Five ways UK side-hustlers can wrangle Etsy, eBay & Amazon payouts without a headache

Your phone buzzes, an Etsy sale, then eBay. Your passion...

2025 $1400 Stimulus Checks Eligibility

The eligibility window to receive the $1400 stimulus checks...

Massachusetts Lottery $4 Million Prize Claim

Anyone can only dream of winning such a lottery prize as 4...

Kill Tooth Pain Nerve In 3 Seconds Permanently

There is nothing like horrible tooth pain that can...

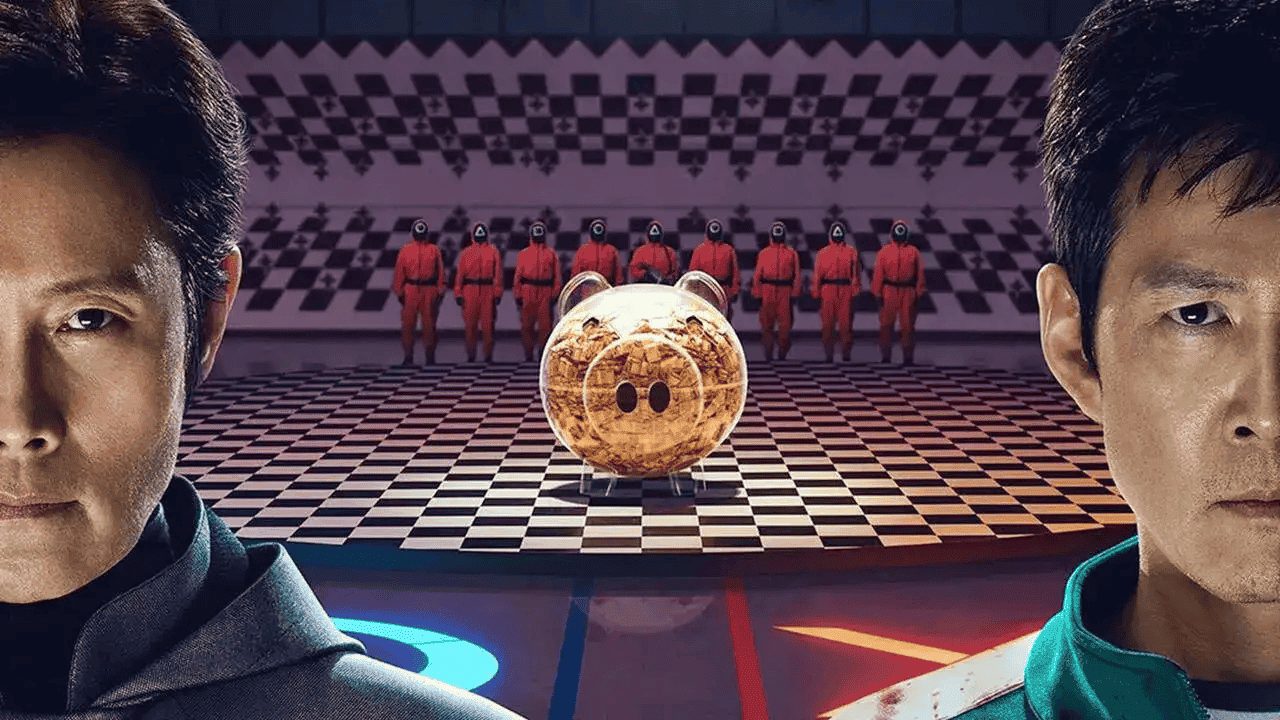

Squid Game Season 3: Final Season Global Release Time & Date Details

Squid Game, the South Korean survival drama that took the...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin