Santander Loses 8771 Million In 2020 After Accounting Adjustment

The Banco Santander dismissed the year of the pandemic with...

10 Best Ways to Clean up Disk Space on Mac

During the worldwide pandemic that has affected many...

The Innocence Project: How They’re Freeing the Wrongfully Incarcerated

The Innocence Project is a non-profit legal organization...

These Small Businesses Are Most Vulnerable to COVID-19

Many high-profile pundits from both the business and...

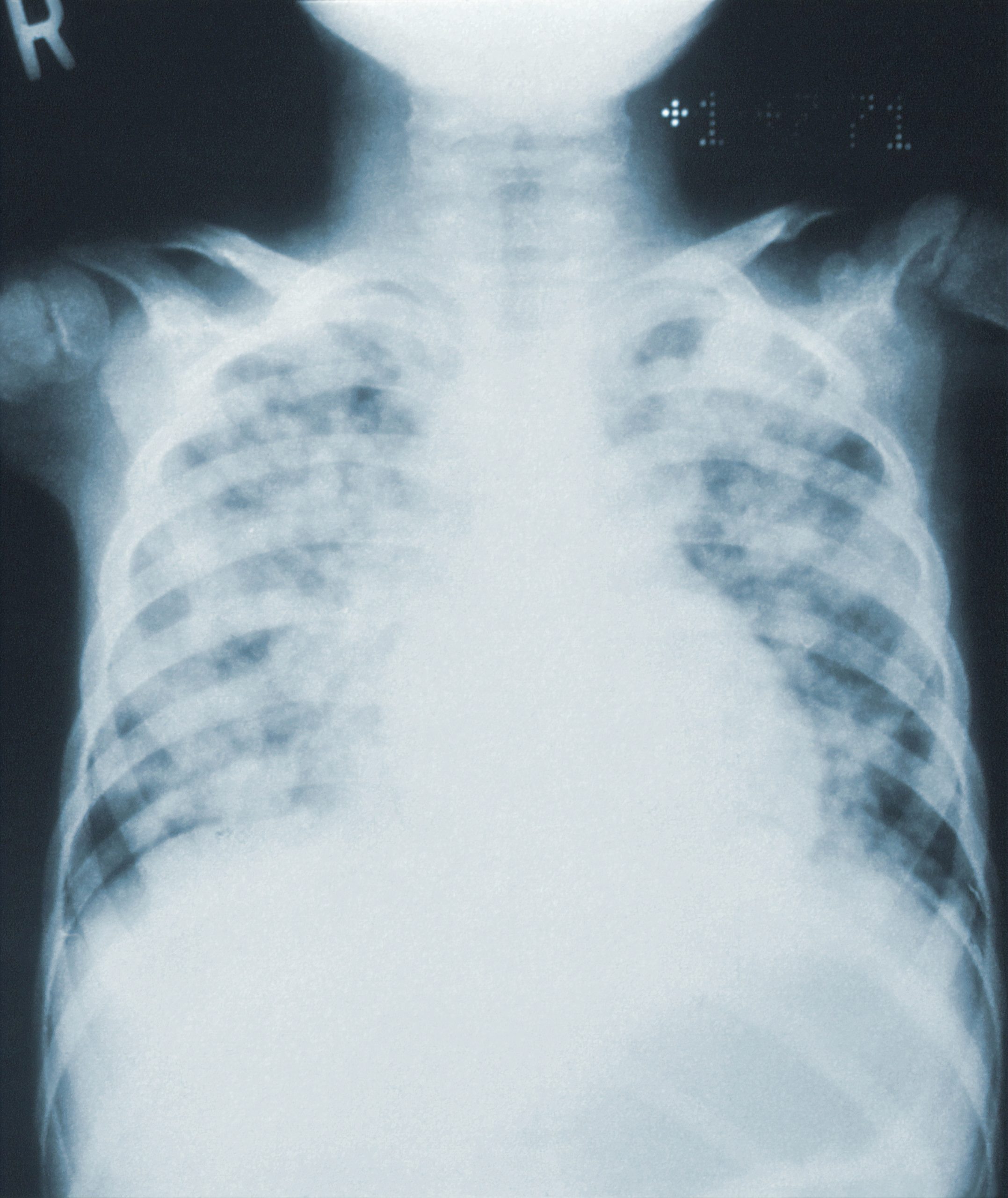

What to Expect During a Lung Cancer Screening

Early lung cancer detection saves lives. A lung cancer...

5 eCommerce pricing strategies that every seller should know.

One of the best business approaches is knowing all the top...

5 Steps to Kick Start Your Mortgage Journey

Speak to a broker “Fail to prepare, prepare to fail” the...

Storing and trading cryptocurrencies: The current security risks

Security is often touted as the primary advantage of...

Everything You Need to Know about selecting Laptop Rental

You may have enough reasons to choose laptop rental. but...

Should I buy a Lab Diamond or an Earth Diamond?

In 2020, more lab diamonds were purchased by consumers than...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin