Defending my business against legal action from creditors

If your business is on the receiving end of serious...

Everyone Hates Vanilla: Britain’s Favourite Flavour of Chocolate Revealed

Britain is certainly a nation of chocolate lovers, so much...

What All DJs Should Remember in COVID-19 Times

Various arms of the entertainment industry have been hit...

LIA Relief Trust Charity Introduced by Zuneth Sattar

The LIA Relief Trust is a charitable organisation that...

What Are the Areas Boutique Hotels and Retailers Should Focus On? by Graham Shear

Where is my niche? Over the years, I have consistently...

Pandemic bounceback: Capital’s rental market gets boost as Gravity Co-living unveils two new large complexes

In a massive lift for the embattled sector, Gravity...

The Evolving Games ― How the Olympics Changes With Society

The modern Olympic Games has come a long way from its...

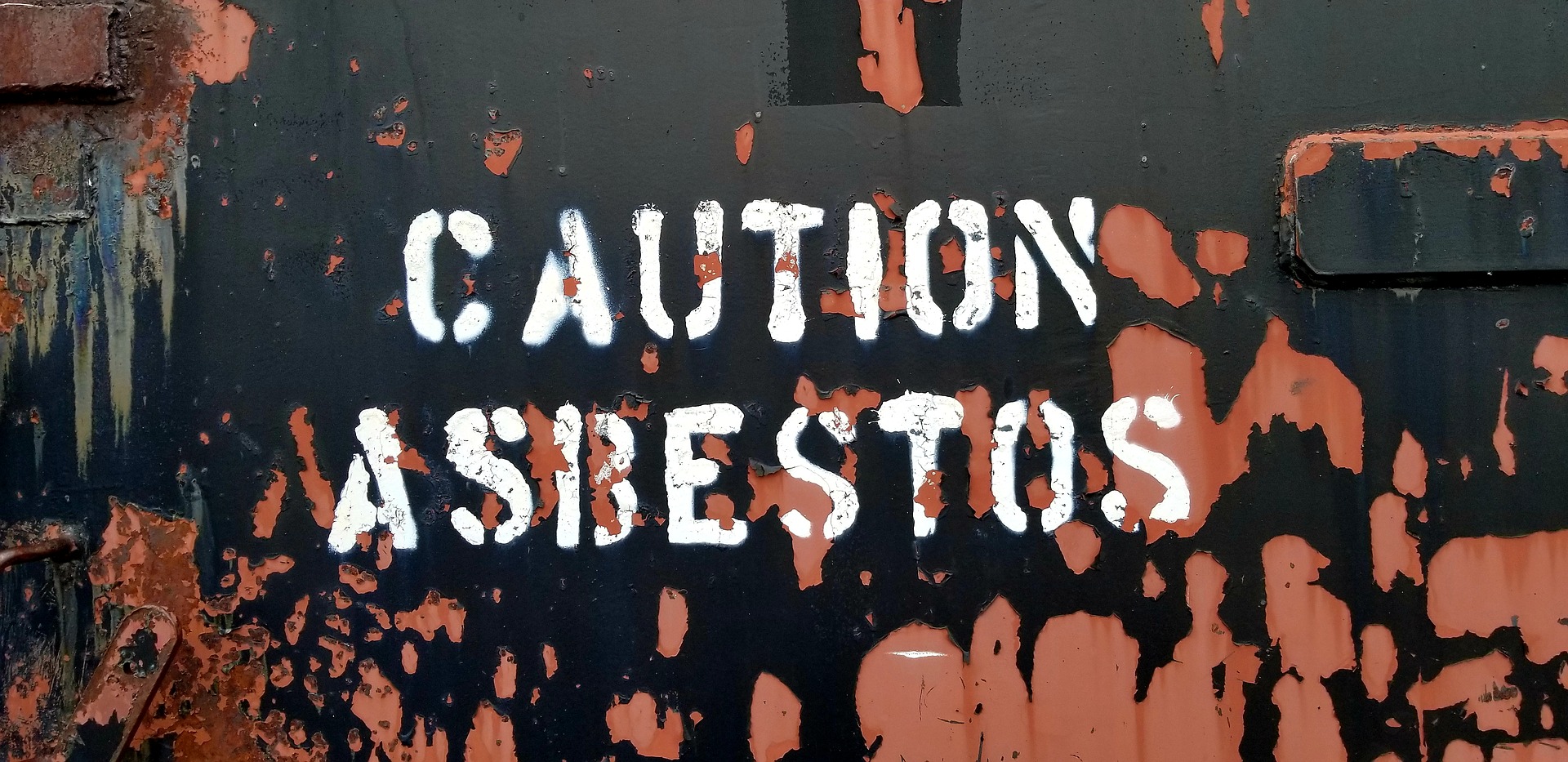

Asbestos: What Are My Responsibilities as a Property Owner?

It’s common knowledge that asbestos is a highly damaging...

Mind the Gap: Why 2020 Serves Up the Ideal Gap Year Opportunity

2020 is a year that will live long in the memory. It’s been...

Five basic skills of receptionist by Graham Shear

Currently, tourism is for many countries and regions, one...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin