Cardano Hits $0.65 as Alonzo EVM Goes Live and ETF News Heats Up

October 29, 2025 -In a seismic change in the cryptocurrency...

Tron TRX Drops to $0.298: $26M On-Ramp Hits Record as USDT Rules 60% of Transfers

Today, Tron (TRX), the blockchain with high throughput and...

Dogecoin Price Jumps to $0.206: ETF News and Fed Cut Hopes Drive Big Rally Today

The original meme-based cryptocurrency, Dogecoin (DOGE), is...

SaudiDialect.com Launches to Teach Real Saudi Arabic — Helping Expats Adapt Faster to Local Culture and Business Life

SaudiDialect.com has officially launched as the first...

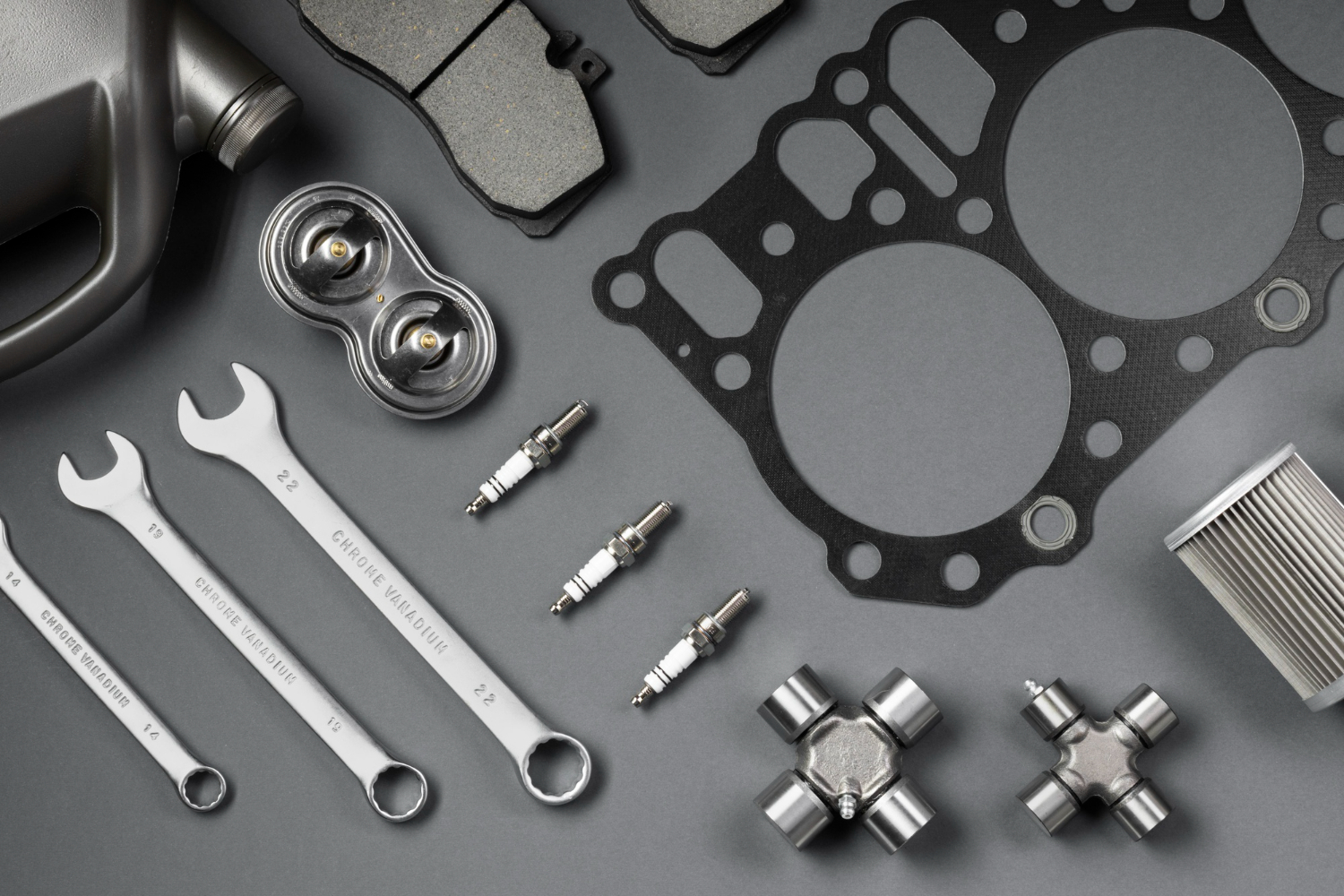

UK Drivers Reveal the Car Parts They’re Replacing Most in 2025

Being a driver is no longer a luxury in the modern world,...

Lululemon (TSX: LULU) Shares Spike 5% October 28 – Ex-Walmart CTO Suresh Kumar Joins Board for Global Growth

Teamwork Lululemon Athletica Inc. (TSX: LULU; NASDAQ:...

How a professional Fire Alarm System installation Is carried out?

Fire safety is one of the key aspects that must be...

Top-Rated MX5 Parts to Upgrade Your Mazda’s Performance

The Mazda MX-5, often affectionately known as the Miata,...

Gina Carano, Disney, and a Firing That Won’t Leave the Headlines

Setting the scene The Gina Carano Disney lawsuit isn’t just...

Constellation Software (TSX: CSU) Stock Falls 2% on Q3 Earnings Miss October 28 – $1.2B Cash Fuels M&A Outlook

Constellation Software Inc. (TSX: CSU), the Toronto-based...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin