How to Earn Passive Income Cloud Mining with HappyMiner

Most individuals return their investment amount within 3-10...

Secrets of Successful Marketing: Online Gaming Industry Case Study

The marketing industry is living in confusing times in...

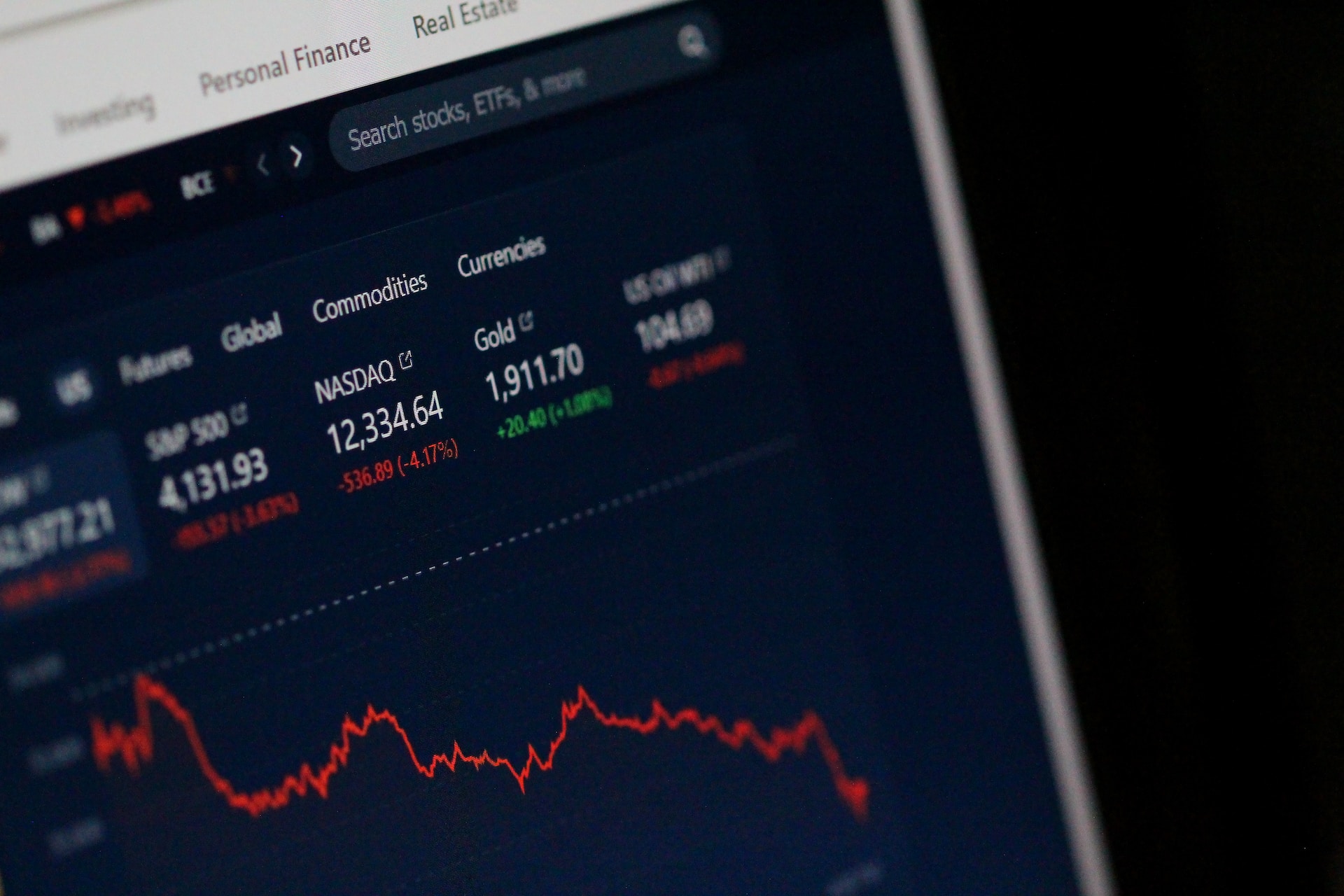

Gold vs Silver: Which is the Better Investment?

In a world where many financial investments can fluctuate...

Five Ways Mobile Apps Are Aiding Addiction Recovery

Technology has long been instrumental in the healthcare...

How to Choose the Right Life Insurance Policy: Factors to Consider

Choosing the right life insurance policy is a significant...

Maximizing ROI on SMS Marketing Campaigns

It’s hard to ignore the stats surrounding modern SMS...

Getting Started with HubSpot CRM: A Step-by-Step Guide for Business Executives

HubSpot is a powerful Customer Relationship Management...

How to Compare Doctors to Save Money in the UK

In a time when healthcare costs are skyrocketing, and the...

The Financial Boon of SEO for London’s Small Businesses: Thriving in the Digital Age

Search Engine Optimisation (SEO) is a digital marketing...

Lessons From the Life Of Mark E. Denning: A Top Fund Manager at The Capital Group

Mark E. Denning is in a class of his own when it comes to...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped SOL

Wrapped SOL