Guide to Conducting a Trademark Search in the UK

Trademark searches are an essential part of the trademark...

ThinkMarkets and TradingView Forge New Integration

ThinkMarkets, a distinguished provider of multi-asset...

Trading Platform & Digital and Real-World Assets, tanX, Hits a Billion-Dollar Quarterly Trading Volume Milestone

Real-World Assets and institutional trading platform tanX...

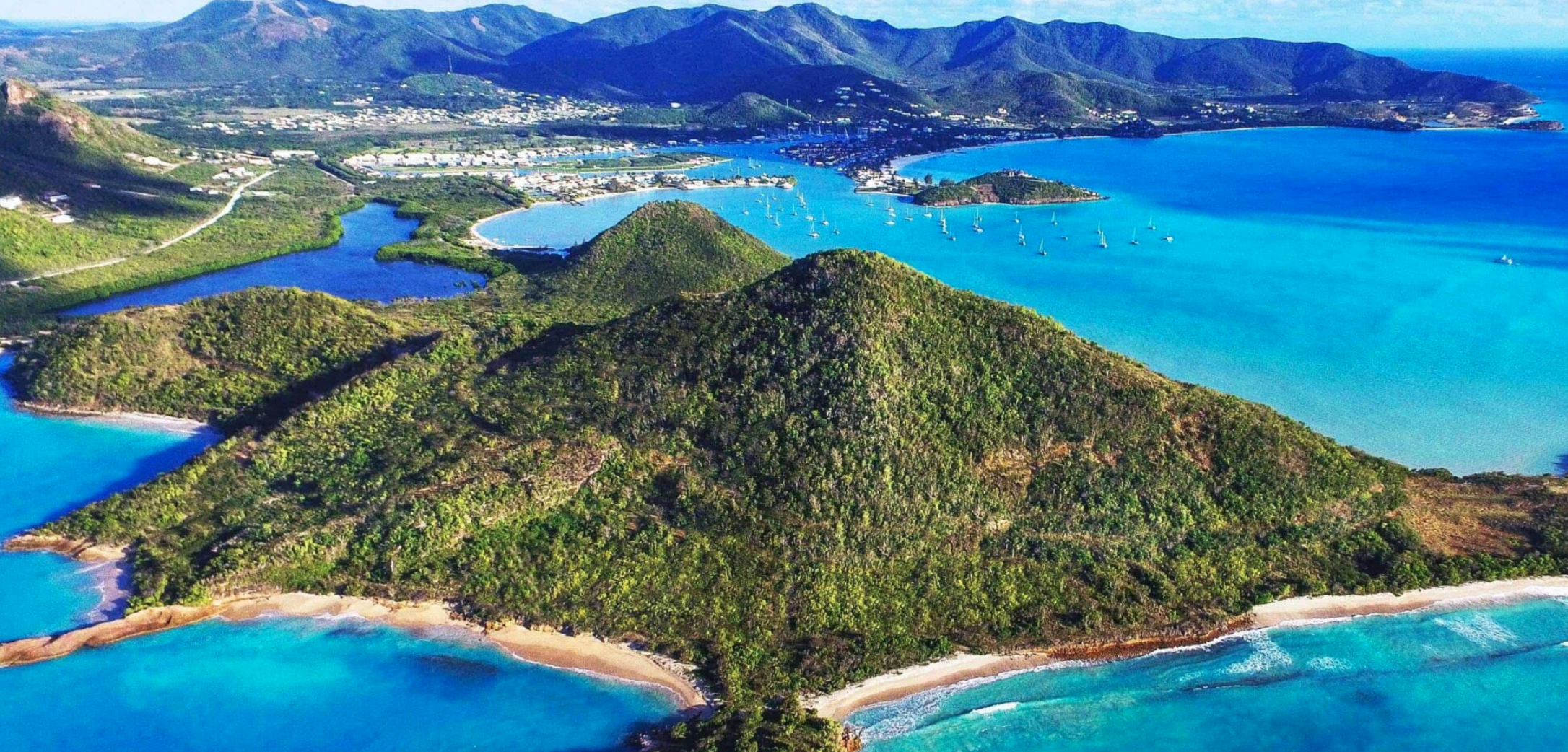

Pearns Point , Antigua, Launches Luxury Turnkey Villas

Pearns Point, the highly anticipated beach and oceanfront...

CapitalRise Funds Three New Deals With a Total Lending Value of £20 Million In Just Nine Days

Leading prime property finance firm CapitalRise continues...

2RL Reaches New Heights: Introduces Autonomous Drone Racing Championship with a $1 Million Prize Pool

The Abu Dhabi Autonomous Racing League (A2RL), which made...

A Retirement Planning Guide: Preparing For Assisted Living Needs

Planning for retirement is about much more than a full bank...

Achieving High Profit as a Medical Professional: Strategies to Follow

Medical professionals often focus on patient care. But...

Ensuring Leadership Continuity: Benefits of CEO Succession Plan

CEO succession plans are insurance policies for businesses....

Key Insights for Evaluating Commercial Energy Rates

Many businesses thrive when the owner learns to minimize...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin