From SoundCloud to Supercars – Inside Lil Pump’s Net worth Rise

The phrase “Gucci Gang” seemed to be repeated...

Britain Could Be Sleepwalking Into AI-Induced Blackouts – And 2028 Is the Date People Whisper

Bustle with the sounds of delivery vans nosing into side...

Apple’s Risky U.S. Cloud Strategy Might Break EU Privacy Rules—Again

Brussels meeting rooms illuminated by fluorescent lights,...

Canada’s New Telecom Rules Could Trip Up Starlink: Starlink Canada Regulation Challenges Loom

Elon Musk’s Starlink and Canada have always had a...

Alberta AI Compute Real Estate Could Replace Oil Sands

The bitumen in Alberta’s oil sands might not be the...

Amazon AI Customer Service UK Transforms Support Roles

When automated voices respond to consumer inquiries, they...

Used Car Sales Hold Steady as UK Drivers Prioritise Value Over New Metal

Britain’s used car market has proven remarkably...

Aksebe Mineralöle GmbH Accelerates Cross-Border Energy Operations Across Europe

The trucks leave before dawn. At a logistics terminal near...

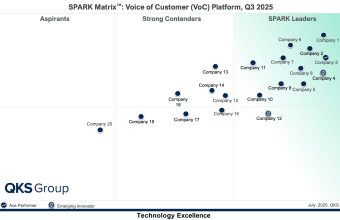

Customer Surveys Generate Data. Few Companies Know What to Do With It

Thousands of enterprises spend millions gathering customer...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin