The Animals and Paying the Price for Human Fly-Tipping

Fly-tipping is despised for its vandalism, uncleanliness,...

Can Waste-to-Energy Solutions Solve Two Problems at Once?

The world is in the midst of a waste crisis. Tonnes and...

In the Deep Sea, No-One Can Hear Diving Accidents

Deep-sea diving is high-risk — have you ever wondered why...

How to Make Your Business More Eco-Friendly

As we continue to work towards the government’s net zero...

Smart Construction: What Does the Future Hold?

As the world of technology and construction develops, we...

How Sustainability is Shaping Bridge Construction

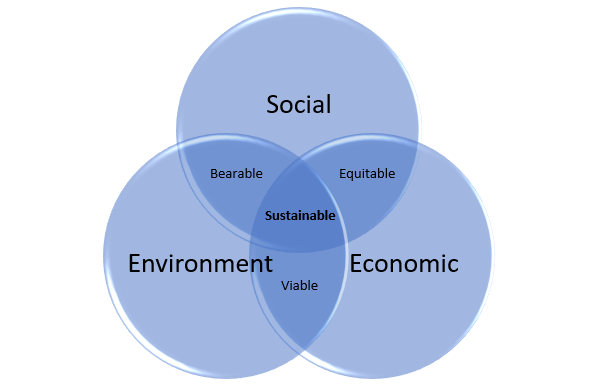

Concern over sustainability has never been greater, and...

70% of Workers Are Considering Shifting Careers Due to Covid-19

The current situation has led many of to assess our futures...

Approval for US- based company to deliver Coronavirus testing technology throughout Nigeria.

Nigeria will be receiving an approved multi-functional...

6 Best Drop Servicing Niches for Beginners (2020) – By Dylan Sigley

You’re excited to start your drop servicing business, but...

How has COVID-19 affected used car prices? Two experts give their opinion

Used car prices have risen steadily since the pandemic...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin