UK based Crypto Marketing Agency is creating jobs as it aims to double in size

British based Connect Crypto Marketing specialises in...

Understanding The Crypto Market Collapse

Fueled by fiscal stimulus and fear of inflation,...

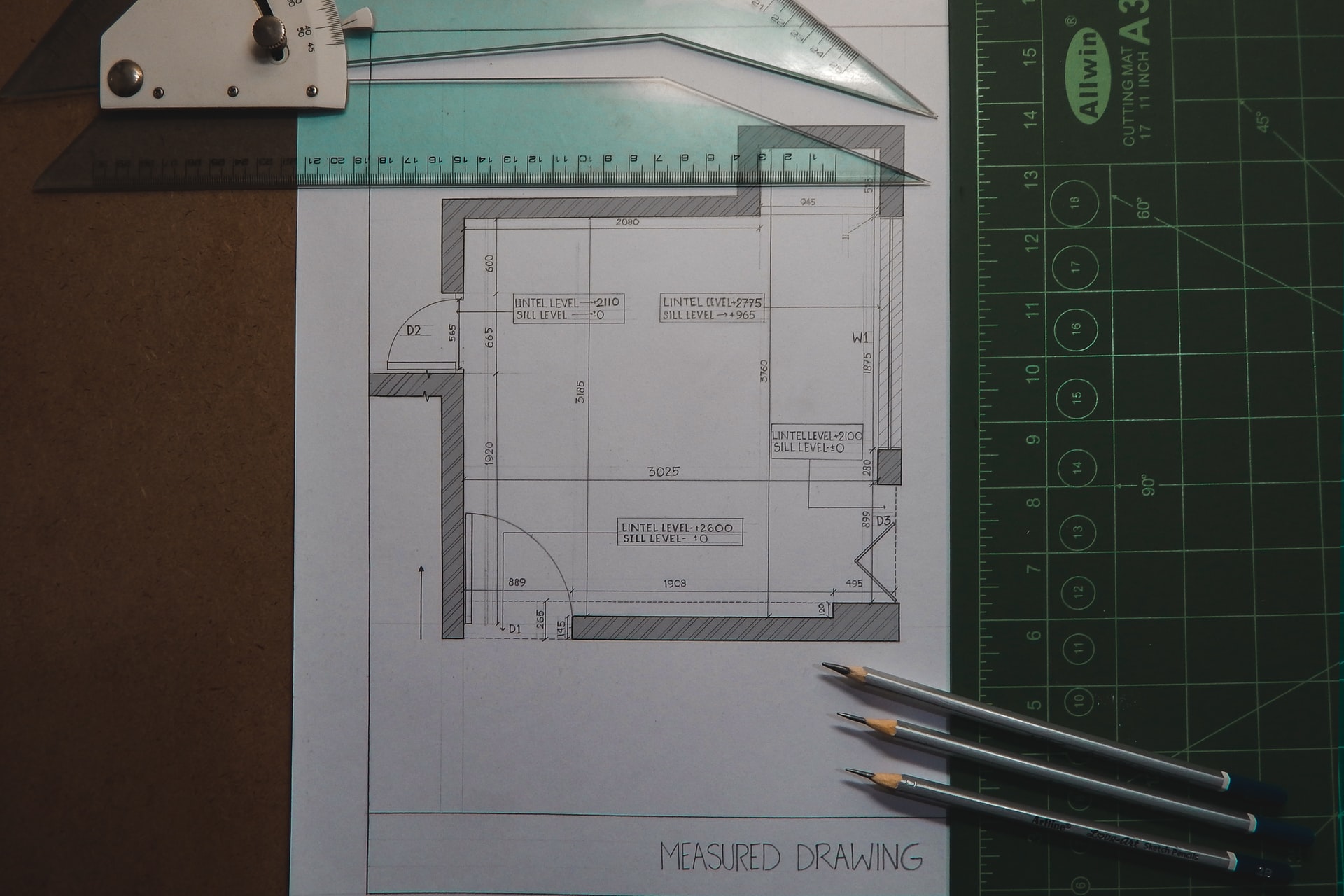

Understanding the Role of an Architect in a Construction Project

Architects are professionals who design and plan buildings...

Reasons Why New Gaming Sites Are Better

We know that many people seem to veer away from new UK slot...

Some Points That Raised Bitcoin’s Status

When the bitcoin cryptocurrency made its first move in the...

Cryptocurrency Tokens: How to remain anonymous?

As a form of alternative payment for goods and services,...

5 Practically Proven Ways To Promote Your Brand On Instagram For Free

If you’re running an online business, and not harnessing...

A Quick Guide Explaining How To Create Personalised Football Cards

You are someone who wishes to personalize their own...

What Are The Best Money Transfer Applications?

The popularity of mobile and online applications that...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin