What is the right time for selling a life insurance policy and how it works

The importance of life insurance as a financial asset is...

Violence Increases In Final Stretch Of US Withdrawal From Afghanistan

With the United States forces in full retreat from the...

Biden Returned The Favor To Buttigieg

Joe Biden has chosen Pete Buttigieg, the former mayor of...

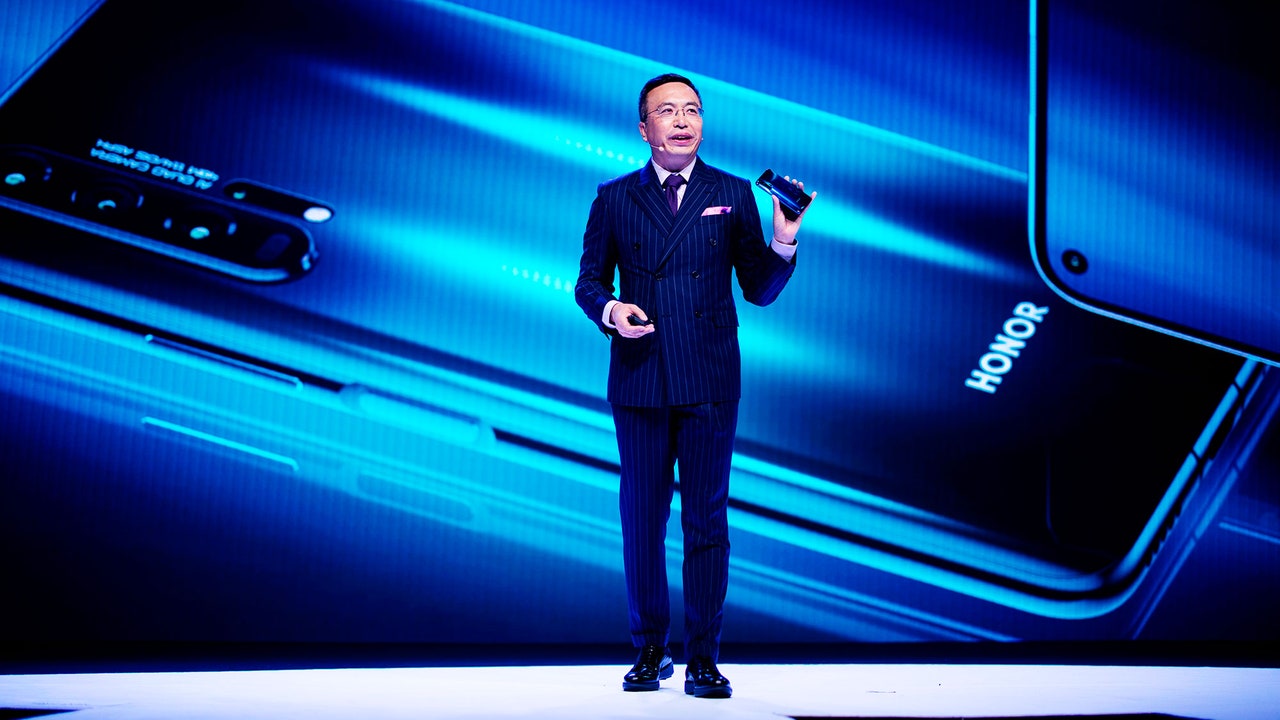

Huawei Detached From Honor Under US Pressure

Donald Trump ordered in May to extend the ban on companies...

93% Population Used The Internet In Three Months

81.4% of households with at least one member between 16 and...

Solid Is The Platform For Returning Data To Citizens

The father of the World Wide Web, Tim Berners-Lee, has...

An Airbnb dating with a panic button

At least from theory, the pandemic has been an obstacle to...

Assisted Reproduction From Your Own Home

Fertility treatments involve many visits to the clinics to...

Lifeline Of The Spanish Hospitality Industry Is Digitization

Covid-19 has destroyed families, has blown up the way of...

Bill Gates Predicts When The Next Pandemic Will Arrive

A year has passed since the first confirmed case of a...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin