How Pre-employment Assessments Can Help You Hire Great People

When hiring employees, everything rests on the hiring...

What are the Benefits of a Home Warranty?

Homeowners can choose from a variety of plans to reduce...

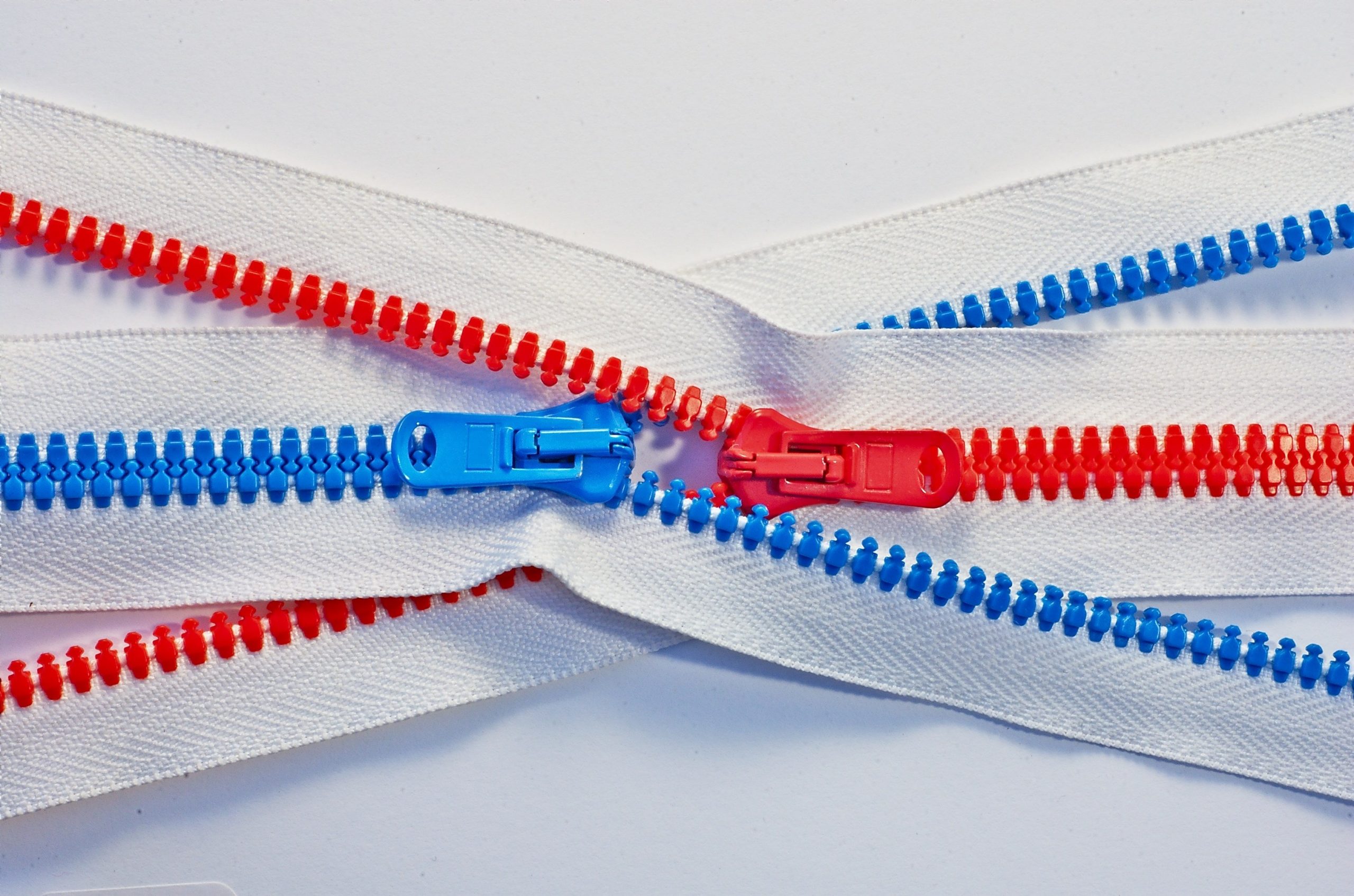

What is a Zipper Used For? What Materials are They Made Of?

Zippers might seem daunting at first yet there is no need...

Why Look for Online Translation Jobs at Protranslate.net?

Entering the world of translation isn’t as simple and easy...

The Impact of COVID on the UK Gambling Scene

The COVID-19 pandemic brought the economies across the...

How To Raise Money & Increase Cash Flow Using Invoice Financing

Invoice financing allows you to boost your cash flow...

What Cryptocurrencies Have Superior Technology Than Bitcoin?

Bitcoin may have set the standard and made cryptocurrencies...

Why Are Hair Transplants In Turkey So Popular

Thanks to modern hair transplant procedures, hair loss is a...

The Primary Reason for A Global Financial Crisis

The GFC (Global Financial Crisis), a worldwide...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped SOL

Wrapped SOL