UK Energy Experts Take the Guesswork Out of Going Solar

Solar and energy storage experts iJo Power are making the...

The watering hole, piggybacking, dumpster diving, and other social engineering attacks threatening employees

Cybersecurity expert shares 10 intricate social engineering...

Why you need to protect your business from international copyright infringement

Despite international treaties developing a set of minimum...

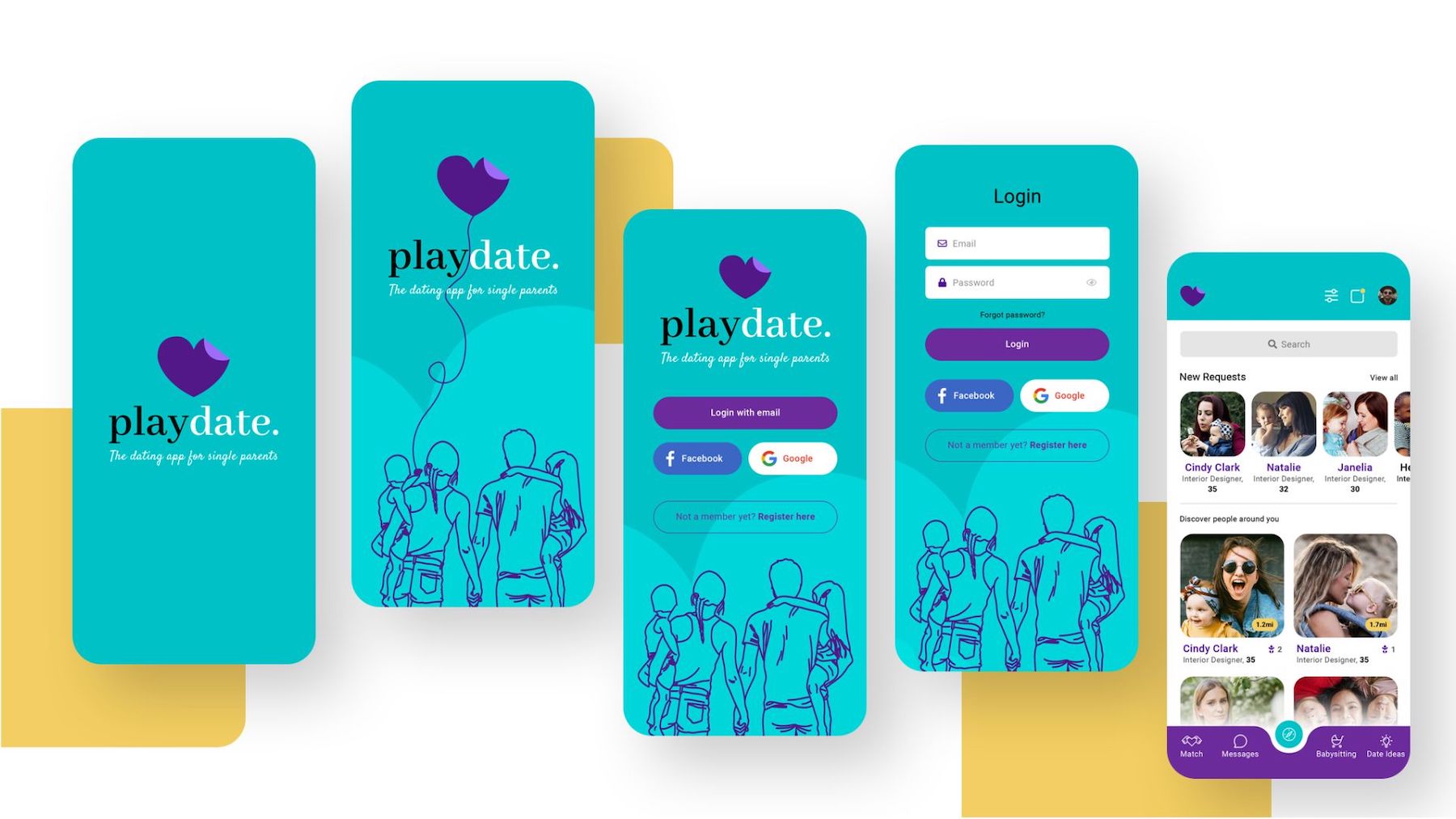

The UK’s first single parent dating app, Playdate, closes a £250,000 investment round from angel investors & social impact VC Ankh Impact Ventures

Playdate, the Uk’s first dating app aimed solely at single...

How Amazon price trackers and two little-known Amazon services can grab you a bargain

Savvy bargain hunters are learning how a little-known...

DATA: Where are the most successful new businesses opening in the UK?

Research from CMC Markets has revealed Reading as the UK...

Which Country has the Most Graduate Jobs in Finance?

Finance continues to dominate as one of the most desirable...

3 Ways to Light Up A Room with Aesthetic Neon Wall Signs

Wall decor is necessary for reviving a place. Different...

Valeria Vahorovska: Promotion of Companies to the International Market Largely Depends on Online Payment Systems

Previously, small and medium-sized businesses experienced...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin