How Can Students With Low Funds See The World?

What are the best ways to save money while traveling? How...

Divorcing an Alcoholic or Drug Addict and Stay Sane

Living in a marriage with an alcoholic or drug addict may...

The Rise Of The Hybrid Workspace: What It Is And Why It’s Here To Stay

Do you ever feel like there’s too much to keep track...

How to Overcome a Poor Credit Rating

It’s not long after you assume financial independence from...

Five ways you can earn extra money through your love of sport

The adage that you should make money doing something you...

Why Does Every Business Needs Online Form Builder? 5 Use Cases

If you own a business, you must utilize an online form...

Importance Of Indicators In Knowledge Management

A successful knowledge management system contributes to the...

The Best Ways to Use Offers, Coupons, Discounts, and Deals to Generate More Sales

The model of better pricing for a business is not always...

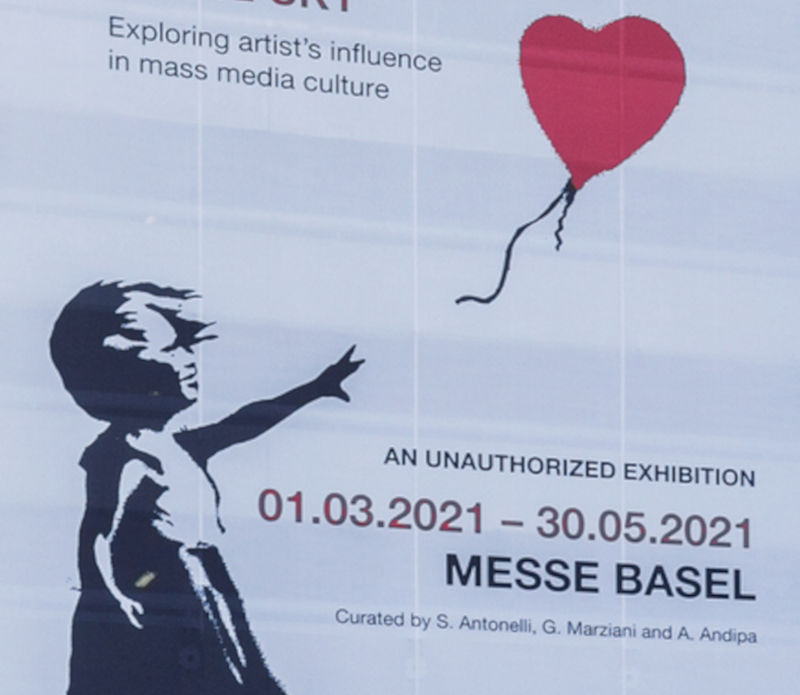

The Largest Sales of Banksy Artwork in the World

When a Banksy original art piece goes to auction or is...

Steps to Start Window Cleaning Business

If you want to start a business with low overhead costs,...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin