Holiday Scam Alert: Expert Reveals 5 Common Accommodation Scams to Avoid

An online expert has issued a warning about holiday let...

Generative AI to Comprise Over 40% of AI Market by 2030, Doubling Current Share

Less than two years after ChatGPT’s release, which...

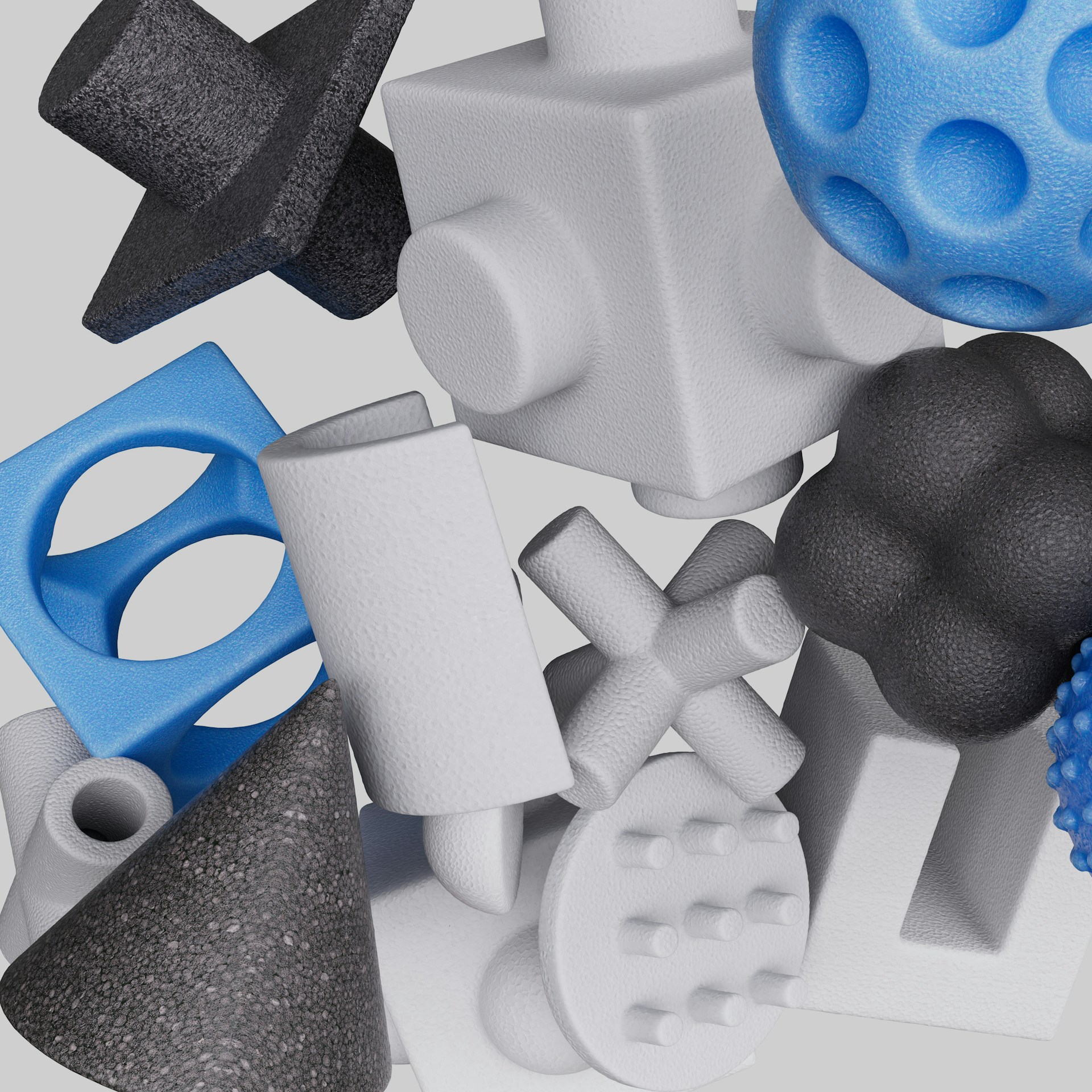

Inside PS Injection Molding: Key Techniques Driving Manufacturing Efficiency

Polystyrene injection molding is one of the technique that...

Keltbray’s Infrastructure Services to Accelerate Growth Strategy Under New Ownership

Keltbray’s Infrastructure Services Limited (KISL), a...

Allica Bank Reveals 2024 ‘Established Business of the Year’ Shortlist

The Allica Bank Great British Entrepreneur Awards is...

NatWest Student Living Index Shows 154% Surge in Time Students Spend on Part-Time Work

Students’ part-time work hours have surged by 154%....

Spain Rejects Digital Nomads — Where Should Brits Head Instead?

UK digital nomads seeking authentic adventure may want to...

The Surprising Resilience of Business Cards in a Digital-First Era

In an era where LinkedIn connections and email signatures...

Class of 2024: The Jobs School Leavers Aspire To and What’s Actually Available

The most viewed job ads for school leavers include...

Lutz Holding Expands Presence in Switzerland

Lutz-Jesco Suisse SA will enter the Swiss market, offering...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin