Using a Pool Cleaner to Prevent Frogs from Getting into your Pool

Why Frogs Occur in Pools and How Can a Pool Cleaner Help...

Moncloa Denies That It Is Studying A Government Crisis

Moncloa has come up against rumors that point to an...

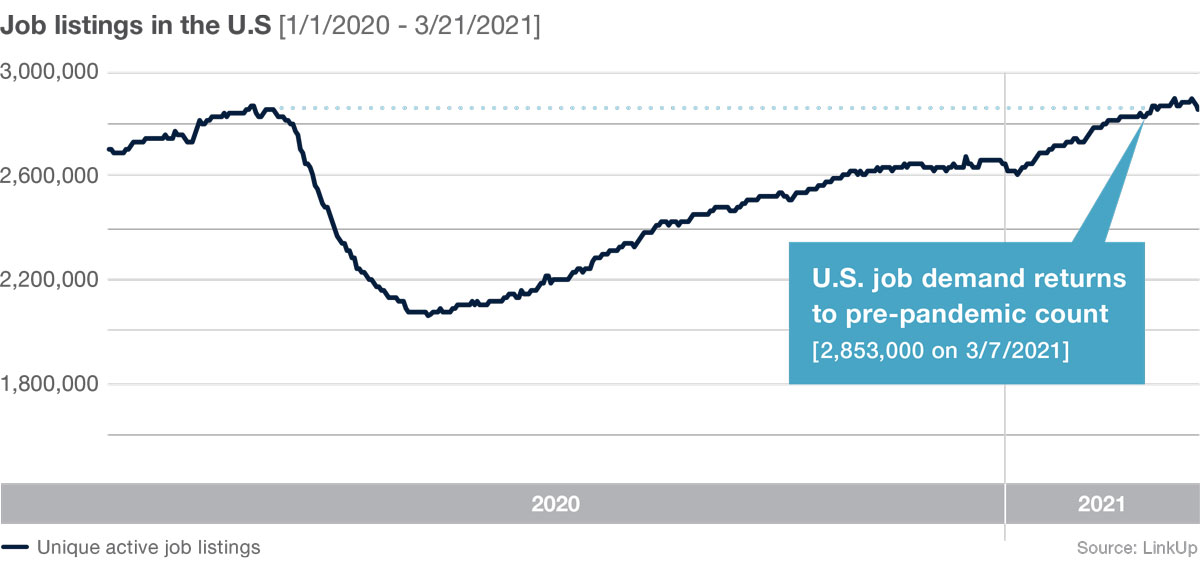

The Pace Of Job Creation Returns To Pre Pandemic Levels

The Spanish economy returns to cruising speed in May. This...

SEO Services Continue To Gain Momentum

When digital marketing first came to life so many years...

Forex or Stock Trading: Which is Best for You?

Many people are surprised to learn that Forex trading and...

Money saving tips for college students in UK

Everyone knows that university students scrape by on a...

5 Ways to Earn Cash Online in 2021

Ecommerce has boomed over the past couple of years. Due to...

Airlines Recover Routes To Europe And Latin America

The airlines begin to see the light at the end of the...

The Harmonist founded by Lola Tillyaeva (Till) scoops two nominations at 2021 Fragrance Foundation Awards

The Paris-based newcomer is in the running for both women’s...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin