Aisles Introduces Shield: The Next-Generation AI Security Solution

Portland, OR – Imagine a world where your security systems...

Aisles Eyes $100M Acquisition of Private Bank, Plans Exclusive AI-Driven Payment Platform

Portland, OR – Aisles, a prominent name in AI...

The Role of Custom Metal Fabrication in Modern Industry

In today’s industrial landscape, custom metal fabrication...

Navigating the Digital Wallet Revolution

There is no denying that the global financial scene is...

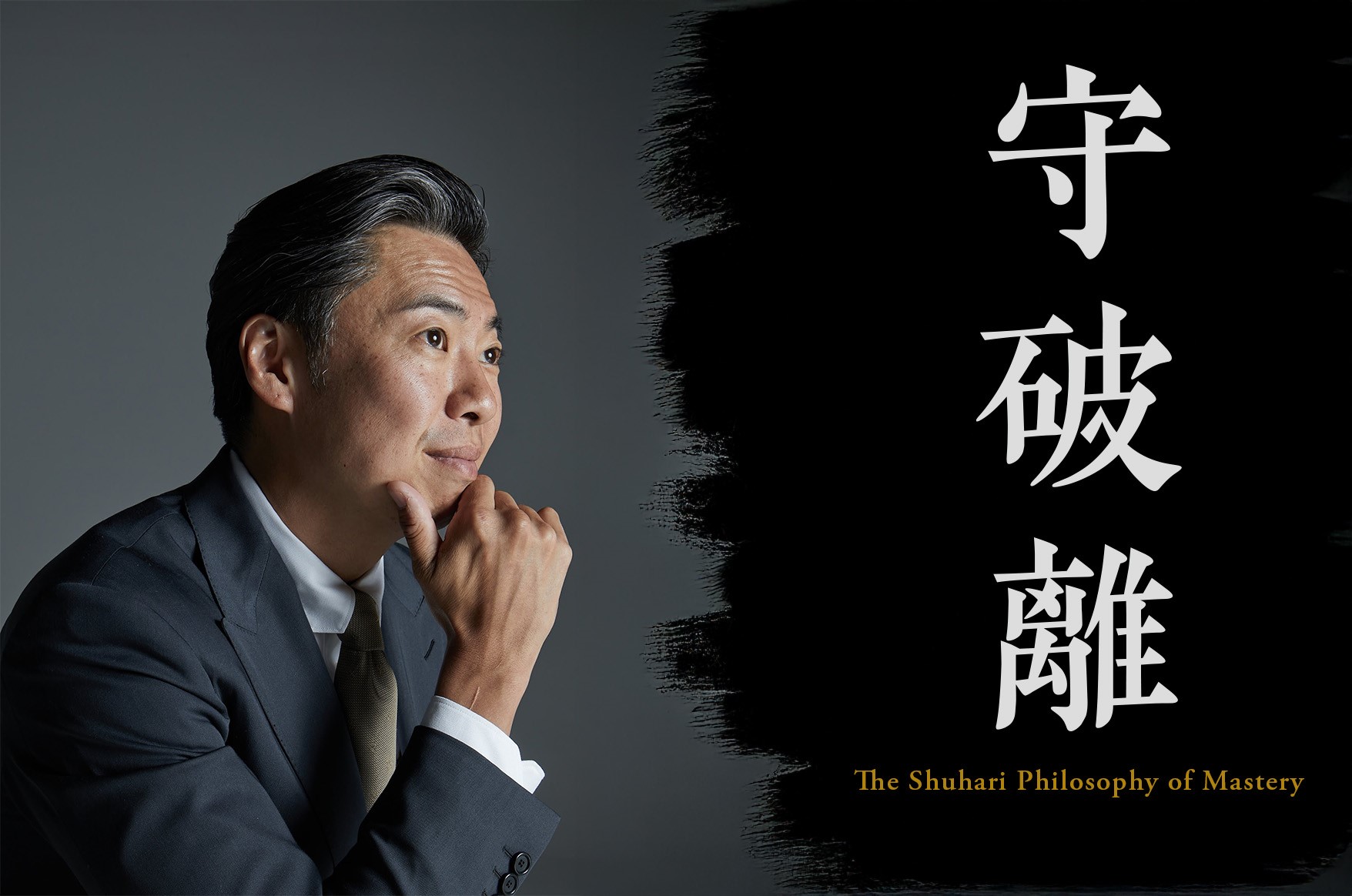

Shuhari: Bridging Tradition and Innovation in Business Practices

In a world defined by rapid change, businesses and...

AgentFun AI Gains Traction As Novel AI Agent Trading Platform

AgentFun.AI is a new platform that fully merges the two...

Leslie Token Gains Traction As Ethereum’s Mascot Coin

In the ever-fluctuating journey of cryptocurrency’s...

Octobank Named Best E-commerce Acquirer of 2024 by Visa

Octobank was named a leader in acquiring services for 2024,...

Red Notice Reform: Examining the Path to Fairer Practices

An Interpol Red Notice is often perceived as an...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin