Cardano (ADA), a native token of the Cardano blockchain, is causing a stir in the cryptocurrency market, currently priced at about 0.62 $, with great momentum. Backed by successful scalability upgrades, a growing ecosystem, and growing institutional fascination, Cardano is extending itself as a top player in the altcoin universe. This 800-word article will discuss the new opportunities leading to the promotion of Cardano, the technological growth, as well as the presence on the market.

Scalability Breakthroughs Boost Performance

Full scalability is a point of certainty of Cardano development, and today, the news confirms the remarkable development in this aspect. The introduction of a layer-2 scaling solution is the Hydra protocol, which has led to a drastic increase in the number of transactions within the network. Hydra allows Cardano to perform thousands of transactions per second, making it competitive to its rivals in terms of processing speed, such as Solana, and still keeping the fees and energy consumption low. This update has strengthened Cardano as a destination for decentralized applications (dApps), especially decentralized finance (DeFi) and non-fungible tokens (NFTs).

ADA has received a favorable reaction in the market, as the trading volume of this coin shows significant growth/increase on large exchanges. The posts on X show increasing enthusiasm, with developers and investors raving about how Cardano can support high-volume use cases, and yet, maintain security. This achievements scale is regarded as a milestone to mainstreaming, an aspect that makes Cardano a potential platform to use in global financial systems.

Speculation and the ETF Universal Backing

The other primary factor that hypes Cardano nowadays is institutional interest. It is written that recently, some hedge funds have paid more attention to ADA, and even more of them acquired it because of the strategic approach to research and sustainable blockchain architecture of Cardano. Cardano does not use the energy-intensive proof-of-work algorithm transaction verification system but instead uses the more energy-efficient proof-of-stake (PoS) solution that resonates with the current trends of investing in environmentally-friendly practices, hence its popularity among environmentally-friendly funds.

There are also forward speculations concerning an exchange-traded fund (ETF) related to Cardano. After ETFs of other prominent cryptocurrencies got approved, analysts argue that ETFs of Cardano are a probable next candidate due to their great foundation and framework that allows the cryptocurrencies to comply with the regulations. The optimism was further stimulated by a Bloomberg report stating a 95 percent probability of approvals of altcoin ETFs in the U.S. come mid-2026. This kind of development will be able to attract a lot of institutional money, and it might even drive ADA near its price target of $1 soon.

Growth and Practical Applications of Ecosystems

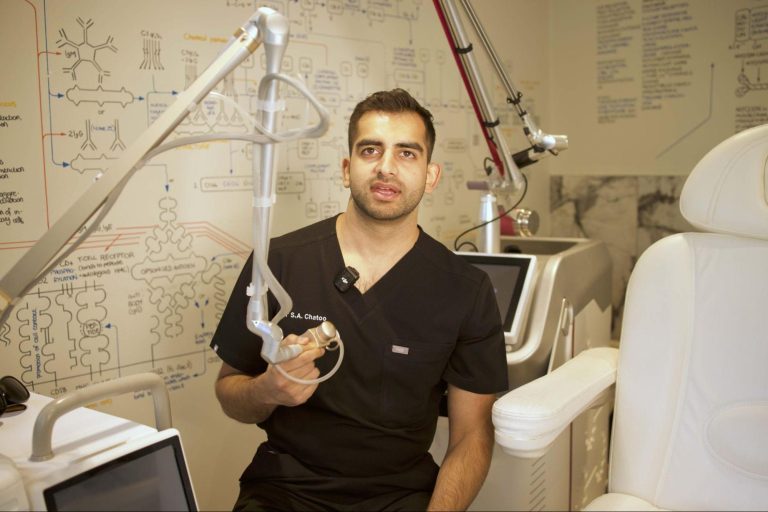

The ecosystem of Cardano is growing faster, as more than 1,000 dApps are live or in progress. In circulation is the news of the release of several popular initiatives that include a DeFi solution operating in the microfinance segment in Africa and an NFT platform selling digital art. Such projects demonstrate the versatility of Cardano because the scope of its smart contracts capabilities is vast and applicable in many areas, including financial inclusion as well as in creative industries.

The alliance with one of the Latin American universities was announced, and the goal set was to apply the blockchain of Cardano as the means of secure credentialing to make academic affairs. One thing that this project emphasizes is that Cardano is more concerned with real-world use, especially in places that have an underdeveloped ecosystem. Bringing tamper-proof records and cheap transactions, Cardano is creating its niche in the field of education and governance, which is otherwise ignored by other blockchains.

These attempts to drive adoption on the part of the Cardano Foundation to drive adoption in emerging markets are paying off, as transaction volumes in Africa and Southeast Asia are gaining momentum. Such markets, which have so many unbanked individuals, are a colossal opportunity to use Cardano to spur financial inclusion, which again strengthens its long-term value thesis even further.

Crowdsourcing and Meme-Fi Hype

The diverse community, which actively supports Cardano, is playing a central part in its ascendancy. On X, the holders of ADA coins are actively spreading the success of this network; they inform about technical news and price forecasts. Cardano is attracting a younger generation of investors with the introduction of what has been termed the “Meme-Fi” phenomenon, in which practical projects also merge with the meme coin culture. There are memes on Cardano having green credentials and its founder possessing an academic background, giving the project some level of cultural relevance.

This community-based impetus has made Cardano gain a wide variety of investment population, including those who are long-term holders as well as those speculating on it. Although other analysts warn that the hype associated with memes may result in volatility, Cardano has sound fundamentals, which can help it to overcome this risk and stay firm in price fluctuations.

Technical Analysis and Price Forecast

Technically, however, Cardano is displaying signs of a bull market. ADA has just penetrated a major resistance point of $0.60, and the next target of analysts is at 0.75. The network currently has a staking value of over $20 billion after surging to its current position as a result of high holder confidence. The fact that Cardano has been relatively stable in price compared with the recent dip in the traditional markets also makes it come out as a safe bet among altcoins.

Assuming that Cardano continues its current trend, analysts predict that the token might hit the value of $1 by the end of 2025, with more ambitious investors aiming at the mark of 1.50 by the middle of 2026. Short-term performance might, however, be affected by macroeconomic factors like the world interest rate policies. Such risks notwithstanding, Cardano is an attractive coin because of its innovation on long-term scalability and adoption.

Problems and Future Possibilities

Even though Cardano’s prospects are good, there are problems. There is a lot of competition with other layer-1 blockchains, that is, Solana and Avalanche, and Cardano needs to keep innovating to remain ahead. The family of slow but well-researched character of development of the network, on the one hand, is considered one of its advantages; on the other hand, it has also been criticized as being slow at its pace of building compared to its competitors that have a faster track base.

However, the cautious approach of Cardano has developed a stable and safe system, which has won the reputation of being reliable and safe among developers and institutions. The plan to upgrade it with improved smart contract capabilities and cross-chain interaction will increase its already strong user base.

The Reasons to Use Cardano

This is evidenced by the Cardano revolution of 2025, which is its unbeatable combination of scholarly diligence, scalability, and practicality. It can be separated in a highly saturated market with its sustainability and inclusion focus, and recent improvements in functionality and collaborations show the maturing ecosystem. In the continually developing crypto market, Cardano is an outstanding alternative to turn to as an investor or developer alike due to its capacity to be innovative without creating chaos.

As its price increases, institutional attention rises, the community waits in excitement, and 2021 is going to be a breakthrough year for Cardano. You may be an experienced investor or newborn enthusiast, but the history of ADA is something you should not keep an eye on when it comes to the future of blockchain development and power.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin