Why is Ibiza So Popular Among Party-Goers?

When discussing party destinations around the world, it is...

Increased Knowledge Equals Increased Sales In The World Of Spencer Lodge

Lately, sales has been treated with some neglect in...

12 Healthcare Tips For Modern Women

Our health is possibly the most important aspect of life;...

A Brief Learning About Programmable Logic Controller

A programmable Logic Controller (PLC) is a certain kind of...

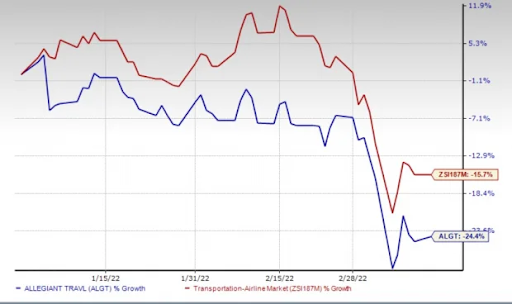

Travel Stocks Show Signs of Recovering from Yet Another Test as Industry Grows in the Wake of Geopolitical Tensions

For a travel industry that’s spent the past two years...

What is a sex crimes lawyer and why you might need one?

You might be wondering what a sex crime lawyer does. What...

Internet Marketing: Why Are Residential Proxies Important?

Internet Marketers jobs are extremely dynamic, and they...

Five stars you won’t see at World Cup 2022

The top football leagues across Europe are racing to a...

3 wildcard strategies for new businesses to stand out

There’s a lot to consider when starting a business. While...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin