CBI Warns of Economic Stagnation Amid Global and Domestic Pressures

The UK economy is preparing to endure a tough time as the...

Aisles UK Secures £1 Million in Angel Funding to Launch AI-Powered Infrastructure for Retail, Education, and Public Safety

London, UK – Aisles UK has completed a £1 million Angel...

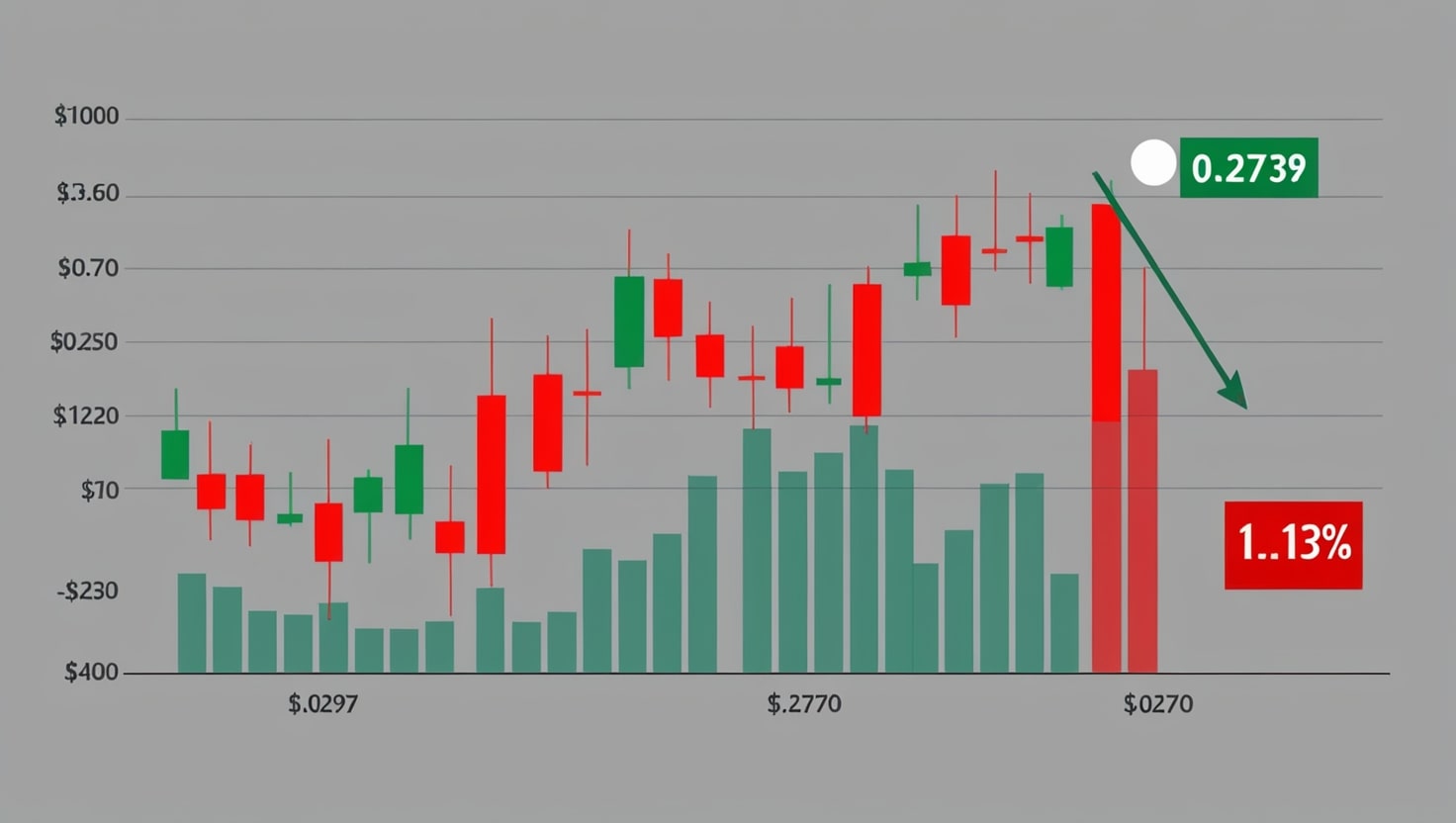

TRON Price Falls Amid Crypto Market Woes

TRON (TRX) declined by 1.13 percent today, trading at a...

Why You Should Choose a Career in Code Enforcement

Code enforcement is an important career that focuses on...

Tax Hikes Loom: Spending Review Sparks Wealth Flight Warnings

The UK Chancellor’s latest Spending Review signals looming...

Lagoon Dredging Technology Drives Breakthroughs in Wastewater Efficiency

Wastewater lagoons are a vital component of municipal and...

Smart Solar: How IoT Helps Maximize the Value of Your Photovoltaic System

These days, it’s common to spot solar panels on...

Offices Streamline Communication With Voicemail-to-Email Integration

In today’s busy work environment, keeping up with messages...

Finance Management Trends Shift Toward Risk-Aware Planning

Let’s be honest, managing your finances can feel a lot like...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

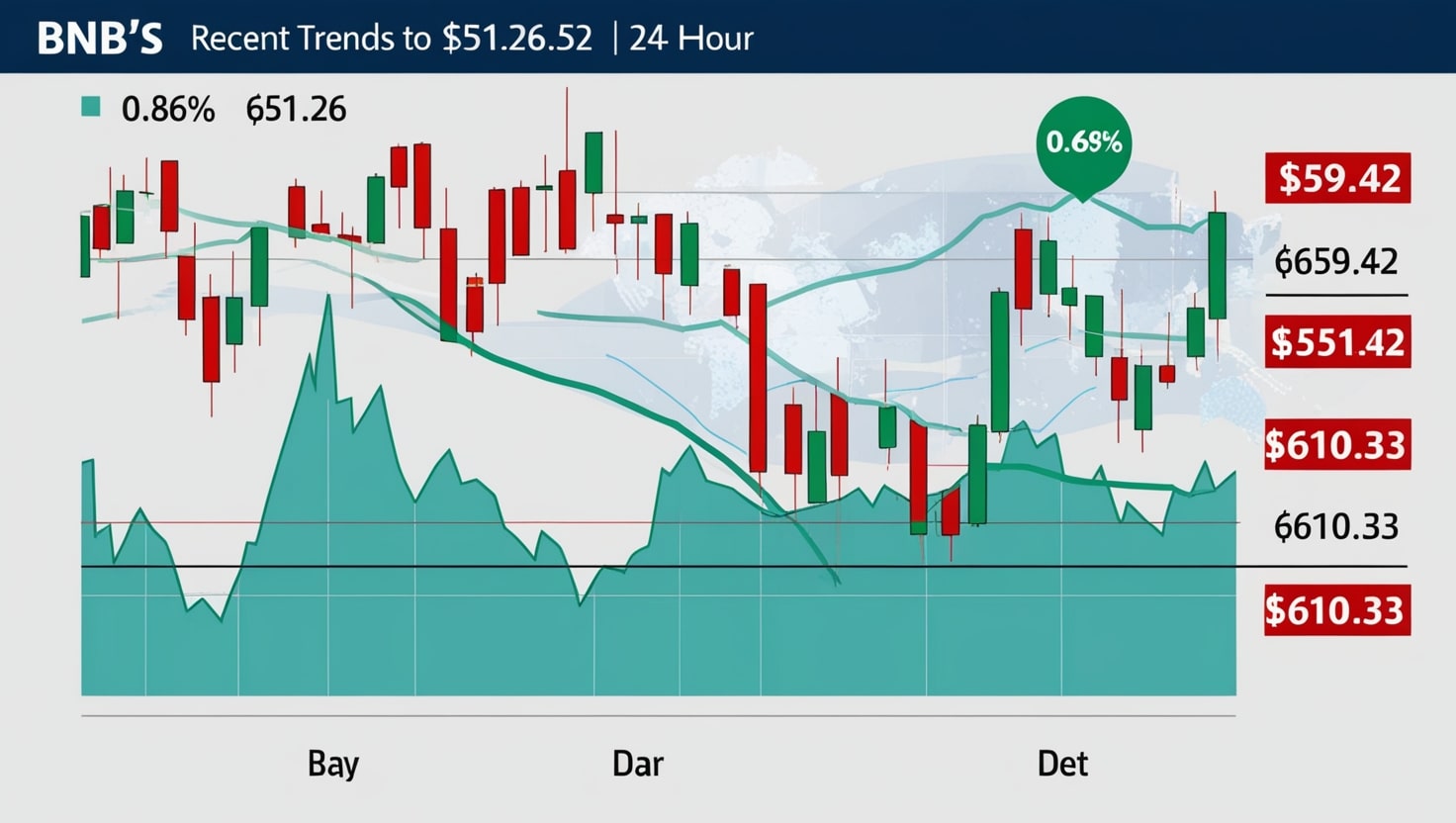

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin