The Science Behind Hair Transplants: What to Expect from the Process

Hair loss affects millions of people worldwide, impacting...

Empowering UK Consumers: MoneyRepublic Launches Financial Comparison Platform in the UK

MoneyRepublic, an innovative financial comparison platform,...

AI Tokens See Combined Market Cap Fall by $8 Billion in a Single Month

AI Token Market Cap Drops by $8 Billion in a Month...

Stocks Set for Continued Gains as Momentum Grows

Stocks are set to continue their upward momentum, fueled by...

Building a Winning eCommerce Site: The Essential Components

If you operate an eCommerce site, then you need to make...

Securing Your Finances Through Divorce: What to Plan Before, During, and After

Divorce is an emotionally challenging process that brings...

How to Avoid a Property Chains Collapsing

Buying a new house can be a stressful and daunting process,...

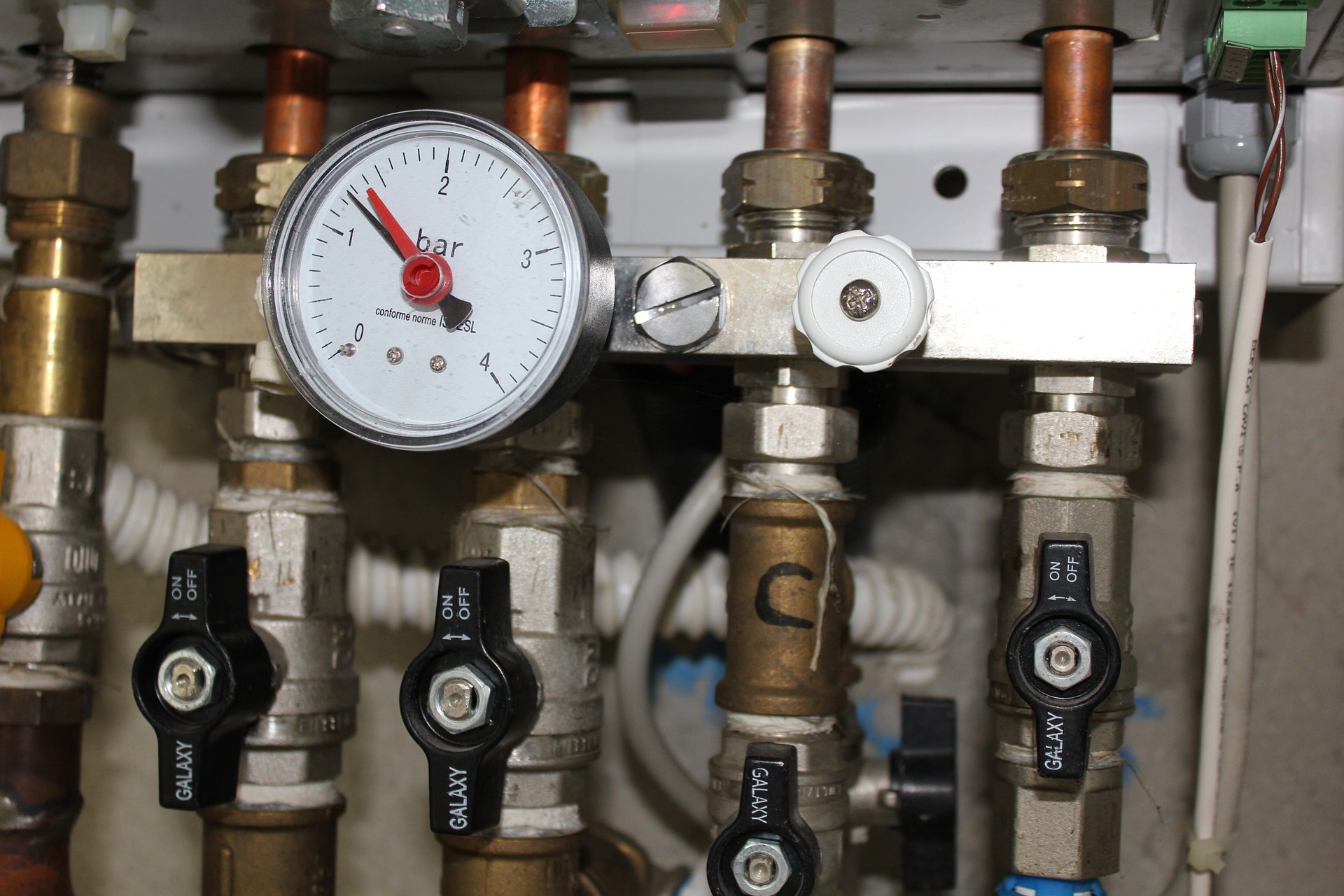

Boosting Business Efficiency: Crucial Boiler Maintenance for London Companies

The Importance of Routine Maintenance Routine maintenance...

Learn Yoga Online. Where to Find the Best Yoga Courses?

Everyone is hurrying to get somewhere these days. For that...

BoilerWave – MK Electrical Group Limited Unveils Cutting-Edge Microwave Boiler

A Carbon Emission Game-Changer Seeks £5M Investment to...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin