United States vs Canada Hockey Live Score and updates

The U.S. and Canada are set to clash in the 4 Nations...

4 Nations Face-Off Final Preview: How to watch Team Canada Hockey

Hockey fans, the moment we’ve all been waiting for is here!...

How to watch 4 Nations Face-off Final in Canada

The stage is set for an epic showdown as Team USA and Team...

What channel is Team Canada game on? How to watch 4 nations championship in Canada

The stage is set for an epic showdown as Team...

Where to watch Canada vs USA Live: 4 Nations Hockey From Canada TV

The game everybody wanted is the game everybody got....

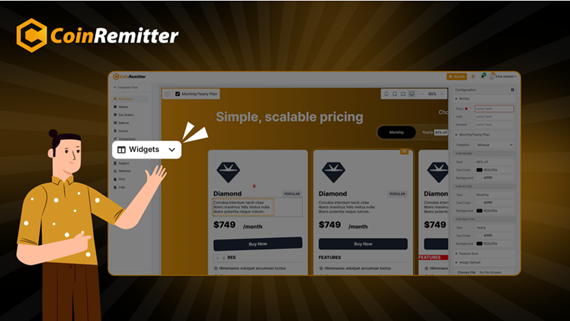

Coinremitter Introduces the “Pricing Widget” Feature, Simplifying Crypto Payment Integration for Businesses

Coinremitter, one of the most popular crypto payment...

Key Factors Influencing Back Injury Settlements in 2025

Back injuries resulting from car accidents are,...

Unveiling the Future of Crypto Exchange Licenses: A Glimpse into Trends and Predictions

The last decade has seen the growth of cryptocurrency into...

The Best Business Ideas with Minimal Investment in 2025

Being a business owner is a dream of many people. But what...

Salesforce Editions Comparison: Choosing the Right One

If your target is to optimize your business operations,...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin