The digital business landscape is evolving, and more professionals are looking for opportunities beyond the constraints of traditional careers. Enter Darren and Mike’s Dream Team, a powerhouse mentorship program designed to help aspiring entrepreneurs build successful online businesses with confidence. By combining automation, digital marketing, and a proven business model, Darren and Mike have created a roadmap that eliminates guesswork and maximizes success.

Unlike traditional business ventures that often require years of trial and error, Darren and Mike provide a streamlined system that fast-tracks financial independence and time freedom. Their hands-on approach, paired with the power of MLM and Enagic distribution, has empowered countless individuals to break free from the 9-to-5 grind and embrace the lucrative world of online business. In this article, we’ll explore who Darren and Mike are, the key principles behind their Dream Team, and why so many professionals are making the switch to digital entrepreneurship.

Who Are Darren and Mike?

Darren and Mike are two visionary entrepreneurs who have built a thriving digital business by leveraging MLM, automation, and expert mentorship. Their journey into the world of online business and Enagic distribution didn’t start overnight. Like many entrepreneurs, they faced challenges, but through persistence and strategic decision-making, they discovered a system that not only worked for them but could be replicated for others.

What sets Darren and Mike apart from other digital business coaches is their commitment to hands-on mentorship. Rather than offering generic advice, they provide a structured, step-by-step approach tailored to each individual’s strengths and goals. Their expertise in digital business and network marketing has enabled them to cultivate a community of like-minded entrepreneurs who are not just chasing financial success but also achieving time freedom and flexibility.

As Enagic distributors, Darren and Mike found a business model that aligns with their values—offering a product that promotes health while also providing a lucrative opportunity for those looking to enter the MLM space. Their focus is not just on selling products but on building sustainable businesses that generate long-term success. Through their Dream Team, they continue to help thousands of people transition from traditional jobs to profitable online ventures, proving that financial freedom is achievable with the right guidance and system in place.

The Dream Team Approach: What Sets Darren and Mike Apart?

Success in the digital business world doesn’t happen by chance—it requires a well-structured plan, expert guidance, and a supportive network. Darren and Mike’s Dream Team is built on these core principles, offering aspiring entrepreneurs a clear path to success.

One of the most significant advantages of Mike and Darren’s system is their step-by-step mentorship program. Many people attempting to start an online business feel overwhelmed by the sheer volume of information available. Darren and Mike eliminate this confusion by breaking down the process into simple, actionable steps. They provide hands-on coaching, helping members build their businesses efficiently without wasting time on trial and error.

Another crucial component of their approach is automation. Many traditional businesses require constant management and physical presence, limiting flexibility. However, Darren and Mike teach their community how to leverage digital tools and automated marketing systems to generate income without being tied to a desk all day. This makes it possible to build a business while still having time for family, travel, or other pursuits.

Unlike many online business programs, Darren and Mike emphasize community-driven success. Their Dream Team isn’t just about making money—it’s about creating a network of entrepreneurs who support and learn from each other. This collaborative environment fosters motivation and accountability, increasing the likelihood of long-term success.

By providing personalized mentorship, automation strategies, and a supportive community, Darren and Mike have developed a system that simplifies the process of building a digital business. Their members don’t have to navigate the industry alone—they have a proven roadmap and expert mentors guiding them every step of the way.

Why Professionals Are Choosing Online Business Over Traditional Careers

The traditional career path is becoming less appealing to many professionals who are seeking financial independence, flexibility, and control over their lives. Darren and Mike’s Dream Team provides an alternative that aligns with modern aspirations—a digital business model that offers freedom from the 9-to-5 grind.

One of the biggest drawbacks of traditional careers is the lack of control over income and time. Many professionals spend years climbing the corporate ladder, only to hit salary caps or experience job insecurity. In contrast, a digital business allows individuals to scale their income based on effort and strategy, rather than waiting for incremental raises or promotions.

Another major issue with conventional business models is high startup costs and operational risks. Opening a brick-and-mortar business often requires significant investment in real estate, inventory, and staff—expenses that many aspiring entrepreneurs simply can’t afford. On the other hand, Darren and Mike’s online business model eliminates these overhead costs, allowing people to start their own business with minimal risk and upfront investment.

Flexibility is another key factor driving professionals toward digital entrepreneurship. Many traditional careers demand long hours, commutes, and rigid schedules that leave little room for personal growth, family time, or travel. By embracing automation and online marketing, members of Darren and Mike’s Dream Team can work from anywhere in the world while maintaining control over their schedules.

Through Darren and Mike’s mentorship, automation strategies, and supportive community, professionals are discovering that financial success no longer requires sacrificing personal freedom. This shift in mindset is why more people are choosing online business over traditional career paths—and why Darren and Mike’s Dream Team is leading the charge in this digital revolution.

How Darren and Mike Help Entrepreneurs Succeed in MLM

One of the key pillars of Mike and Darren’s success is their ability to transform MLM into a sustainable and profitable business model. While many people have misconceptions about MLM, Darren and Mike break the stigma by teaching ethical, results-driven strategies that work.

At the core of their success is their partnership with Enagic, a global leader in water ionization technology. Unlike traditional MLM approaches that rely solely on word-of-mouth marketing, Darren and Mike incorporate digital strategies and automation to create a seamless and scalable business. This modernized approach to MLM removes common barriers—such as cold calling, inventory management, and in-person selling—making it easier and more efficient to build a business online.

Another major distinction of Darren and Mike’s MLM strategy is their focus on education and mentorship. Many people fail in MLM because they lack guidance and a structured plan. Darren and Mike provide comprehensive training, teaching their team how to use digital marketing, social media, and automation to attract the right audience and drive sustainable growth.

Rather than relying on outdated recruitment tactics, they focus on value-driven strategies that prioritize relationship-building and long-term success. This means their team members aren’t just pushing sales—they’re educating and empowering others to build their own businesses.

By combining MLM with a modern, digital-first approach, Darren and Mike have redefined what success in network marketing looks like. Their mentorship ensures that members are set up for long-term financial growth, rather than experiencing short-lived wins.

Key Benefits of Joining Darren and Mike’s Dream Team

Success in the online business world isn’t just about having a great idea—it’s about having the right system, mentorship, and support network. That’s exactly what Darren and Mike’s Dream Team provides. Their program isn’t just a business opportunity; it’s a comprehensive strategy for long-term financial success.

Here are the key benefits of joining Darren and Mike’s Dream Team:

- Step-by-Step Mentorship: Many aspiring entrepreneurs fail because they don’t have a clear plan. Darren and Mike’s mentorship eliminates guesswork, offering a structured approach to building a successful online business.

- Proven Automation Strategies: Unlike traditional MLM models, their system leverages automation to generate leads, nurture prospects, and drive sales—all while reducing manual workload. This allows members to scale their businesses without needing to work around the clock.

- A Supportive Community: The Dream Team is more than just a business program—it’s a network of like-minded entrepreneurs who encourage and learn from each other. This level of support keeps members motivated and accountable, increasing their chances of success.

- Access to a Lucrative Business Model: By becoming Enagic distributors, members gain access to a high-quality product with a strong global demand. Unlike other MLM opportunities, Enagic’s compensation structure allows for substantial earnings and residual income.

- Time and Financial Freedom: One of the most attractive benefits of Darren and Mike’s program is the ability to break free from the traditional 9-to-5. By following their blueprint, members can create a business that supports their ideal lifestyle—whether that means working from home, traveling the world, or spending more time with family.

With all these advantages, it’s no surprise that more professionals are choosing Darren and Mike’s Dream Team to make the shift into online entrepreneurship.

Why Darren and Mike’s Dream Team is the Ultimate Online Business Solution

In today’s fast-paced world, more people are looking for ways to take control of their finances and lifestyle—and Darren and Mike’s Dream Team is providing the perfect solution. Their proven system, expert mentorship, and supportive community make it possible for anyone, regardless of experience, to build a successful digital business.

By leveraging automation, digital marketing, and a modern approach to MLM, Darren and Mike have revolutionized the way people achieve financial freedom. Their members aren’t just building businesses—they’re creating a life of independence, flexibility, and security.

For those who are ready to leave behind outdated business models and embrace a smarter, more sustainable way to earn, Darren and Mike’s Dream Team offers the tools, knowledge, and support necessary to succeed.

Now is the time to take the leap into digital entrepreneurship—and there’s no better way to start than with Darren and Mike leading the way.

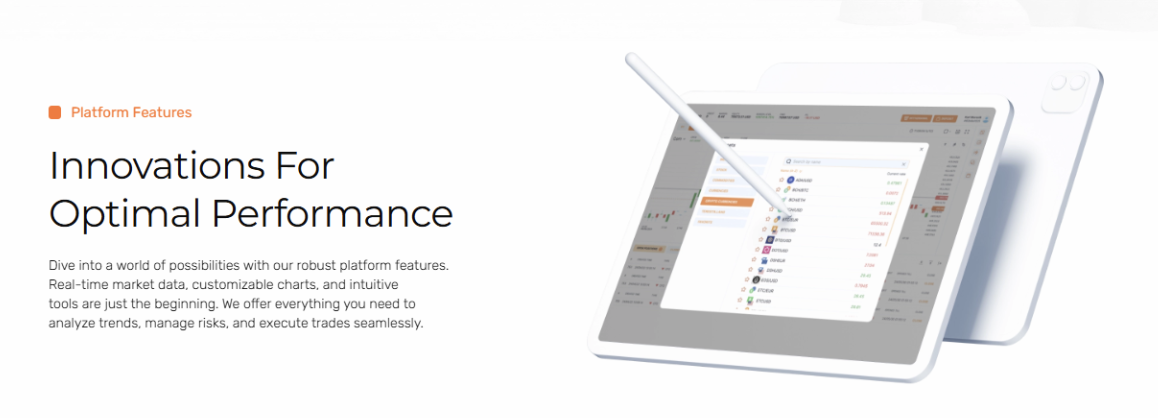

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin  Solana

Solana