Fantom’s Transition to Sonic Reshapes the Blockchain Landscape

The blockchain world never sits still, and Fantom’s...

Future of Fintech Marketing: The Key Role of Headless CMS in Driving Engaged Success

The fintech industry is flourishing from solutions and...

Protecting Small Business Assets Remains a Critical Priority

Running a small business can feel like a balancing act,...

The Fed Open Market Holds Rates Steady Amid Uncertainty with Trump’s Return to Office

The Fed Open Market Committee has kept its policy rate...

Japan vs Mexico Baseball Caribbean Series TV Channel, Live Streams, Schedule and Score

The Caribbean Series, known as the “Serie del...

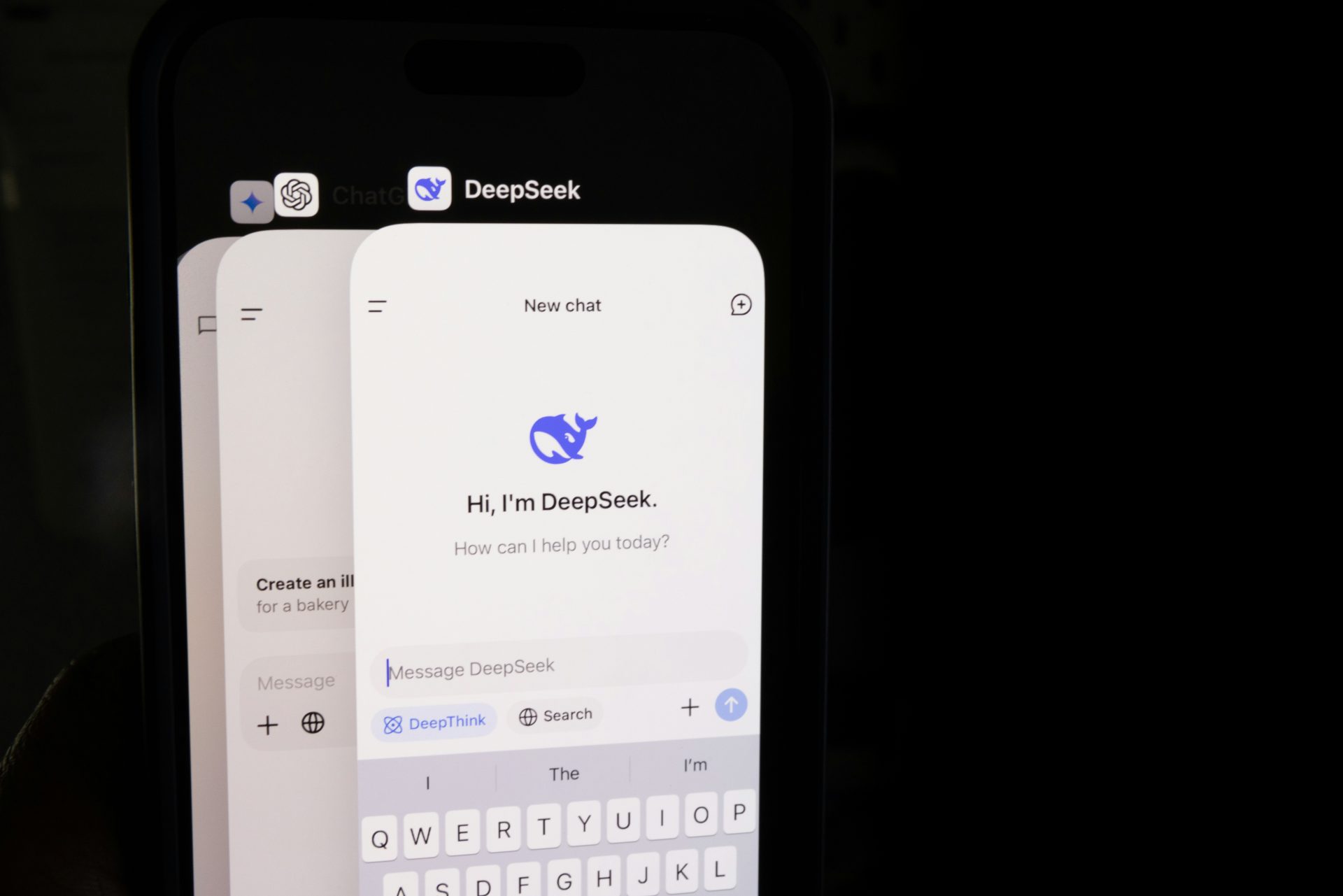

DeepSeek AI Breaks Google Trends Records, Challenging ChatGPT

The latest release of the Chinese AI model DeepSeek has...

Google Makes Average US Worker’s Salary in Just 16 Seconds

Every year, the tech giants of the GAFAM group—Google,...

Nexusform Network: AI-Powered Crypto Trading Platform Gains Market Buzz

Nexusform Network is a user-friendly, web-based trading...

Organised Functions Thrive with a Focus on Inclusivity and Diversity

Encouragement of meaningful participation and engagement...

Welzo Hits $42M Valuation as it Expands into 35 Countries, Surpassing 3.89 Million Users

Welzo, a prominent global marketplace for health and...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin