National Energy Leaders Pledge Support for Libya Energy & Economic Summit 2026

Senior figures from prominent state-backed and nationally...

Drivers Re-examine Old Car Finance Deals as Concerns Over Fairness Increase

Across the UK, a growing number of motorists are...

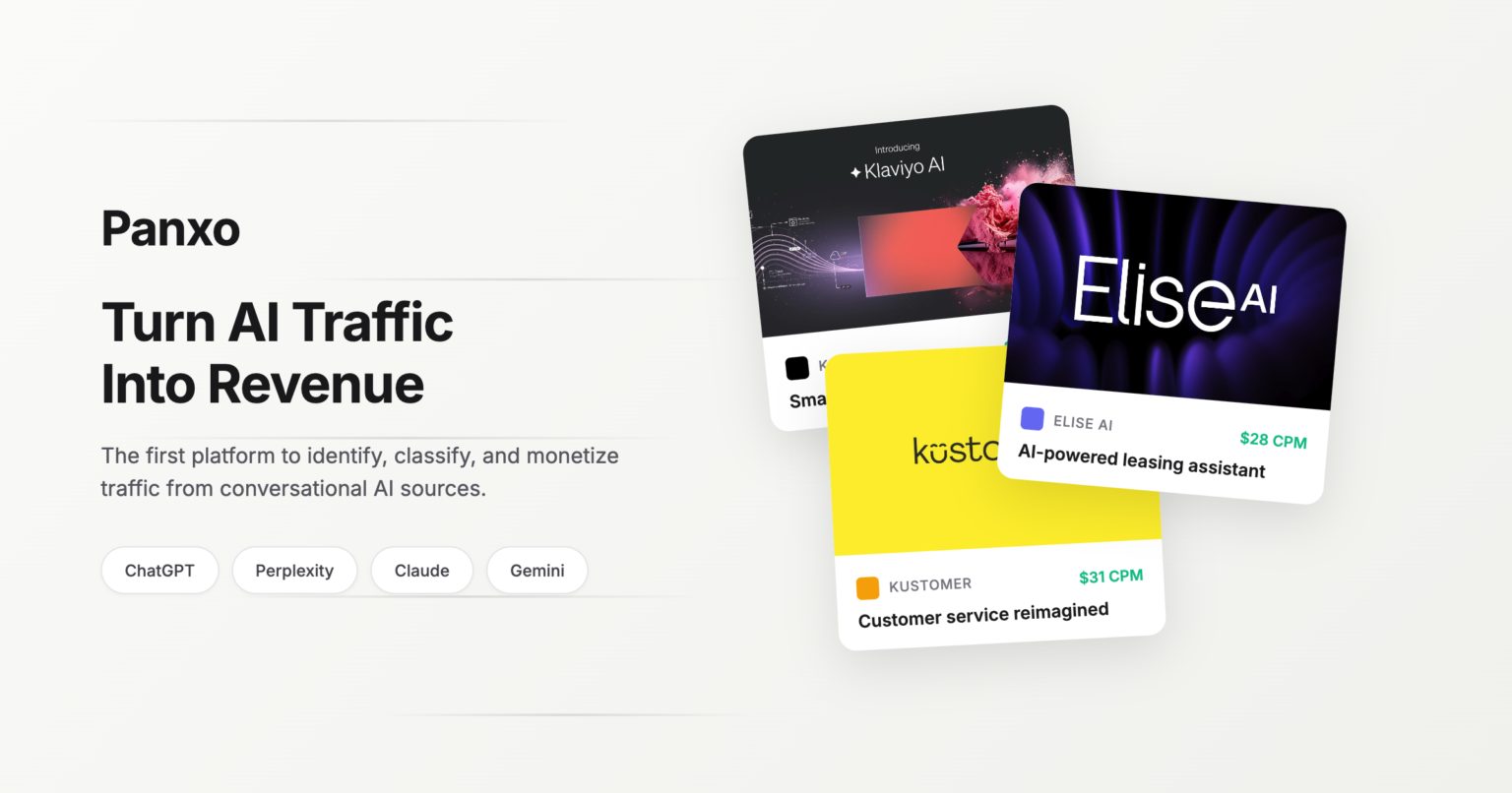

Panxo Introduces the First Platform to Monetize Traffic from ChatGPT and Other Conversational AI Sources

Panxo announced the public launch of its next-generation...

Smart Financial Resolutions For 2026

The start of a new year is always a great opportunity to...

Acquiring at Scale: Why Teams Split Orchestration From Processing

Acquiring still sells itself as a tidy diagram: connect a...

Nayax Partners with Unipaas to Launch Fully Integrated Card-Present Payments Solution

The announcement that Nayax has partnered with Unipaas to...

How PayDo Helps Online Businesses Scale Internationally Without Banking Complexity

You have a solid business, yet you aren’t seeing the full...

How to Budget for Buying a Home

Scrolling through property sites can feel like a harmless...

From Soldier to Summit: How Nic Williams Went from Military Graduate to Fairbanks’ #1 Realtor with Over 500 Real Estate Deals Closed

Living in Alaska is both demanding and rewarding. The...

Alejandro Betancourt López Accumulated 2,000 Ride-Share Licenses Before Anyone Noticed Why

Most investors chase trends. A smaller number spot them...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Wrapped SOL

Wrapped SOL  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin