How RPA Can Change the Business Landscape

Robotic process automation has the potential to completely...

Profit Time Machine: How you could have turned $600 into $1M

Cryptocurrencies, especially Bitcoin, have presented an...

5 Ways to Make Your Money Work for You

As ace investor Warren Buffet likes to put it, “If you...

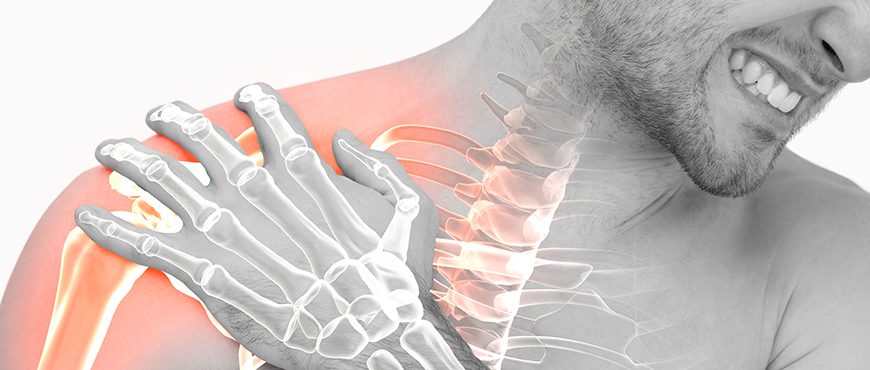

Humerus Fracture – All You Need to Know

Humerus fracture occurs in the upper arm bone and due to...

Future of cryptocurrency in UK

Recently, cryptocurrencies have been the talk of the town....

Flipping Vacant Land: How to Make Money Out of It

For sure, you’ve heard about the enterprise of flipping...

The 5 Best Personal Finance Apps For 2021

Managing our finances always prove to be taxing and...

The Reality About Custom Printed Boxes

Custom size, custom printed wholesale boxes are available...

Online Latest Technology Screen Recording Tool with Perfect Resolution

Video screen recording can be proceeding with easy and...

27 Best Sites to Buy TikTok Followers (Real & Active)

Tik Tok is a growing rage. And from the looks of it, this...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin