Cheap Vintage Ralph Lauren Clothing Parts

The polo giant of the clothing world, Ralph Lauren is a...

Steps to improve customer loyalty

There are various leading brands as well as hungry startups...

Reasons Behind Average UK House Prices Rise With Each Year

According to the Office for National Statistics, the...

Finally A Crypto Trading Bot Which Fought Market Fluctuations And Delivered Consistent Profits. Find out more

Cryptocurrencies were first established in 2008, but in...

Car Insurance: Complete Guide for Young Drivers

If you are driving for the first time in your life, it is...

7 Introduction Email Templates That Work in 2021

An introduction email is a message in which you introduce...

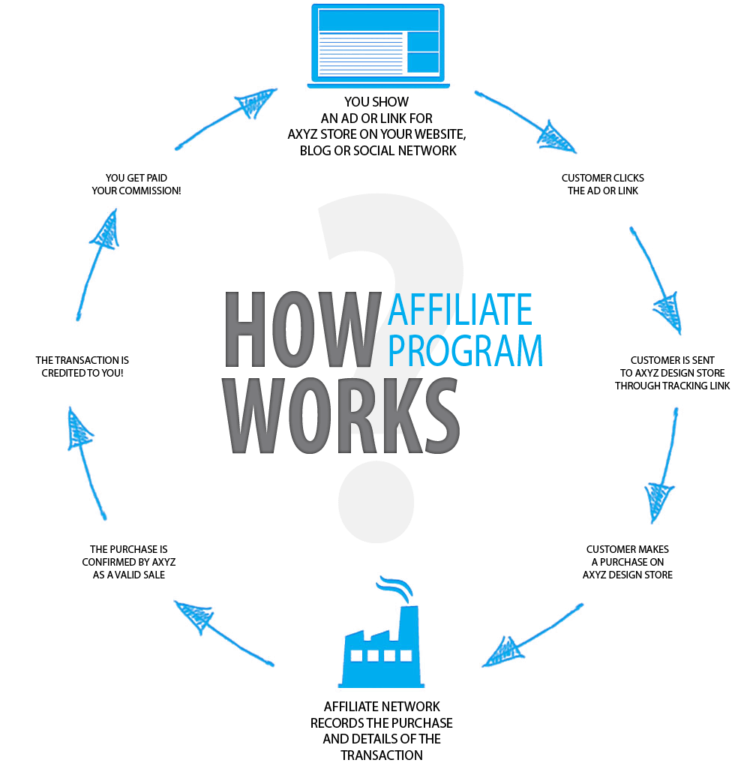

What is affiliate marketing? How to start making money on affiliate programs

Finding a powerful source of income may take things in your...

How Does Coinbase Work: Guidelines for New Clients

One of the first crucial decisions you need to take at the...

What Are the Best Crypto Telegram Groups?

When one wants to earn from trading crypto, fiat currency,...

How to Shop Responsibly this Holiday Season

In recent years, corporations have faced immense pressure...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin