A bold and unmissable documentary that confronts the realities of a global emergency

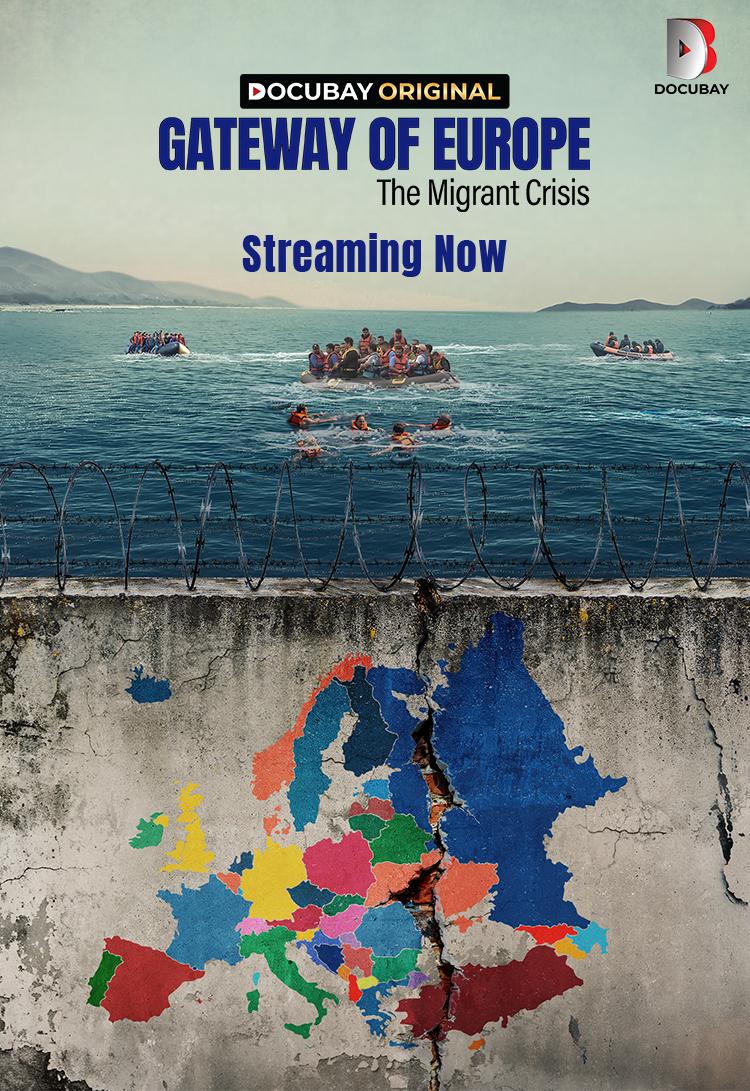

Mumbai, [20th June]:-DocuBay, the leading platform for premium documentaries and part of IN10 Media Network, has released the much-awaited powerful new original, Gateway of Europe – The Migrant Crisis, and streaming globally. Released on World Refugee Day on June 20, this gripping documentary pulls viewers straight into the heart of one of today’s most pressing humanitarian challenges. With urgent storytelling and unforgettable real-life accounts, the film is a must-watch for anyone seeking to understand the human cost of migration in Europe.

Filmed on the frontline island of Lampedusa, Gateway of Europe offers a raw, immersive lens into the journey of migrants risking everything for safety, and the communities caught in the tide of crisis. Through unfiltered visuals and deeply personal stories, it lays bare the choices, resilience, and realities that headlines often miss.

Streaming now only on DocuBay, Gateway of Europe is more than a documentary; it’s a powerful reminder of our shared humanity in turbulent times.

Aditya Pittie, Managing Director, IN10 Media Network, said At DocuBay, we believe in the power of storytelling to inspire change, build empathy, and spark meaningful conversations. Gateway of Europe – The Migrant Crisis brings a deeply human perspective to a global issue shedding light on the intertwined realities of migration, human rights, and policy. This documentary is a call to awareness and action, giving a platform to voices that are too often overlooked’’

Max Serio, Filmmaker & Director of Gateway of Europe – The Migrant Crisis, said:“ “My intent was to portray the human faces behind the migration crisis—people driven by hope, fear, and the pursuit of a better future. This film is an invitation to look beyond politics and borders, and truly understand their journey.”

Samar Khan, Chief Content Officer, DocuBay, said: “At DocuBay, we are committed to curating stories with purpose—ones that resonate across borders, spark reflection, and foster cross-cultural understanding. Gateway of Europe – The Migrant Crisis encourages viewers to look deeper, beyond statistics and headlines, and confront the emotional and personal truths behind global migration.

Documentaries like this can transform complex societal issues into powerful, intimate human experiences’’.

Now streaming exclusively on DocuBay, the full feature delivers a gripping and unfiltered portrayal of the migrant crisis through powerful visuals, deeply personal narratives, and a raw urgency that captures the scale and emotional weight of this global emergency. Watch it today!

About DocuBay

Headquartered in Mumbai, DocuBay is a global video-on-demand platform offering a curated collection of premium international documentaries. With a strong emphasis on factual storytelling, DocuBay showcases a wide variety of real-world content from across the globe. Available in more than 170 countries, the service is accessible via platforms such as the Apple App Store, Google Play, Fire TV, Roku, Apple TV, and Samsung Smart TVs, with additional platforms on the horizon.

About IN10 Media Network

IN10 Media Network is a dynamic media and entertainment group housing a diverse range of content-driven brands. With a foundation in creativity and a passion for storytelling, its portfolio spans television, digital, production, and more—including EPIC, ShowBox, Filamchi Bhojpuri, Gubbare, Ishara, Nazara, EPIC ON, DocuBay, MovieVerse Studios, Juggernaut Productions, and Let’s Get LOUDER. Guided by founder and entrepreneur Aditya Pittie, IN10 Media is committed to developing innovative media ventures and premium content across formats.

About Picasso Film

Picasso Film, established in 2008 and headquartered in Prague, is a globally recognized independent production company known for its high-quality documentary storytelling. The studio specializes in factual series across genres such as history, current events, true crime, science, and nature. With over 50 acclaimed titles to its name, Picasso Film’s work is regularly featured on top-tier platforms like National Geographic, Netflix, Discovery Channel, Curiosity Stream, and RTL.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin