Vacation Without Breaking the Bank: 6 Affordable European Locations

While mobile phones undoubtedly provide countless benefits...

Ways to Play Music Using Your Amazon Echo Device

While mobile phones undoubtedly provide countless benefits...

“Flexibility Is Vital”: How Arani Soosaipillai Scaled Prax Group’s Workforce From Two to 1,400

When Sanjeev and Arani Soosaipillai launched their first...

Get Premium Deals on the Latest Gaming Consoles and Bundle Offers

While mobile phones undoubtedly provide countless benefits...

Power Up Your Routine with Game-Changing Smartwatch Deals

While mobile phones undoubtedly provide countless benefits...

Camping Yeti Bottles Yeti Drinking Bottles

Camping offers a chance to connect with nature, but it...

Life Insurance Demand Surges Across the UK and Northern Ireland

If you’re in the finance or insurance world,...

Financial Strategies Reshape Decision-Making in Digital Entertainment Platforms

There’s a reason the casino floor feels like its own...

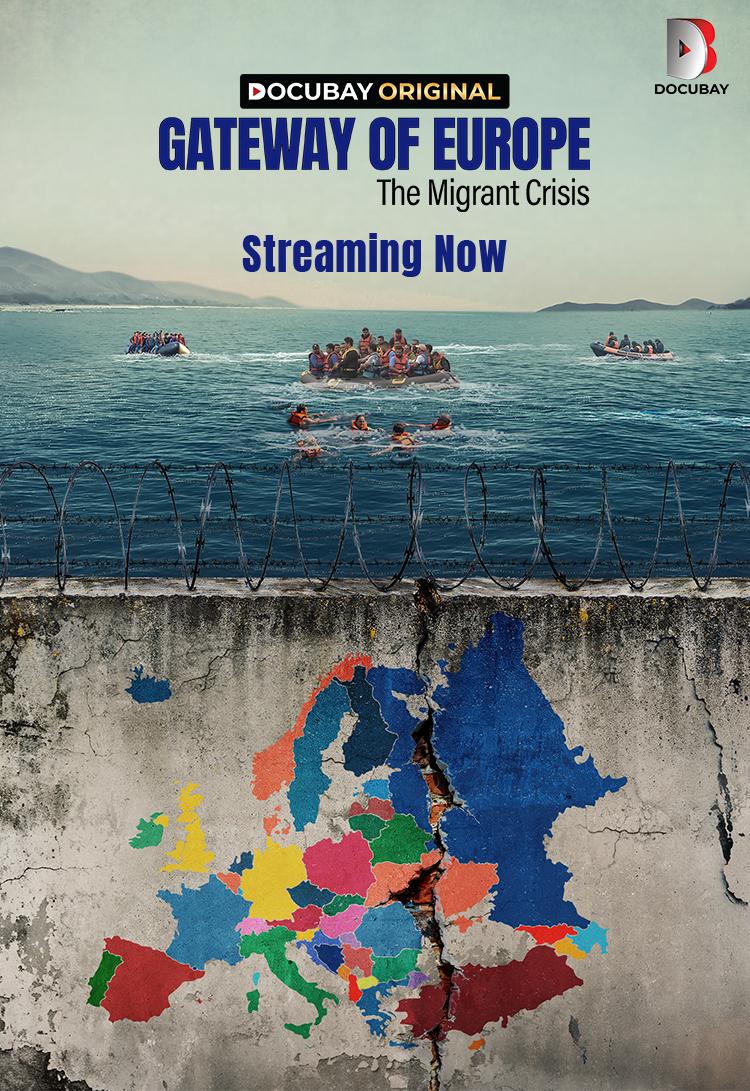

‘Gateway of Europe – The Migrant Crisis’: DocuBay’s Hard-Hitting New Original Is Now Streaming

A bold and unmissable documentary that confronts the...

The Hidden Downsides of Cheap Compression Gear

Compression socks have become a go-to solution for...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin