A Tree For a Mattress Will Put You In a Good Night Sleep

MattressNextDay has partnered with a global environmental...

9 Deliberate Things to Do to Improve Your Trading

If being in the trading business hadn’t been...

Office Equipment and Employee Well-Being

Your goal is to make money. However, if you don’t take care...

As US regulators warn brokerage firms and investors of the risks involved, the retail trading boom shows no signs of slowing

As Elon Musk finalises the process of purchasing Twitter...

Eventleaf | An Mobile Event and Mobile Conference App

Are you looking for a mobile event and conference app? Look...

5 Biggest Threats Today’s Businesses Face

Owning and operating a business can be difficult enough...

4 Core Functions All Small Businesses Should Consider Outsourcing Right Now

Many small business owners like to have full control and...

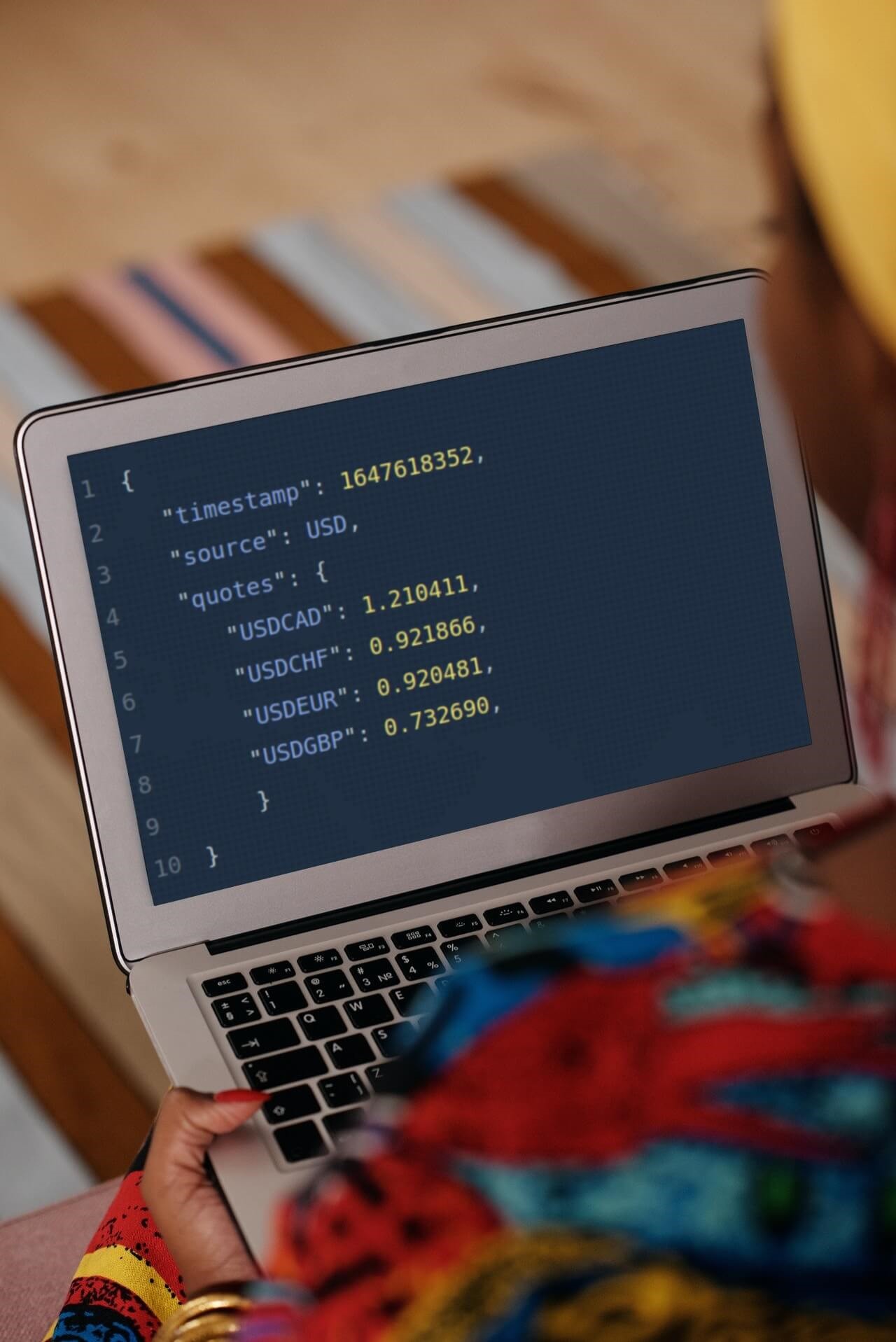

12 Helpful Tips For Using A Currency API

APIs have been increasingly popular over the years. It’s...

A Beginner’s Guide to Bootstrap File Upload

As a new web developer, hearing about Bootstrap file upload...

5 Examples Of Successful HTML Editors

An HTML editor is software that includes several tools for...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin