MENA’s Game District Acquires EverBlast Maker Gleam Games

With more than 2 billion mobile game downloads globally,...

AJet Achieves Global Milestone with APEX Award

Türkiye’s New Airline Recognised as “Four-Star...

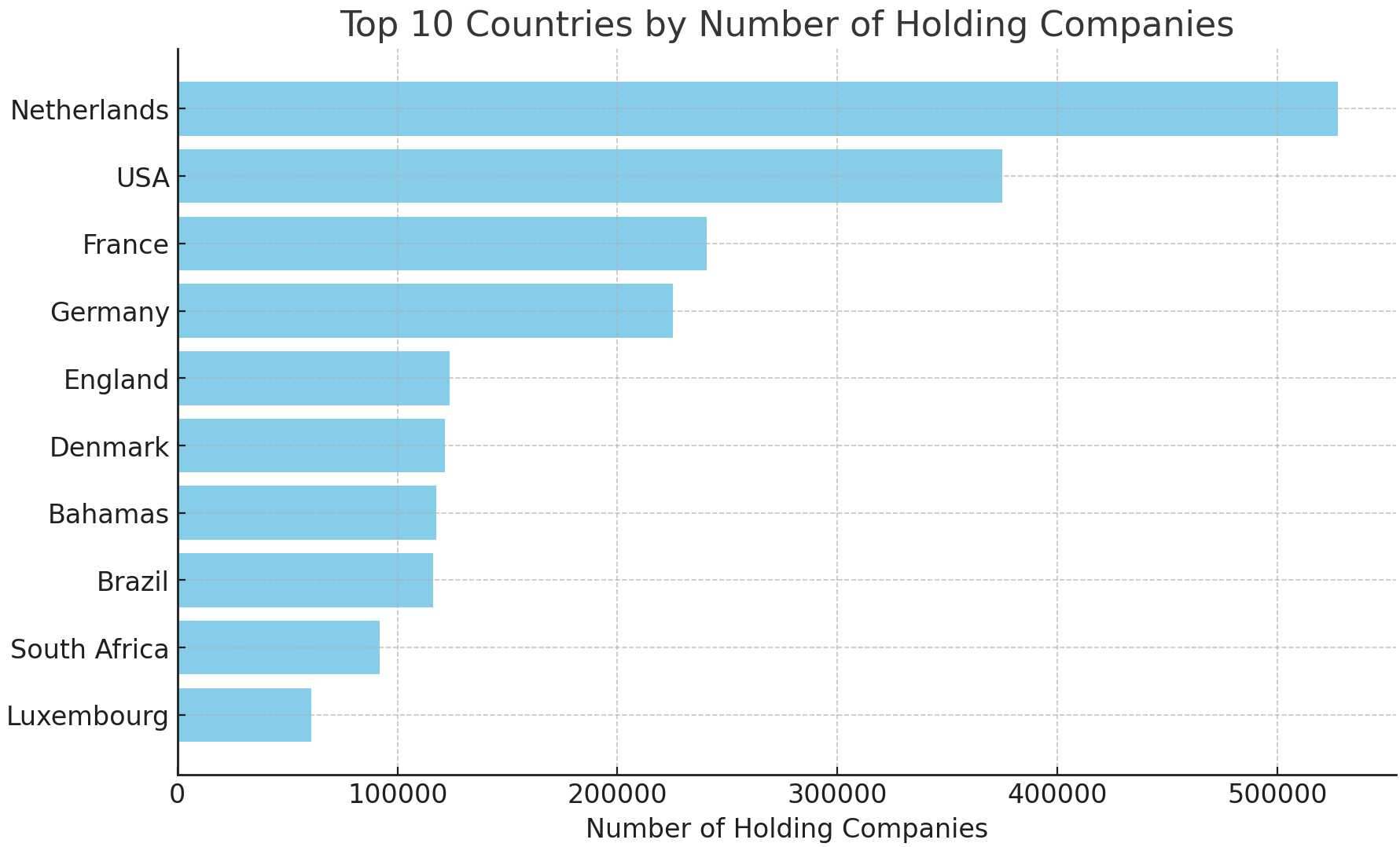

The Netherlands hosts the highest concentration of holding entities worldwide

Amsterdam, 12 November 2024 – Small country, big numbers:...

Credit Evolution: Unpacking the Spectrum of Loans Available Today

Borrowing has become a practical solution for funding...

Navigating Volatility: How Investors Approach Risk in the Share Market

Investing in the share market can feel like stepping onto a...

B2CORE Android App 2.0: Elevating Trading and Financial Management

Building on the success of the initial release, B2BROKER is...

Albright IP Wins Landmark IP Case for Liking Ltd in High Court

In a landmark ruling by the Intellectual Property...

UK Construction Transformed by Module-T’s Modular Off-Site Solutions

As the need for rapid and environmentally friendly...

Digital Wallets and Banking Innovations Transform Insurance Payments

Insurance is a popular way of protection from financial...

Player Protection Measures in iGaming

Consumer protection is the main pillar for the iGaming...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin