Commercial Cleaning Services Dallas: Boost Your Business

Maintaining a clean business environment is vital for the...

Cable Key Ring: Organized Business Travel Essentials

journey. A small but powerful tool that can make a...

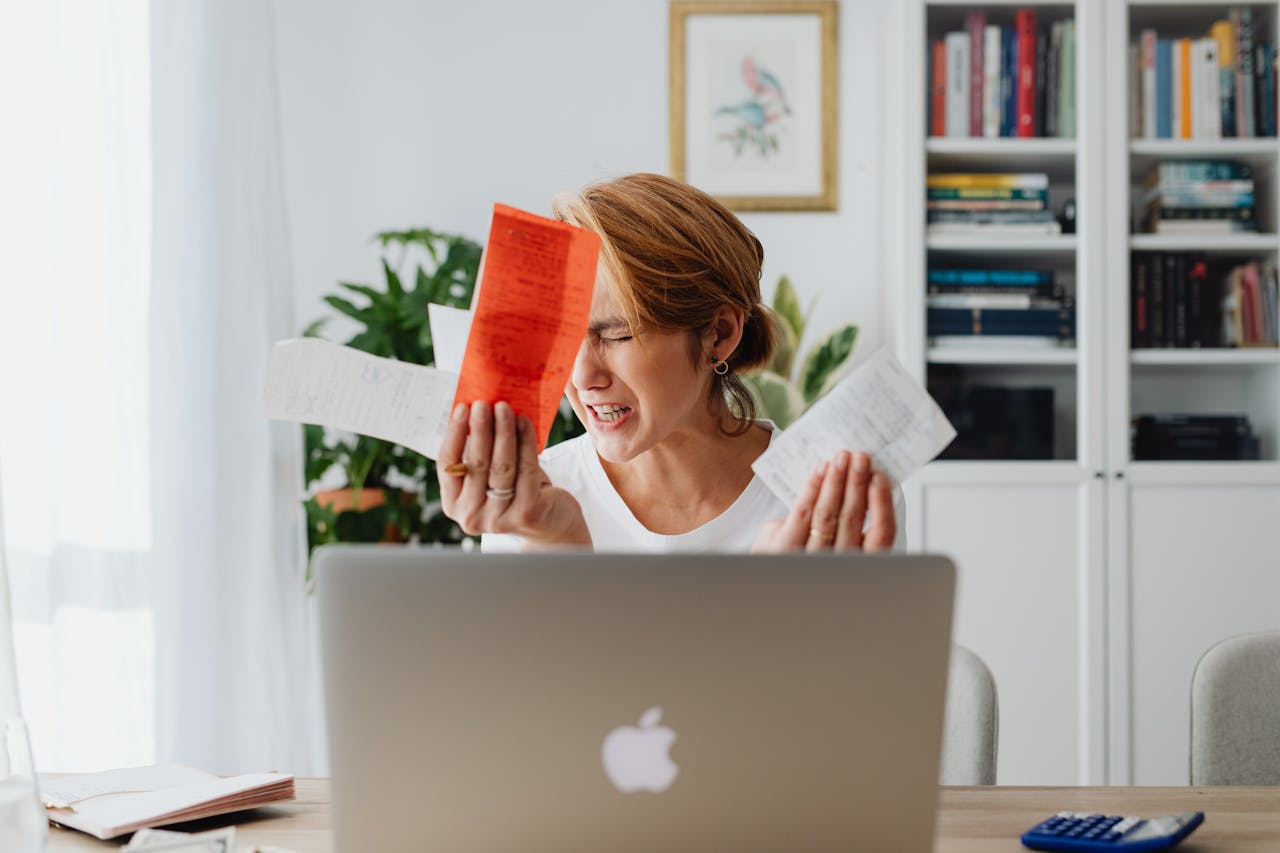

Understanding Your Options for Smarter Borrowing

Debt can feel like a weight that just keeps growing—bills...

Bridging the Gap Between Understanding Finance and Strategic Action

The biggest shift in personal finance today isn’t about...

How Do Themed Play Units Enhance Children’s Imaginative Play?

Childhood is a precious time, brimming with curiosity,...

What Sports Can Be Played on a MUGA? A Breakdown by Surface Type

Multi Use Games Areas, more commonly known as MUGAs, are an...

Sustaining Online Success Through Proactive Web Management

In today’s digital-first world, your website provides...

Inside the Lucrative World of Football Player Salaries

Soccer is not only the world’s most favorite sport,...

Origami Tech Unveils Free No-Code Platform for Automated Cryptocurrency Trading

Dubai-based fintech start-up Origami Tech has launched its...

TRON Rides DeFi Wave to Top Ten Glory

Even in the unpredictable realm of digital currencies, Tron...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin