UK Faces World’s Largest Millionaire Exodus Amid Labour Tax Hikes

The UK has experienced the largest millionaire exodus of...

The Sale Season Is Already Here: What’s Changing Between Black Friday & Cyber Monday 2025

Black Friday and Cyber Monday are a thing every year, and...

Custom Cabinets for Home Offices: Designing for Productivity

The home office has undergone a remarkable transformation...

Siemens Energy Shares Surge Nearly 5% After Major Analyst Upgrade

Siemens Energy AG was a market leader today as its stock...

Mantle MNT Hits $1.34: Tokenized Apple & Tesla Stocks Launch on xStocks Bybit November 10, 2025

On November 10, 2025, Mantle (MNT) demonstrated a strong...

Stellar XLM Steady at $0.29: 1 Billion Q3 Operations and IBM Partnership Boost on November 10, 2025

Stellar Lumens (XLM) has held on to its position in the...

Ethereum Surges Above $3,600: Key Crypto Developments and Price Rally on November 10, 2025

Etherium has been outstanding on November 10, 2025, with...

Fortum Shares Surge 18% on €3B Green Hydrogen Pact with German Giants – Finland’s Energy Leap

Fortum Oyj shares jumped 18% in a scorching surge on the...

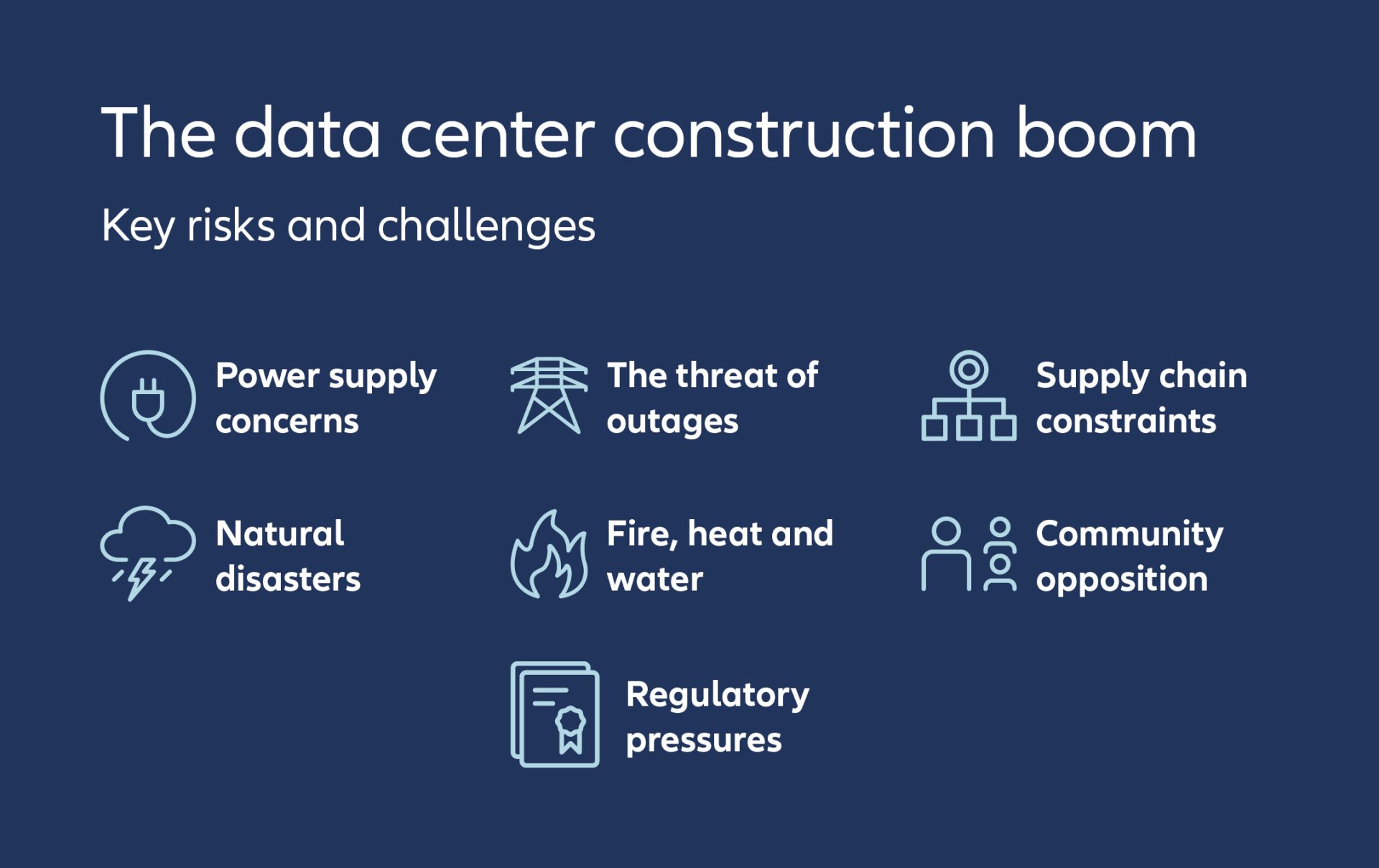

Data Centres Surge Globally as Cloud Computing Demands Rise

AI and cloud computing are driving an unprecedented global...

USDC Stablecoin Dominates with 500% APY Yields: LBank Earn Program and Polygon Visa Spending Go Live

November 7, 2025, USDC cemented its role as the stablecoin...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin