Creative Chaos: How Proper Shelving and Workbenches Fuel Your Artistic Endeavours

In the exciting world of creative business, when chaos and...

Revolutionise Your Cleaning Regimen with the Tineco Floor One S3 Wet and Dry Vacuum Cleaner

Whether we like it or not, cleaning our homes is a task...

How Does Shared Ownership Work and Is It Worth It?

The dream of owning a home is out of reach for many people...

Revolutionize Your Office Coffee: Discover the Perfect Coffee Machine for Your Workspace

The coffee break is the office hero. It is during that time...

Yazan Al Homsi: A Journey from Saudi Arabia to the Global Investing Scene

A prominent figure in the realm of venture capital, Yazan...

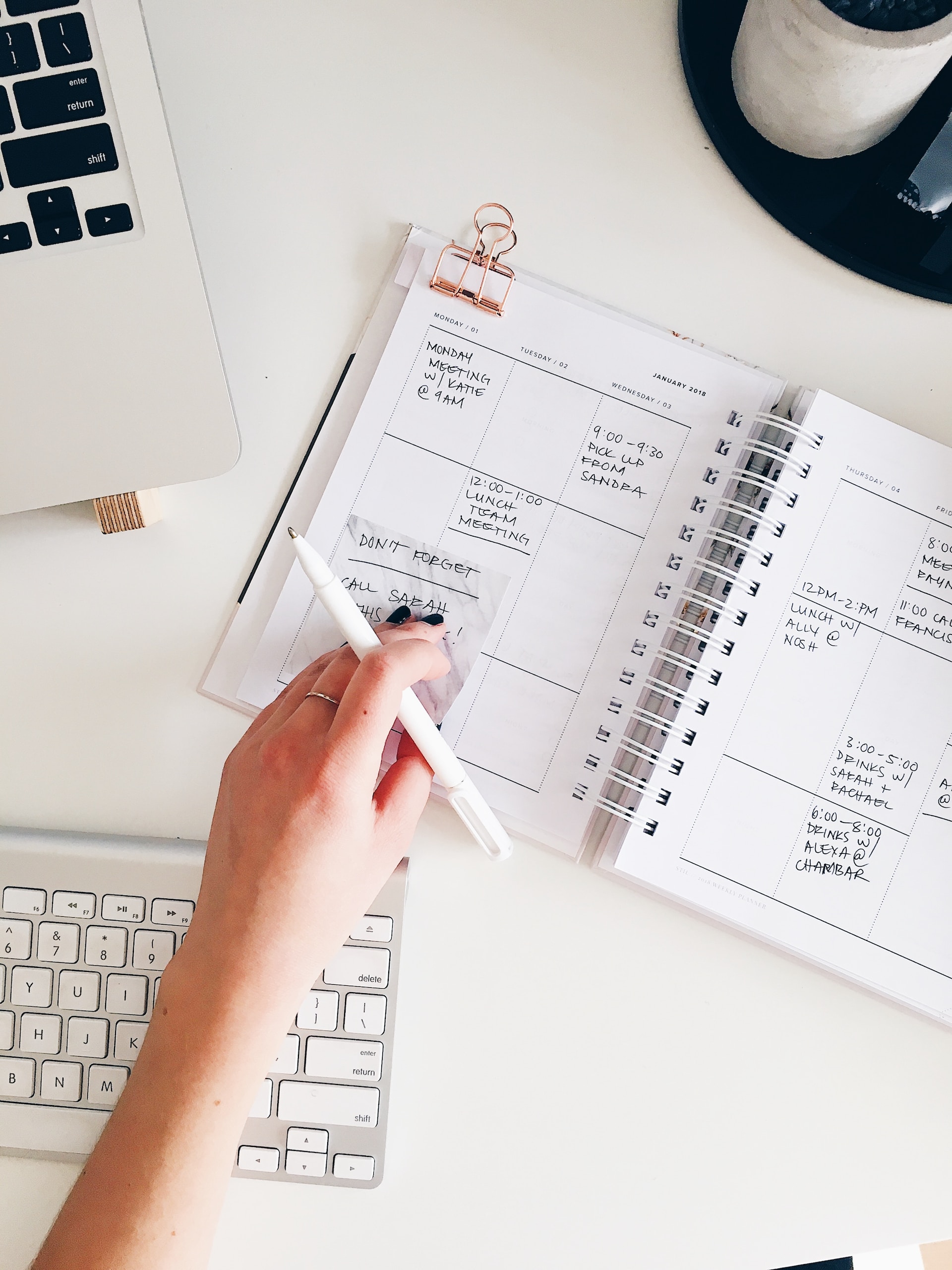

Unlocking Cost Savings: How to Find Affordable Virtual Assistants Through Remote Staffing Companies

In today’s fast-paced business environment, companies...

Prefabricated and modular construction manufacturer Module-T to expand into Europe from the South of France

After a decade and a half of pioneering modular and...

Insurance Industry’s Game-Changers: 3 Trends That are Making Waves

In an era defined by rapid technological advancement and...

Maintaining Family Harmony Amidst Financial Challenges

In the hustle and bustle of modern life, financial...

Elevating Entertainment: The Strategy Behind Amplifying Live Gaming Thrills

Playing at an online live casino is growing and popular as...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin