Sport and Female Empowerment: Four Inspirational Icons to Impose Post-Lockdown Change

Historically, the world has assumed several aspects of...

Five of the Most Innovative Buildings in the World

Architects and construction companies are constantly...

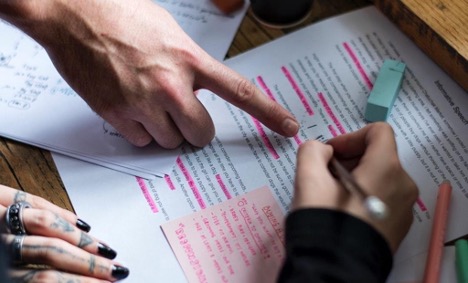

Top Ways to Write an Outstanding Writing Plan for Your Essay

An academic essay is about answering questions in a...

Best Advice for Writing a Student Resume After Graduation

Are you looking for resume tips for college students? Then...

Wise Student’s Advice for writing college term papers

Running out a term paper is a herculean task, while it has...

What Is A Cash Flow Forecast?

Cash flow is the lifeblood of any business. The simple fact...

8 Signs You Have a Water Leak in Your Home

Leaks in the home can easily become your worst nightmare...

How to Save Money on Your New Boiler Upgrade

Do you need a new boiler in your home? If your boiler is...

4 Tips for Success in Fashion Retail

New designers are advertising their fashion lines on social...

Winter BBQ – Christmas Day on the Charcoal

‘That’s summer over for another year’, is undoubtedly one...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped SOL

Wrapped SOL