How the rental market in Manchester is changing and what it means for Landlords

Over recent years Manchester has made itself a popular...

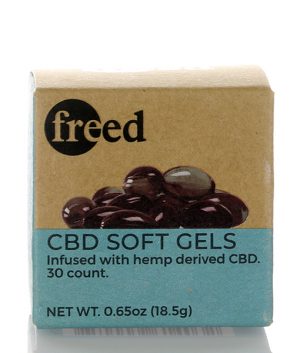

10 Best CBD Oil Capsules and How to Choose One

CBD soft gels are ideal for those who want to enjoy the...

Tips for Having Pets in Your Contract Hire Car

Taking a car on contract hire is now a popular way of...

Beykoz su sızıntısı tespiti yapan firmalar

Beykoz su sızıntısı tespiti yapan firmalar Beykoz Su Kaçağı...

Competition in the VPN Market Heats Up as Demand Rises

The virtual private network (VPN) market breached the $17...

How Does the Performance Management Cycle Differ for Fast-Growing Companies?

Managing the performance of staff is a critical activity at...

Say Hello to Your New Best Friend, Superglue

You may have some great friends, but nothing compares to...

Debt consolidation: the answer to cutting your monthly loan bills?

It’s a vicious circle: multiple monthly bills and...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin