The Art of the Deal in Big Enterprise Mergers and Acquisitions

Have you ever watched two corporate titans lock horns in a...

DIY Birthday Decorations: Save Money and Add a Personal Touch

Planning a birthday party? You don’t need to spend a...

Enhancing Local Search Presence Through Google Business Profile

If you run a local business, ranking high in Google...

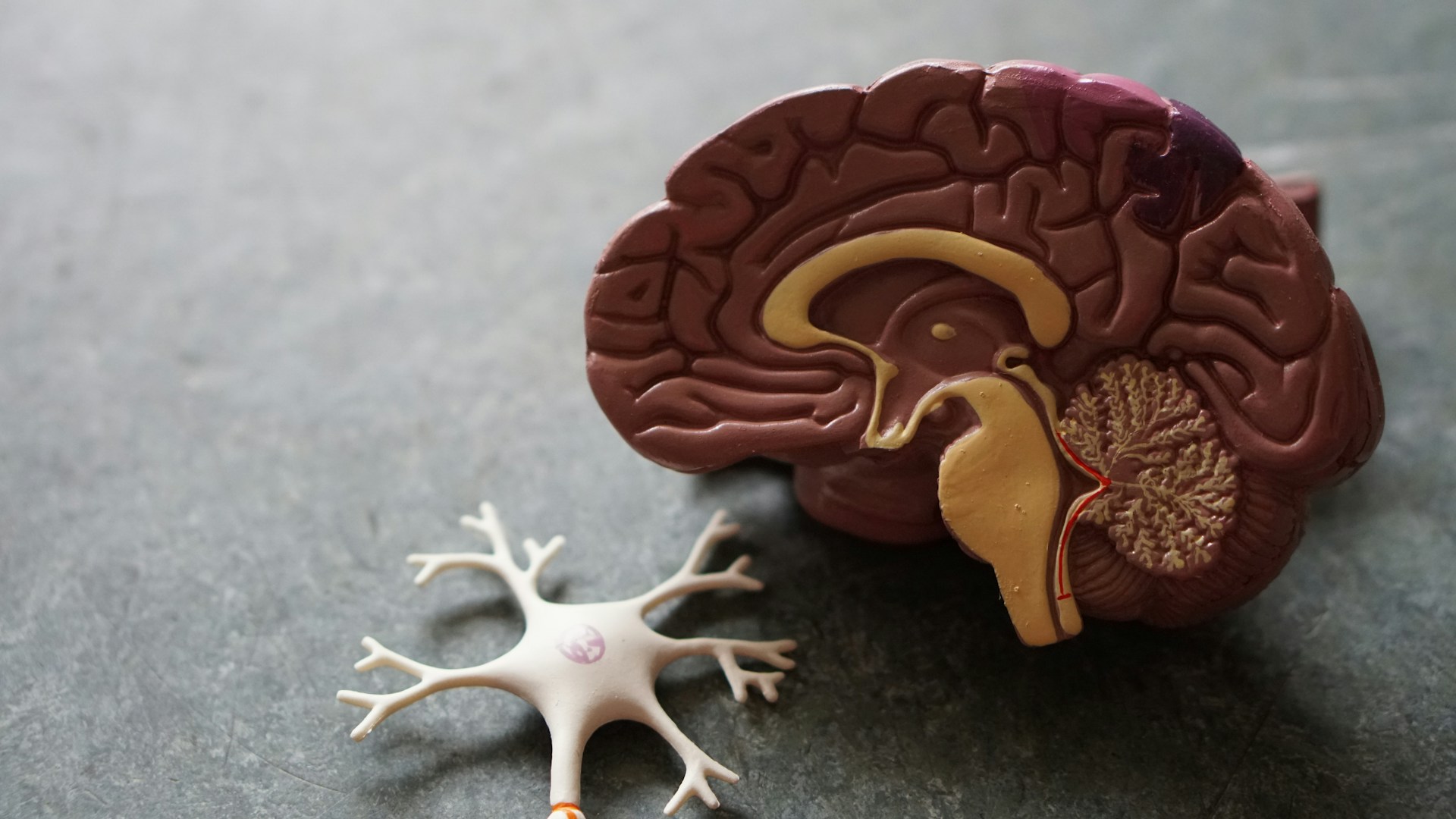

Clarifying the Medical Distinctions Between Alzheimer’s and Dementia

Oftentimes, terms like Alzheimer’s and dementia are...

Leading Proxy Solutions Enhancing Social Media Performance in 2025

In today’s dynamic digital landscape, social media proxies...

Crypto Exit Strategies: When to Take Profits and When to HODL

The cryptocurrency market is highly volatile, with price...

United Kingdom Faces Economic Slowdown as Consumer Spending Declines

The United Kingdom is slowing down economically due to...

US Markets Face Turbulence Amid Trade Tensions and Economic Uncertainty

Trade disputes between the US and other countries have...

DAI Maintains Dollar Peg With Unwavering Market Strength

DAI today still maintains its status of sustainability due...

AI Era Hedge Fund Makes Strong Start to the New Year, Outpacing Global Competitors with Record Returns

In a remarkable turn of events this year, AI Era Hedge Fund...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin