The Small Business Owner’s Complete Guide to E-Invoice Software: From Paper Chaos to Digital Efficiency

E-invoice software replaces paper invoices with secure...

275,000 Traders Liquidated as Bitcoin’s Four-Month Losing Streak Deepens

By the time the dust settled on January 29, 2026, 275,000...

How American Freelancers Navigate Switzerland’s Tax Maze Without Triggering Two Governments

Every franc you invoice in Switzerland must answer to two...

Why UK Founders are Turning to American Buyers—And What it Takes to Get There

As domestic M&A activity stalls, a new pathway to...

How to be Exceptional in a Competitive Medical School Application Process

Applications for medical school are cutthroat; there are...

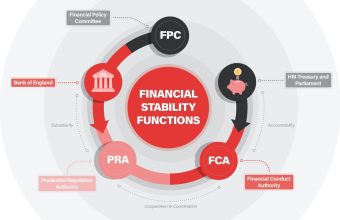

The Role of Regulation in Protecting UK Financial Users

The first time I sat in a dull, high-ceilinged room in...

Why Sustainable Digital Growth Depends on Transparency, Relevance, and User Trust

Building Long-Term Value in Crowded Digital Markets: The...

Understanding Digital Payments and UK Consumer Rights

The British relationship with money used to be tactile....

Why British Patients Are Choosing Moral Dental Surgery Over NHS Waiting Lists for Five-Day Treatments

The trial fitting happens on day three. Patients slip...

How Dr. Jay Johnson Prepares Coaches, Authors, and Speakers to Monetize Their Message and Expand Global Influence

Everyone has a unique story that contains a valuable...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin