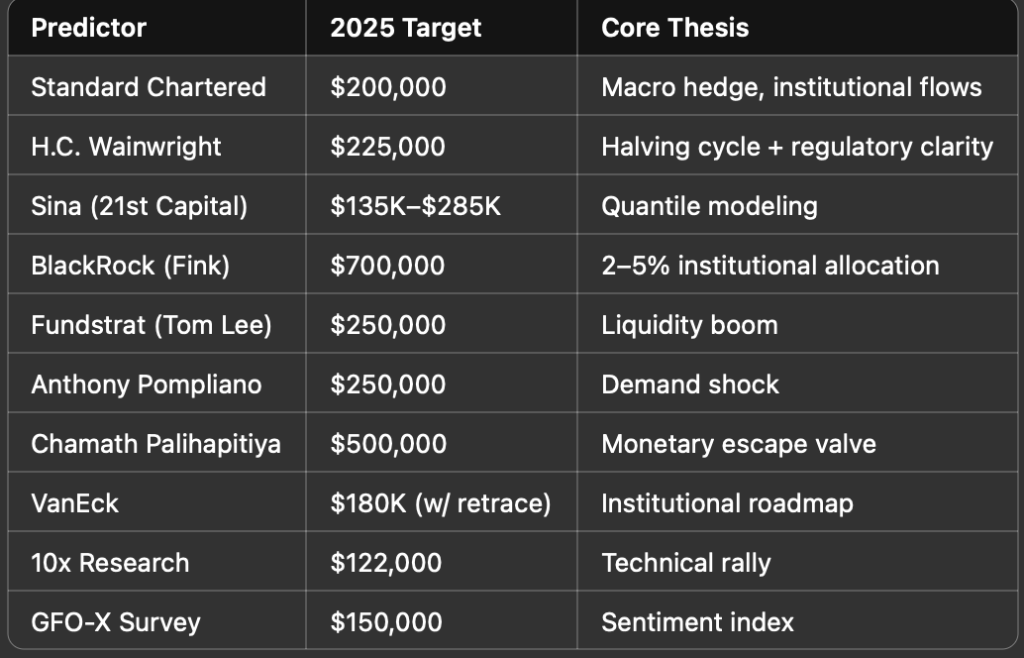

In July 2024, he articulated Bitcoin’s potential as a hedge against currency debasement and geopolitical instability, a view he reiterated at the World Economic Forum in January 2025, where he predicted Bitcoin could reach $700,000 if sovereign wealth funds allocate 2–5% of their portfolios to it.

BlackRock’s leadership in launching spot Bitcoin ETFs in the U.S. marked a turning point for institutional crypto adoption. Approved by the Securities and Exchange Commission (SEC) in January 2024, these ETFs have attracted over $100 billion in net assets, with IBIT leading the pack.

The firm’s recent launch of the iShares Bitcoin ETP in Europe, listed in Paris, Amsterdam, and Frankfurt, further demonstrates its commitment to expanding crypto offerings globally. Additionally, BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) expanded to the Solana blockchain in March 2025, signaling a diversified approach to blockchain-based assets.

The $350 million Bitcoin purchase aligns with BlackRock’s response to growing institutional demand. As traditional investors seek regulated vehicles to gain exposure to cryptocurrencies, IBIT provides a secure and accessible option. The firm’s meetings with the SEC’s crypto task force in April 2025 to discuss future crypto products underscore its proactive stance in shaping the regulatory landscape for digital assets.

Market Implications of the Purchase

BlackRock’s $350 million Bitcoin acquisition has significant implications for the cryptocurrency market. Institutional investments are a key driver of Bitcoin’s price dynamics, as evidenced by the asset’s recovery above $94,000 in April 2025, aided by over $3 billion in cumulative net inflows into U.S. spot Bitcoin ETFs.

The $970.9 million inflow into IBIT on April 28, 2025, alone provided “structural support” for Bitcoin’s price, according to market analysts at Cointelegraph. The $350 million purchase likely contributed to stabilizing Bitcoin’s price around the $94,000–$95,000 range, despite resistance at higher levels.

However, the market has not been without challenges. Bitcoin faced a $1 trillion sell-off in early 2025, dropping to $80,000 amid macroeconomic uncertainty and fears of a prolonged trade war. BlackRock’s consistent buying, even during periods of volatility, signals confidence in Bitcoin’s long-term value. The firm’s acquisitions have counteracted outflows from competitors like Fidelity’s FBTC and ARK Invest’s ARKB, which recorded $87 million and $226 million in outflows, respectively, in late April 2025.

The purchase also highlights the competitive dynamics within the ETF market. While IBIT has dominated with $39 billion in net inflows since its debut, other funds like the Grayscale Bitcoin Trust ETF ($15.2 billion AUM) and Fidelity’s FBTC have struggled to keep pace. BlackRock’s aggressive buying has solidified its position as the market leader, potentially attracting more institutional investors to its platform.

Motivations Behind BlackRock’s Investment

Several factors motivate BlackRock’s $350 million Bitcoin purchase and its broader crypto strategy:

-

Client Demand: Institutional and retail investors are increasingly seeking exposure to Bitcoin as a hedge against inflation, currency debasement, and geopolitical risks. BlackRock’s IBIT ETF caters to this demand by offering a regulated, low-friction investment vehicle.

-

Market Opportunity: Bitcoin’s price surge from $80,000 to $94,000 in early 2025, coupled with its historical resilience, presents an attractive opportunity for asset managers. BlackRock’s purchases capitalize on market dips, positioning the firm to benefit from potential rallies.

-

Strategic Positioning: By leading the spot Bitcoin ETF market, BlackRock reinforces its reputation as an innovator in asset management. Its early adoption of crypto products enhances its competitive edge over rivals like Fidelity and Grayscale.

-

Geopolitical and Economic Trends: BlackRock’s head of thematics and active ETFs, Jay Jacobs, has predicted “geopolitical fragmentation” as a “megaforce” shaping markets over the next several decades. Bitcoin’s decentralized nature makes it an appealing asset in an era of nationalistic trade policies and currency volatility, as warned by Fink in March 2025.

-

Regulatory Clarity: The SEC’s approval of spot Bitcoin ETFs and BlackRock’s ongoing dialogue with regulators provide a stable framework for institutional investment. This clarity reduces the risks associated with crypto exposure, encouraging firms like BlackRock to scale their investments.

The Broader Trend of Institutional Adoption

BlackRock’s $350 million purchase is emblematic of a broader trend of institutional adoption of Bitcoin. Public companies like MicroStrategy, which holds over 250,000 BTC, and Semler Scientific, with 1,100 BTC, have embraced Bitcoin as a reserve asset. Dominari Holdings, linked to Donald Trump’s sons, announced a $2 million investment in IBIT shares in March 2025, reflecting the growing appeal of BlackRock’s ETF among wealth management firms.

Hedge funds have also increased their exposure to IBIT. In Q4 2024, Millennium Management, Citadel Advisors, and D.E. Shaw purchased millions of IBIT shares, with Citadel’s stake rising by 5,196%. These investments underscore Bitcoin’s acceptance as a portfolio diversifier among sophisticated investors.

The success of spot Bitcoin ETFs has disrupted traditional crypto market cycles, which were historically driven by retail speculation. According to Cointelegraph, ETFs have driven tens of billions in liquidity to crypto markets, stabilizing prices and reducing volatility. BlackRock’s role as a market leader has amplified this effect, attracting a new wave of institutional capital.

Challenges and Risks

Despite the bullish outlook, BlackRock’s Bitcoin investments face several challenges:

-

Market Volatility: Bitcoin’s price remains volatile, with a 12% drop in Q1 2025 marking its worst performance since Q2 2024. Resistance at $95,000 and potential sideways movement could limit short-term gains.

-

Regulatory Uncertainty: While the SEC has approved spot Bitcoin ETFs, broader regulatory frameworks for cryptocurrencies remain unclear. BlackRock’s meetings with the SEC suggest ongoing efforts to navigate this landscape, but future regulations could impact crypto investments.

-

Macroeconomic Factors: BlackRock’s Larry Fink has warned that President Donald Trump’s trade policies could stoke inflation, potentially dampening Federal Reserve interest rate cuts in 2025. Such conditions could create headwinds for risk assets like Bitcoin.

-

Competitive Pressures: Outflows from competing ETFs like ARKB and FBTC highlight the competitive nature of the crypto ETF market. BlackRock must maintain its edge through innovation and performance to retain investor confidence.

-

Security Concerns: As BlackRock expands into blockchain-based assets like Solana, cybersecurity challenges, such as digital identity verification, remain a hurdle. Fink has emphasized the need for robust solutions to enable asset tokenization, a priority for the firm’s crypto ambitions.

The Future of BlackRock and Bitcoin

Looking ahead, BlackRock’s $350 million Bitcoin purchase is likely a precursor to further investments in digital assets. The firm’s expansion into Europe and Solana, coupled with its dominance in the U.S. ETF market, positions it as a global leader in crypto adoption. Fink’s prediction of Bitcoin reaching $700,000, while ambitious, reflects the firm’s belief in the asset’s potential to reshape financial markets.

The purchase also signals a shift in how institutional investors perceive Bitcoin. Once viewed as a speculative asset, it is now increasingly seen as a store of value and a hedge against systemic risks. BlackRock’s involvement lends credibility to this narrative, encouraging other asset managers to follow suit.

For the broader crypto market, BlackRock’s investments could drive further price appreciation, particularly if institutional inflows continue to outpace retail selling pressure. However, the market’s ability to break through resistance levels like $95,000 will depend on macroeconomic conditions, regulatory developments, and investor sentiment.

Conclusion

BlackRock’s $350 million Bitcoin purchase through its IBIT ETF is a landmark event in the institutionalization of cryptocurrencies. As the world’s largest asset manager, BlackRock’s strategic acquisitions underscore Bitcoin’s growing acceptance as a legitimate asset class. Driven by client demand, market opportunities, and a vision for the future of finance, the firm’s crypto strategy is reshaping the investment landscape.

While challenges like volatility, regulation, and macroeconomic risks persist, BlackRock’s leadership in the ETF market and its proactive engagement with regulators position it to navigate these hurdles.

The $350 million purchase is not just a financial transaction but a statement of intent a signal that Bitcoin is here to stay, backed by the weight of Wall Street’s biggest player. As institutional adoption accelerates, BlackRock’s moves will continue to influence the trajectory of Bitcoin and the broader crypto market, heralding a new era of digital finance.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped SOL

Wrapped SOL