Innovative Forex Technology Solutions Transforming Brokerage Services

In today’s highly saturated FX market, up-to-date...

Embracing Digital Transformation for a More Tech-Savvy Business Model

If you want your business to grow organically, you have to...

From Losing Millions to Rebuilding an Empire: Rod Khleif’s Journey Through the 2008 Crash

In the world of real estate investing, success is often...

Which Country is Best for Orthopedics?

Orthopedic surgery helps people with musculoskeletal...

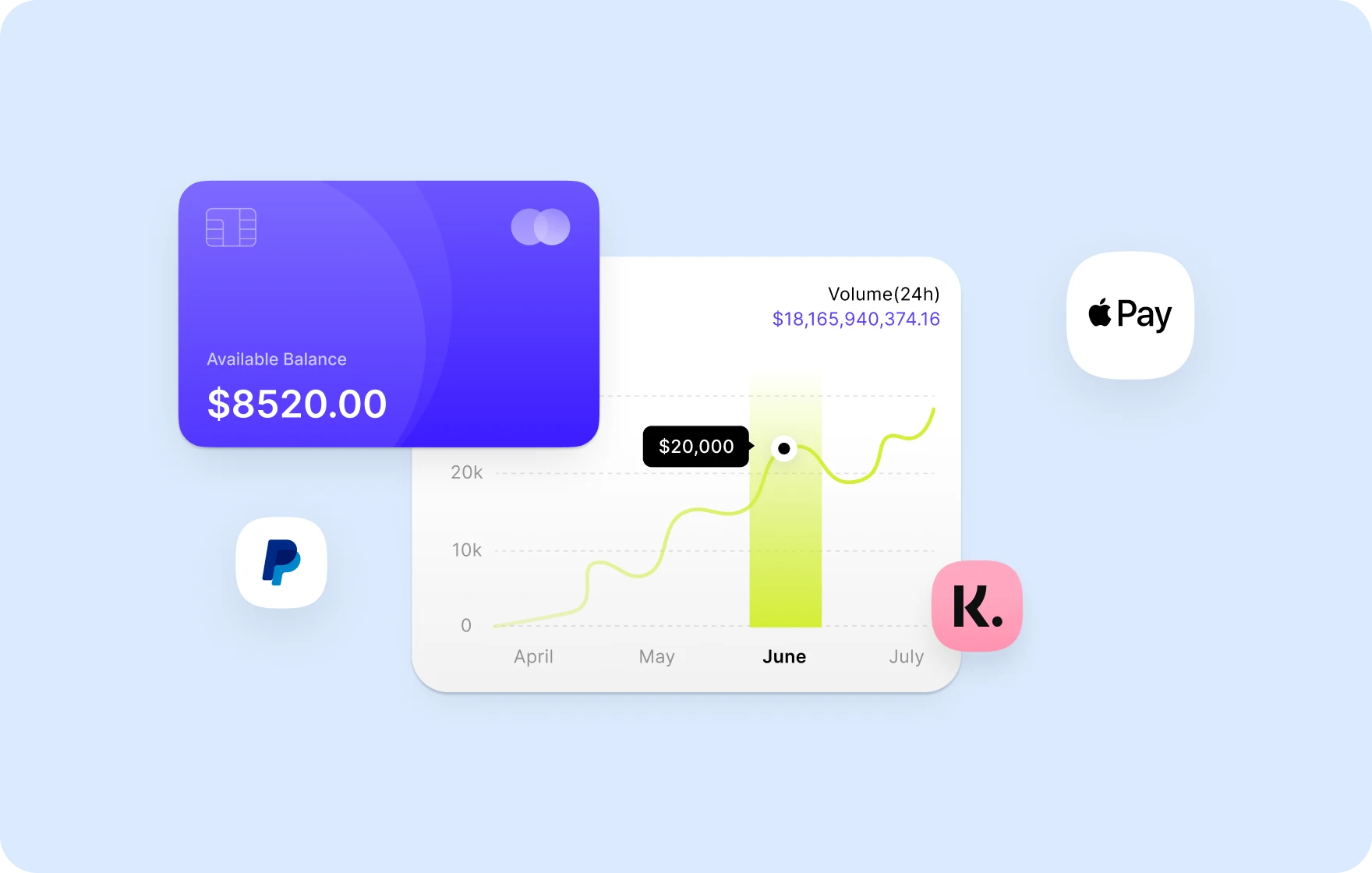

How to build a FinTech website: 12 principles from Goodface, a FinTech web design agency

FinTech is at the intersection of technology and money,...

Solana Surges As Trading Volume And Market Cap Expand

Solana is making its position as one of the best...

UK economy faces challenges As consumer confidence declines

The British economy is currently witnessing a fall in...

German Business Confidence Rises As Economic Recovery Gains Momentum

Based on the findings of Ifo Institute, in the month of...

Cardano ADA Shows Resilience As Market Cap Surges Past 26 Billion

Cardano (ADA) is making a name for itself as one of the...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped SOL

Wrapped SOL