Stellar Lumens Shines Amid Crypto Market Shifts

The current price for Stellar Lumens (XLM) is $0.2651,...

How Darren and Mike’s Dream Team is Revolutionizing Digital Business and MLM Success

The digital business landscape is evolving, and more...

Unlocking Hidden Efficiencies in Your Pallet Delivery Strategy

For businesses looking to grow, particularly small to...

10 Reasons Your Operation Needs Fleet Maintenance Software

Managing a fleet in 2025 with spreadsheets, whiteboards, or...

UK Government’s Approach to Digital Currencies

The UK is getting ready for a future where digital money...

UK’s Top 7 Restaurant Awards Every Business Should Know

Winning a major award can transform your restaurant’s...

How to Buy a Car with Crypto: A Bold Shift in the Automotive Industry

Driving the Future: Why More People Buy Cars with Bitcoin...

How to register a company in the UK with expert support

Why the UK? Registering a business in this country gives...

Why is it worth investing in professional email hosting services?

Email is one of the main means of communication for...

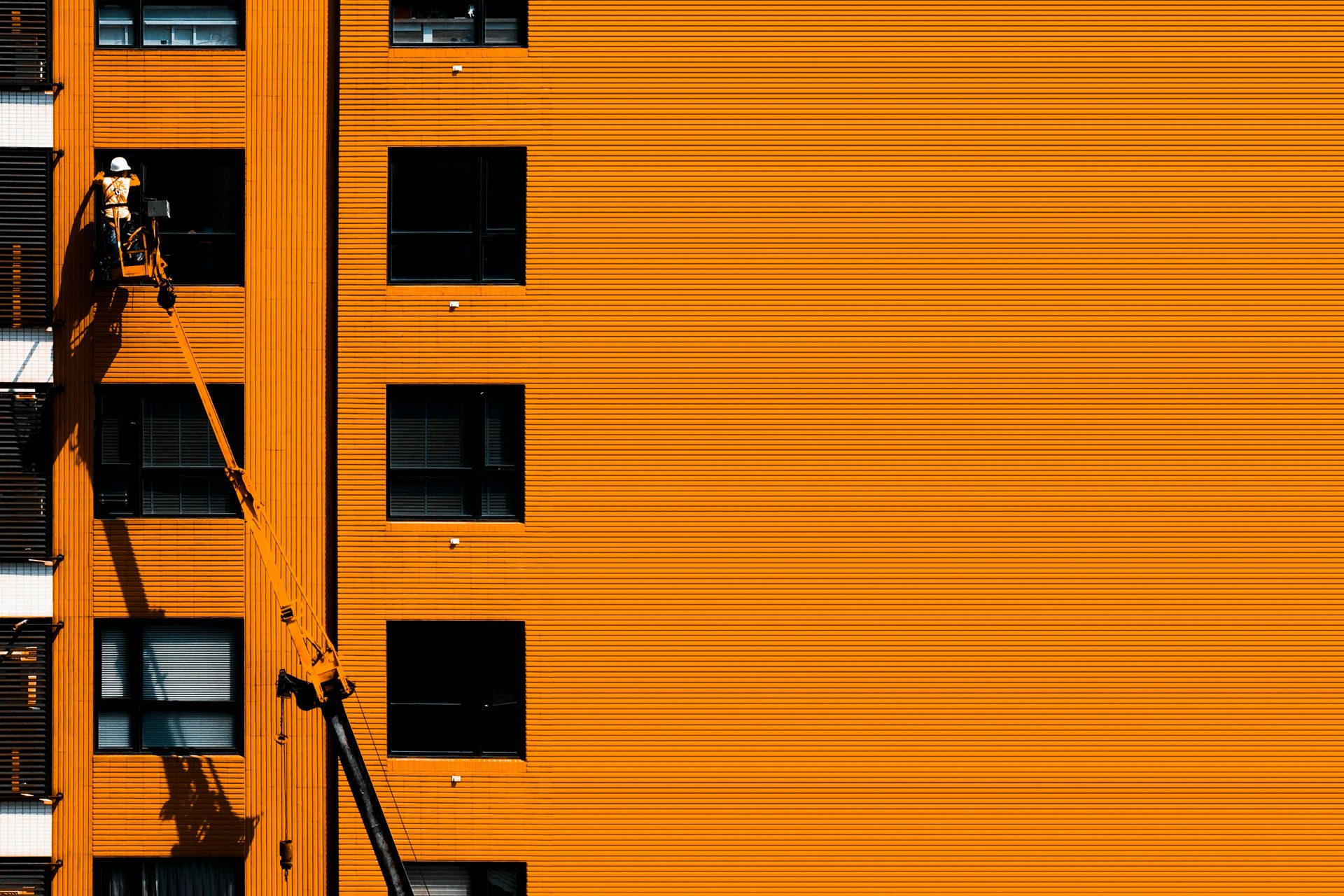

Which UK Industries Hire the Most Operated Access Equipment?

Operated access equipment, such as cherry pickers and boom...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin