Financial Experts Unveil Game-Changing Strategies for Mastering Money Management: Your Ultimate Guide to Smart Wealth Decisions

In the UK, the cost of living has put a major financial...

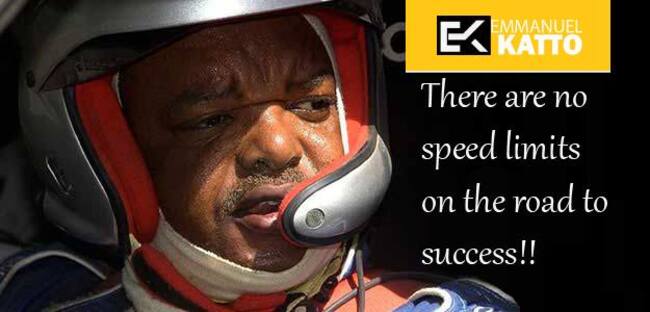

Emmanuel Katto (EMKA) Envisages a Luminous Future for Motorsports in Uganda

Injecting the Scene with Zeal and Visionary Acumen Emmanuel...

Decades of Dazzle: Predicting the Progression of Beauty Ideals

Tracing the trajectory of beauty trends reveals a...

XTrend Speed, the Ultimate Cutting-edge Toolkit for Traders

Reportedly, XTrend Speed, awarded the BEST MOBILE BROKER OF...

The Explosive Rise of Mobile Gaming: Unveiling the Irresistible Allure Behind its Soaring Popularity

Mobile gaming is becoming increasingly popular with modern...

Building a Stellar Website: Key Elements and Best Practices

In today’s digital age, a website serves as the...

US iGaming Stocks to Look out for in 2024

The burgeoning US iGaming market, with its rapid expansion...

Breach of Contract Allegations Against Lottery.com by Woodford Eurasia

Woodford Eurasia has voiced grave concerns regarding...

Exploring Emotional Intelligence in Relationships

Emotional intelligence plays a pivotal role in the success...

Safeguarding Online Community: Unveiling the Crucial Role of Chat Moderators in Live Interactive Entertainment

The experience extends beyond the thrill of numbers being...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin