Study shows only 8% of businesses prepared for PSTN Switch Off – how to make sure you aren’t caught out

Whilst we might only be in 2023, the time for the Public...

Cousin Pat Therapy Uses Social Media to Spread the Message of Mental Wellness

Cousin Pat aka Dr. Patrick Argiro of Cousin Pat Therapy...

JD.com Showcases Chinese New Year Grand Promotion Trends; Promotes New Atmosphere

The annual Chinese New Year Grand Promotion came to Chinese...

A Complete Guide to Development Finance

What is Development Finance? Development finance is a type...

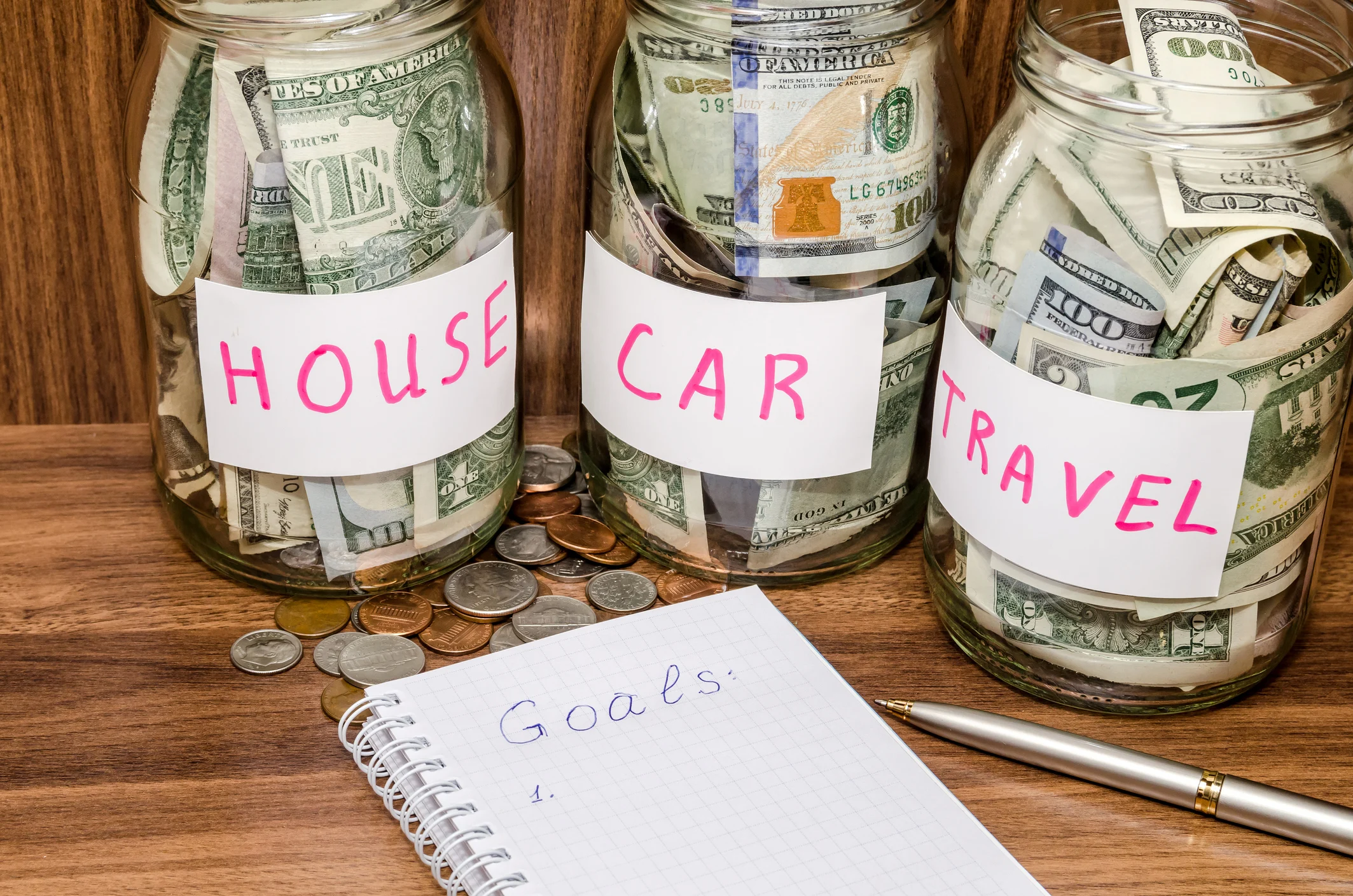

MARCHING AWAY FROM THE BANK: 25 MILLION BRITS SET TO ABANDON THEIR YEARLY SAVING GOALS TODAY

With March beginning today, it seems Brits are...

More Than Half of UK Adults Check Ethical Credentials of Savings Accounts Before Putting Forward Money

A new study conducted by Gatehouse Bank has revealed that...

The Best UK savings accounts and rates for 2023 – Get up to 5% !!

We have searched the current top ten regular savings...

Green for go – a budget wishlist for small businesses

Purbeck Personal Guarantee Insurance, the provider of...

VISA Steams Ahead With Crypto

Visa has made it clear that its plans for crypto-related...

Aston Martin claims profitability will improve this year after a rough 2022

After a tough 2022, Aston Martin expects profitability to...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin