12 Common Mistakes to Avoid When Buying a Motorcycle for Your Kid

Motorcycling is an exciting and empowering experience for...

Unlocking Business Growth: 5 Key Performance Issues Holding You Back

Every business wants to grow, but too often, performance...

Top Telegram Tap-to-Earn Crypto Games of 2026

As the gaming landscape continues to evolve, the...

UK Airport Parking Costs on the Rise as Demand Surges

As travel demand continues to present feasible...

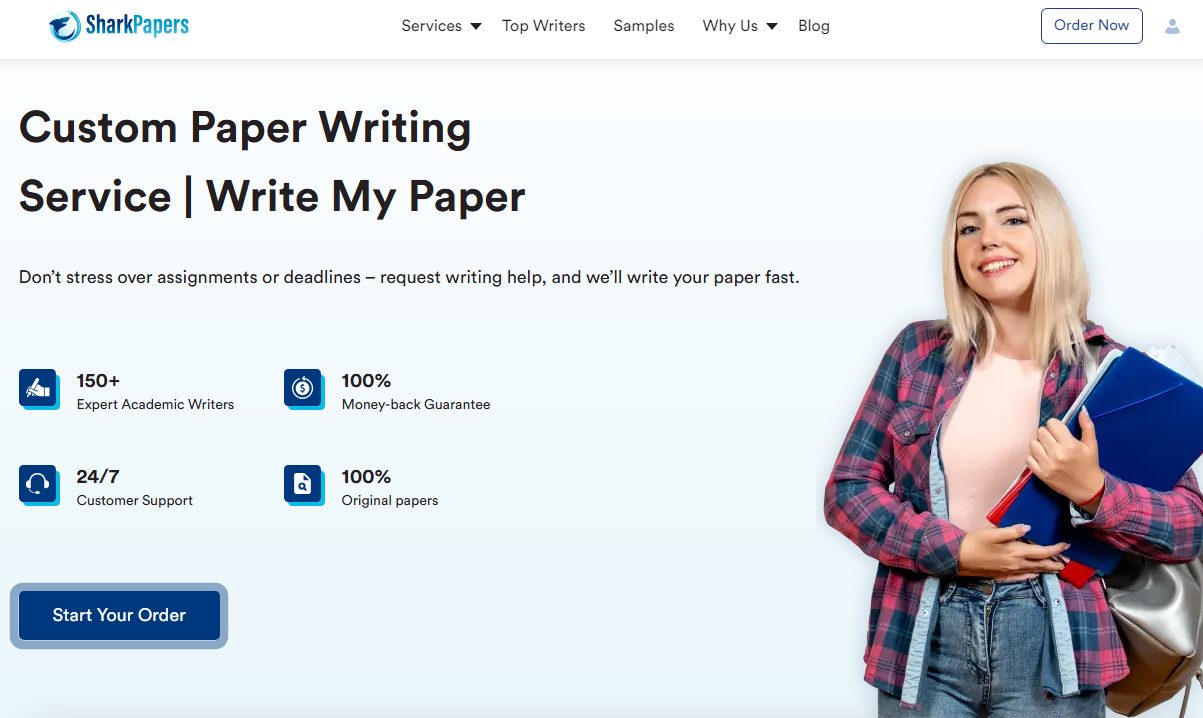

SharkPapers.com: Features, Pricing, and Why It Stands Out

Can we all be honest for a minute and admit that academic...

Evolution of Mobile Banking Apps Over the Years: What’s Next?

If you are an adult managing your own money, you definitely...

Secure Payment Methods for Business

Security is non-negotiable when it comes to online...

AI-Powered Image Generation Transforms Creative Industries

In the ever-evolving virtual landscape, synthetic...

Employee Ownership Trusts Strengthen Business Stability in the UK

The selling of a business is a turbulent time, often...

Team Canada vs Finland Livestream 4 Nations Face-off hockey

This season, the NHL has replaced its traditional All-Star...

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Avalanche

Avalanche  Toncoin

Toncoin