Padrós Asks To Allocate Non Essential Budget Items

The president of the Official College of Physicians of...

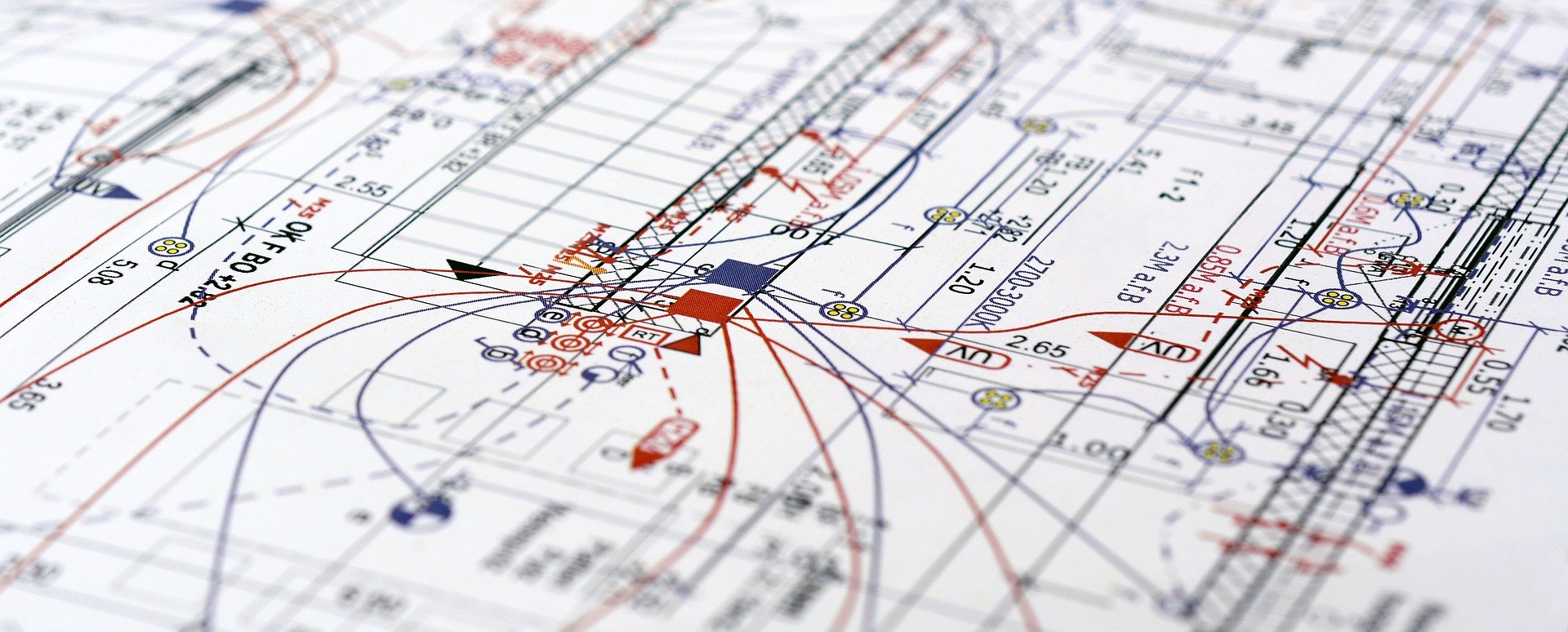

How Staying Connected to Electrical Installations Enables Greater Business Efficiency?

Image courtesy of ABElectricians. What is a baker meant to...

IN-DEPTH REVIEW OF STELLAR PHOTO RECOVERY SOFTWARE

If you’ve been handling digital cameras far...

The Most Secure Bitcoin Wallets in The UK

Before jumping right in to getting yourself bitcoin, you...

Things to Consider Before Installing Underfloor

Are you thinking about adding underfloor heating to your...

How to Make the Most of Your Lockdown Valentine’s Day

Valentine’s Day 2021 is set to be a memorable one – perhaps...

Discover Ten Benefits of Using a POS System

Whether a retailer or a restaurant, a POS system offers...

What Are the Benefits of Telehealth Services and Virtual Appointments?

Healthcare workers and medical practices could see major...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin