The Benefits of Playing Bingo Online Instead of Regular Bingo

Bingo remains one of the most popular entertainment...

Four Ways Technology Helps the Hesitant Beginner Investor

Many of us take the convenience of electronic banking and...

3 steps to set up a business in China

China is the world’s first major economy to recover from...

Five Crucial Tips to Crack any Insurance Exam in First Attempt

Many insurance exams are conducted each year by various...

Padrós Asks To Allocate Non Essential Budget Items

The president of the Official College of Physicians of...

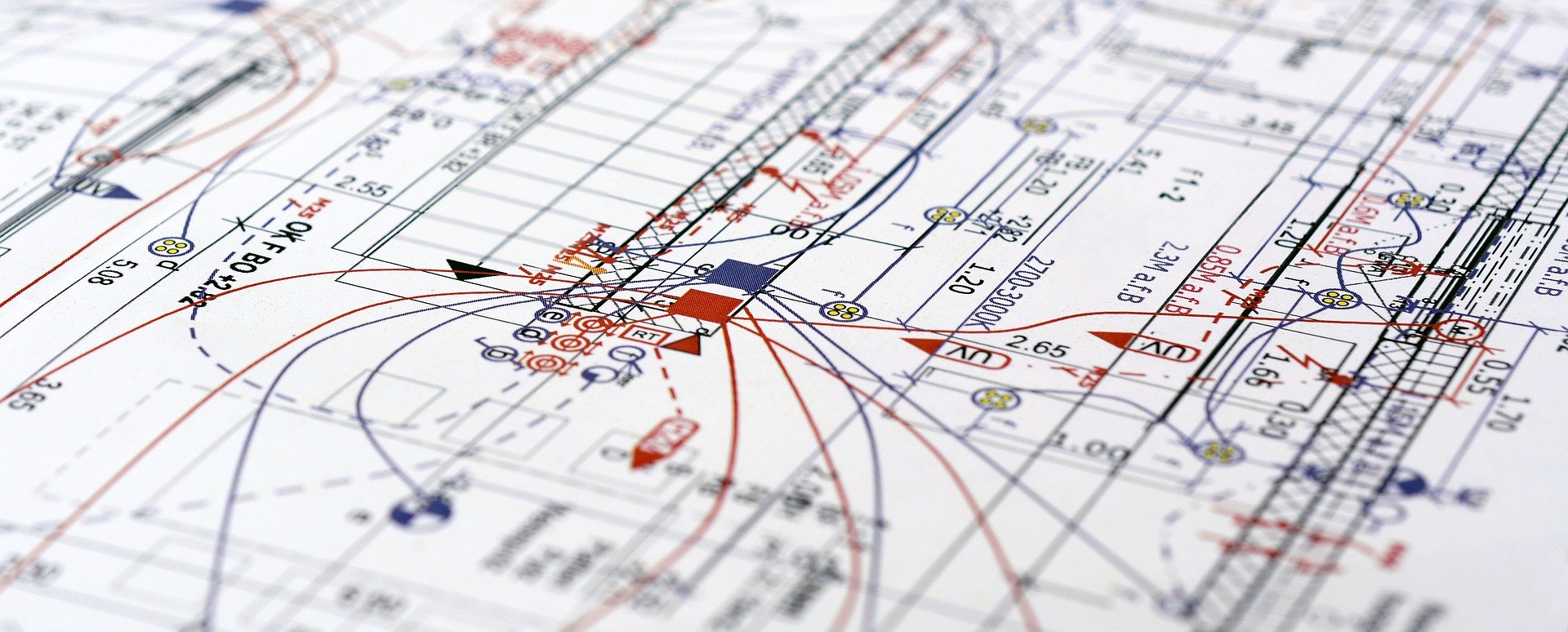

How Staying Connected to Electrical Installations Enables Greater Business Efficiency?

Image courtesy of ABElectricians. What is a baker meant to...

IN-DEPTH REVIEW OF STELLAR PHOTO RECOVERY SOFTWARE

If you’ve been handling digital cameras far...

The Most Secure Bitcoin Wallets in The UK

Before jumping right in to getting yourself bitcoin, you...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin