Pre-Settlement Funding: Can Your Attorney Deny Your Request?

So, you have been in an accident, and the bills keep piling...

The 3 most cost-effective laptop options

The laptop has been able to survive amidst a stiff amount...

Bitcoin Rallies 20% In A Day Of Market Rally

Bitcoin rallies 20% in a day of market rally. Investing.com...

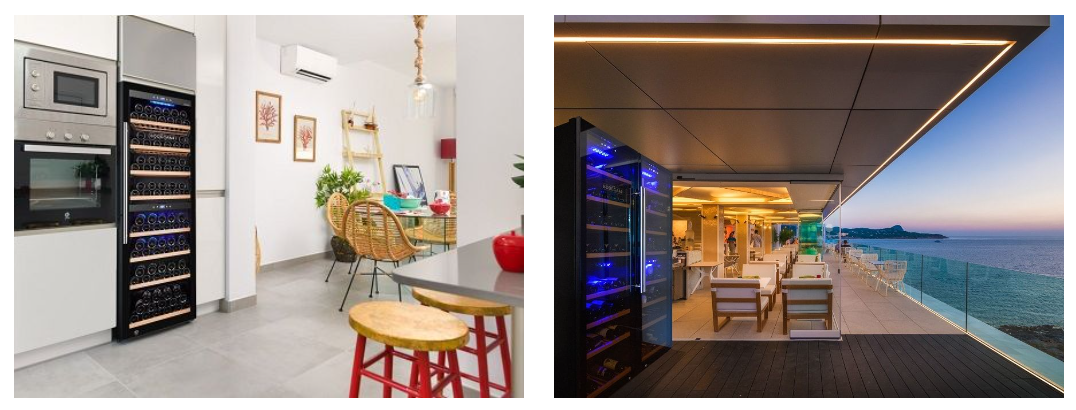

Decorate your home with BODEGA43 wine coolers

One of the most exciting parts of getting to know more...

A look at the most successful horses in Gold Cup history as Al Boum Photo has a third successive victory in his sights

The 2021 Cheltenham Festival is fast approaching, and horse...

Monkfish’s odds for Cheltenham Festival Novices’ Chase slashed after emphatic win at Leopardstown

Monkfish’s careerwas somewhat slow out of the blocks,...

8 Strategies You Can Use for Reopening Your Business After COVID-19

A marketer’s job is to predict and assess how consumers’...

5 Essential Aspects of Setting up a Successful Accounting Firm

The quality of an accounting firm often outlives its...

Here’s 5 Good Tips You Need to Take into Account Before Choosing a Roofing Company.

Trying to find a reputable roofing company to replace your...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin