Reservation Management: A Key Ingredient to Dining in the Most Romantic Restaurants in London

As a city brimming with history, culture, and fantastic...

Stay Warm and Save Money: The Importance of an Annual Boiler Service

Enjoy Warmth Even on a Cold Day Anticipating a cold...

5 Tips for Better Medical Device Management

Managing medical devices correctly is as essential as it...

Will Apple Become A Leading Financial Services Option?

In recent years, Apple has made significant strides to...

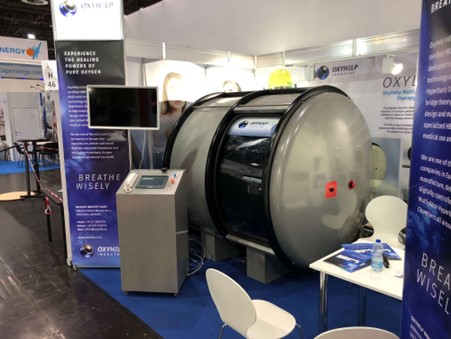

What is the Cost of A HBOT Chamber?

Hyperbaric oxygen therapy has gained more momentum over the...

Exploring the Role of Algorithmic Trading in Quantitative Finance

In the field of finance known as quantitative finance,...

Maker&Son and the Essence of British Craftsmanship

In a world increasingly dominated by mass-produced,...

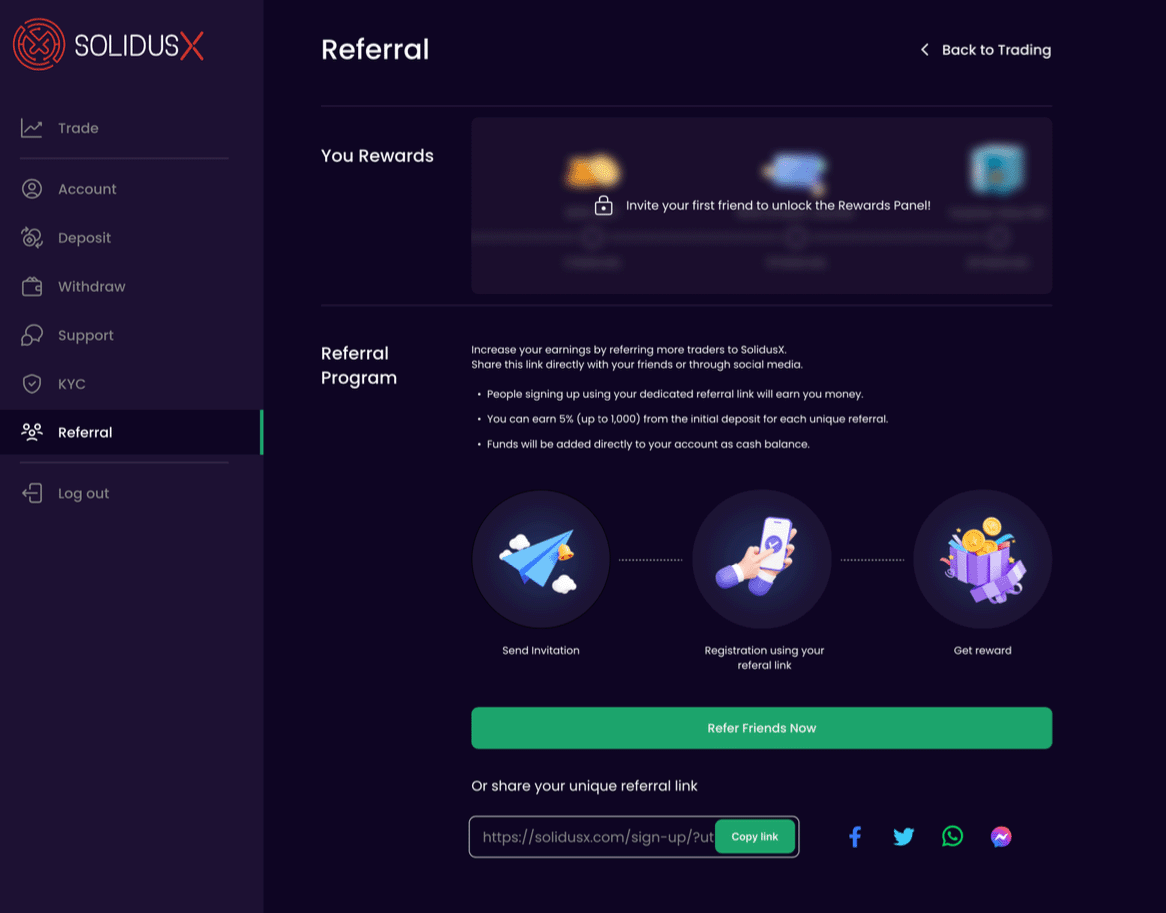

SolidusX Trading Platform 2023 Review: Reinventing online trading

Started its operations in January 2021, SolidusX continues...

The Changing Business of Bingo

Bingo is a game that has been around for nearly 100 years....

How to Slash Your Texas Electricity Bill

Texas is known for great barbecues, friendly people, and...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped SOL

Wrapped SOL