How to Turn Your Love for Parties Into a Career

Nothing beats a good party. A well-planned party can be...

Your Guide to Mastering All Things Horse Racing

Horse racing has so much more to it than the standard...

The Gartner Magic Quadrant and Field Service

According to research company Gartner, a Magic Quadrant is...

How to Take Care of Your Mental Health During the Lockdown

From wildfires to a pandemic and everything in-between:...

7 Ways AI Software Is Helping Businesses Manage Their Contracts (2021)

Artificial Intelligence (AI) has revolutionized the way...

Is Buying a Home Out Of Reach When You Have Bad Credit?

Buying a house can be intimidating for anyone, but even...

Five Crazy Ideas For Neon lights

Guess what? Your search for a new modern interior love is...

5 Ways You Can Style Your Leather Jacket

A leather jacket is a classic staple in any woman’s closet....

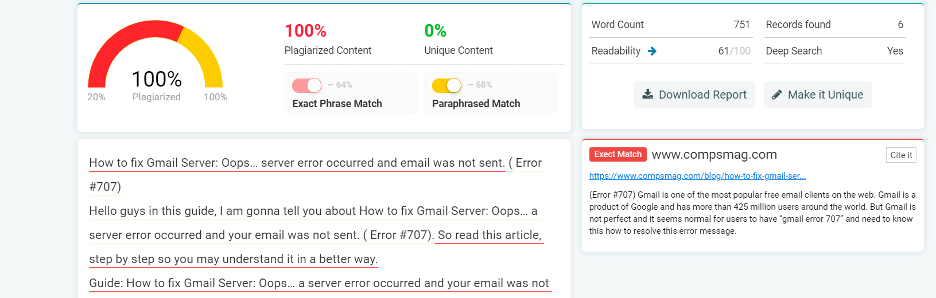

How to pick the best plagiarism checker for your academic institution

With a huge variety of plagiarism checkers on the internet...

5 Marketing Tips For Small Businesses During COVID-19

COVID-19 has hit small and medium businesses exceptionally...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin